Our History

An ally through the years.

How it all began

From our beginnings in auto finance to our expansion into online banking, credit and wealth management, our commitment to customers has been our focus for more than a century.

1920s – 1930s | Starting our engines

Helping auto dealers be successful

The invention of the assembly line changed the way the auto industry did business. To keep factories running smoothly, manufacturers needed auto dealers to buy vehicles in large quantities. In 1919, we opened our doors as GMAC, a division of GM, to help dealers finance and maintain their inventory and keep up with consumer demand.

Making auto financing more accessible

In the early 1920s, people looking to buy a car or truck had to pay cash or secure their own financing from banks that didn’t typically issue loans for automobiles. We made it convenient for customers to get financing right at the dealership. During the Great Depression, car manufactures began segmenting vehicles by cost, from low-price to luxury models. We introduced this pricing concept to the public with our slogan "A car for every purse and purpose."

1919

Opened our doors in New York City and later that year added offices in Detroit, Chicago, San Francisco and Toronto

1924

Financed our 4 millionth vehicle

1939

Formed Motors Insurance Corporation (MIC)

Detroit Car Factory - 1910s

1940s – 1950s | Financing beyond cars

1941

Financed locomotives during WWII

1951

Financed household appliances through participating retailers

1956

Introduced the Time Payment Plan

Honolulu Clipper - 1939

Meeting the needs of the time

During World War II, we helped support the war effort as the financing arm of GM, which supplied the Allies with submarine engines, airplanes, trucks and tanks. Back home, we helped financially troubled railroads stay in business by renting and financing locomotives. In the 1950s, we diversified and worked with participating household appliance retailers and extended financing to customers who couldn't afford to buy a refrigerator, washer or stove outright.

Providing convenience and more options

Americans' love for cars was on the rise during the golden years of automobile design. With our slogan, ''Enjoy financing where you buy,'' more people took advantage of getting the car they wanted and the financing they needed at the same place. In 1956 we introduced "Buying cars on time" with our Time Payment Plan and gave over 2 million customers more options to finance a vehicle with a payment plan that fit their budget.

1960s – 1970s | Ensuring peace of mind

Protecting vehicles inside and out

As car manufacturers pushed innovation and style, auto prices rose and insurance became an increasingly important part of our products and services offering. Our Motors Insurance Corporation provided dealers with physical damage coverage to protect the vehicles they sold, and in the mid 1960s we became the first insurance company to offer comprehensive coverage to dealers' customers. In 1973, we introduced mechanical coverage for new vehicles and for certain used vehicles.

1965

Offered comprehensive coverage for vehicles

1973

Introduced mechanical coverage

1977

Financed our 75 millionth vehicle

Print Ad - 1967

1980s – 1990s | Exploring new roads

1980 - 1990

Initial launch of loans to home buyers

1985

Financed our 100 millionth vehicle

Offered loans to home buyers

1999

Formed our Corporate finance division

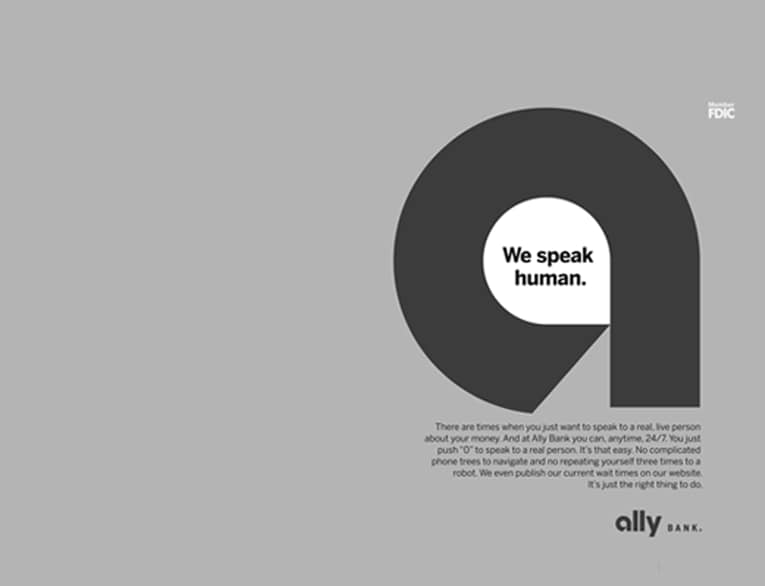

Print Ad - 1989

Expanding our financing capabilities

In the 1980s we leased the auto industry’s first electric-powered cars. We also made our initial offering of mortgage products, helping thousands of Americans become homeowners. In the late 1990s, we purchased The Bank of New York's lending unit. This led to the creation of our Corporate Finance division that soon became one of the most trusted sources of capital for equity sponsors and middle-market companies.

2000s – 2010s | Beginning a transformation

Examining our strengths

During one of the most significant economic downturns our country experienced, we were tested like many other financial services companies. For us, it was an opportunity to review our business model, define our competitive advantages and build on our strengths.

Building a better bank

The world didn't need another bank — it needed a better one. We decided to make a stand on our commitment to customers and put our promise in our name. So we transformed our banking subsidiary into Ally Bank on 3 simple principles: do right, talk straight and be obviously better. As an online bank without physical branch locations, we were able to offer greater value with consistently competitive rates and convenient around-the-clock support when our customers needed it.

2000

Established GMAC Bank

Launched SmartAuction, our unique online remarketing tool for dealers

2001

Reached $1 trillion in financing for 150 million vehicles

2009

Transformed GMAC Bank into Ally Bank

Print Ad - 2014

2010

Renamed our company Ally Financial

2012

Exceeded 1 million Ally Bank customer accounts

2013

Granted financial holding company status

2014

Completed our IPO

2016

-

Served 18,000 auto dealers—and more than four million of their customers—in the U.S.

-

Launched direct-to-consumer home loans to help people reach their homebuying and refinancing goals

2017

-

Acquired TradeKing Group, Inc. and launched Ally Invest, our wealth management and brokerage platform

-

Launched Clearlane® (now Direct Auto) to digitally connect customers to auto finance providers

2018

-

Held the inaugural Ally Challenge presented by McLaren, an official PGA TOUR Champions event

-

Sponsored seven-time NASCAR Cup Series Champion Jimmie Johnson

2019

-

Hosted the inaugural Moguls in the Making entrepreneurial pitch competition for students from Historically Black Colleges and Universities (HBCUs), in collaboration with the Thurgood Marshall College Fund (TMCF)

-

Announced agreement to become the lead sponsor of Charlotte, NC’s Major League Soccer team.

Redefining our company

In 2010, we rebranded as Ally Financial and transformed our auto finance business into Ally Auto — a premier independent finance provider offering dealers of many vehicle makes, including RVs, the most comprehensive suite of products and services available. With our transformation complete, we became a publicly traded company with a diverse mix of investors in 2014.

Ally IPO - 2014

2020s | Doing it right

A relentless ally for your financial well-being

As a leading digital financial services company that’s constantly creating and reinventing, Ally continues to build award-winning experiences and products that bring our customers innovative approaches to online banking, home loans, auto financing and wealth management.

Alex Bowman’s no. 48 Ally Racing Car

2020

-

Formed the Ally Charitable Foundation to deploy grants to support economic mobility in the communities we serve, focusing on affordable housing, financial literacy, workplace preparedness and other initiatives

-

Alex Bowman takes over as the NASCAR driver of the Ally-sponsored No. 48 Hendrick Motorsports Chevrolet

2021

-

Achieved carbon neutrality

-

Became the first banking partner of the National Women's Soccer League

-

Announced elimination of all overdraft fees

-

Launched our widest-reaching campaign in brand history: “We're All Better Off with an Ally”

-

Acquired Fair Square Financial, a digital-first credit card company

2022

-

Made a 50/50 pledge to spend equally in paid media across men's and women's sports by 2027

2023

-

Ally Bank became the official consumer bank of NASCAR and NASCAR-owned tracks

-

Announced nearly $1 billion in giving and capital deployment to address the wealth gap and barriers to economic mobility through housing initiatives