Spending Account

Make everyday banking count.

Annual Percentage Yield

% Less than $15,000 minimum daily balance

A checking account that checks all the boxes.

We’ve always got you covered.

All the ways you’d expect, and even ones you don’t.

Get reimbursed when using other ATMs.

Not around a no-fee ATM? Receive up to $10 per statement cycle for fees charged at ATMs nationwide.

Protect against unexpected overspending.

Have a double line of defense using Overdraft Transfer Service and CoverDraft℠ service, plus we never charge overdraft fees.

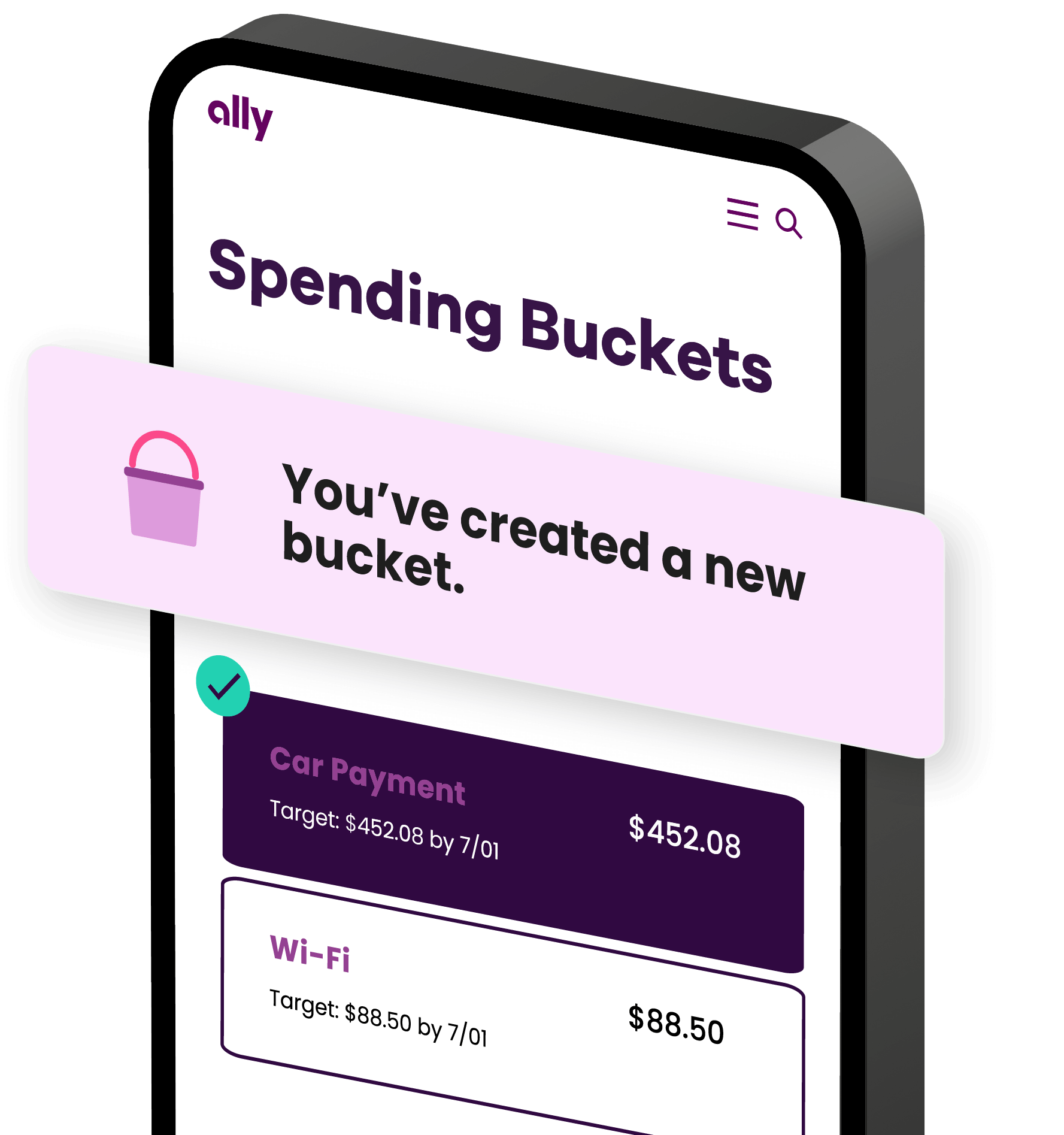

Stay ahead of expenses with buckets.

Set money aside for future spending with help from our spending buckets.

Your money, FDIC-insured.

Deposits are insured by the FDIC up to the maximum allowed by law.

The cash is in the bag (or bucket).

-

Set money aside for ongoing expenses like rent, groceries, and subscriptions

-

Get a clearer picture of your spending habits – and an opportunity to create better ones

Trust through transparency.

Giving you the full picture of where your money goes.

| There’s a lot we don’t charge for | |

| Monthly maintenance | $0 |

| Overdraft items | $0 |

| Low daily balance | $0 |

| Standard checks and debit cards | $0 |

| Deposit slips and prepaid envelopes | $0 |

| Standard or expedited transfers | $0 |

| ...and we won’t hide the fees we do have. | |

| Expedited delivery for checks and debit cards |

$15 |

| Outgoing domestic wires |

$20 |

| Stop payment | $15 |

| Overnight bill pay |

$14.95 |

| Same-day bill pay |

$9.95 |

| International transactions |

Up to 1% |

Get more for your money.

Find out how our rates stack up with other checking accounts.

Ally Bank Spending Account balance tiers :

Less than $15,000 = 0.10% Annual Percentage Yield (APY)

$15,000 or more = 0.25% Annual Percentage Yield (APY)

What you should know.

No minimum deposit required to open an account.

Our Annual Percentage Yields (APYs) are accurate as of . Keep in mind, these rates are variable and may change after the account is open. Fees may reduce earnings. The APYs for other banks are provided by mybanktracker.com and are accurate as of . The APYs in this table are for the state of California.

Bank better, starting now.

Get your account up and running in minutes.

Tell us about yourself.

We’ll need some personal info, like your address and Social Security number.

Add money to your account and receive your free debit card.

The faster you fund, the sooner you’ll earn interest and get your debit card.

Enjoy all the perks.

Start exploring everything our Spending Account has to offer.

Stay on-the-go with our app.

Your card, always in your control.

Lock your card in seconds if it’s lost or stolen.

Deposit checks whenever, wherever.

All you need is your phone and the check. Take a photo and you’re all set.

Send and receive money with a few taps.

Use Zelle® for a fast, safe, and easy way to pay your friends and family.

The reviews are in.

People like it here. We think you will, too.

Average Rating

MOST HELPFUL

MOST RECENT

HIGHEST RATING

FAQs

You have questions. We have answers.

Still have questions? Visit our Help Center.