What we'll cover

The differences between ETFs and mutual funds

Pros and cons of both of these investment types

Popular ETF and mutual fund categories

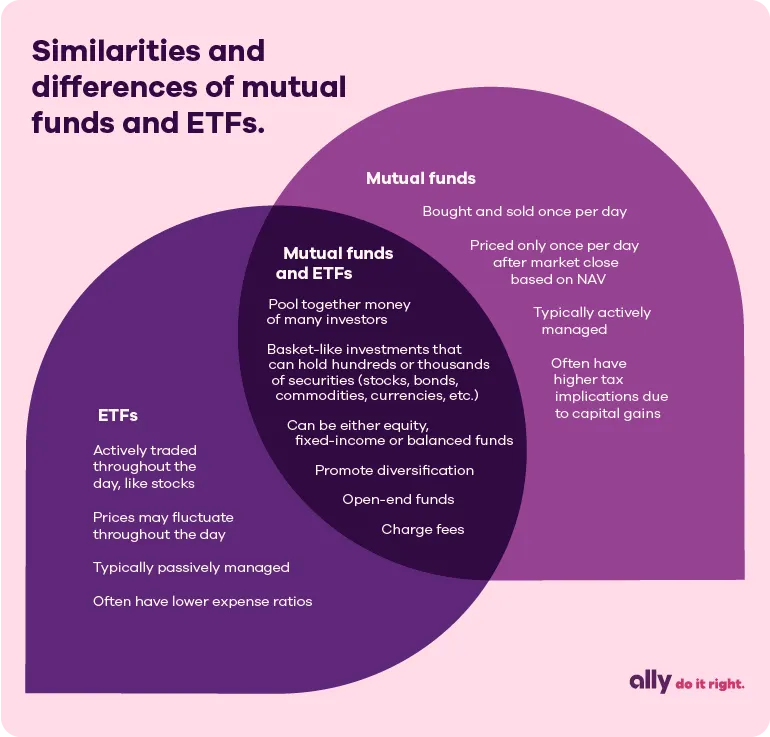

On the surface, mutual funds and exchange-traded funds (ETFs) may seem very similar. Both are basket-like investments that promote diversification, are professionally managed and can earn or lose money. However, they also have distinctive attributes that make them unique.

Read on as we compare ETFs and mutual funds and discuss their similarities and differences.

Mutual funds

Mutual funds are pooled assets that invest in securities such as stocks and bonds. Buying a mutual fund gives you instant diversification, which means that you spread your money around in different asset classes, instead of putting it into a single company like you do when you invest in an individual stock.

ETFs

Exchange-traded funds (ETFs) are baskets of securities that you can buy and sell during market hours, possibly reducing your risk. For example, an ETF may track the S&P 500, which tracks the stock performance of the 500 largest companies on the U.S. stock exchange. Just like purchasing a mutual fund, you buy a fund that bundles assets, which offers more diversity than an individual stock.

Similarities between ETFs and mutual funds

At first glance, you can see many similarities between ETFs and mutual funds, including the following:

Pool investors' money together: Mutual funds and ETFs both combine the money of many investors together in a basket of securities, which offers portfolio diversification to investors.

Can hold many securities: ETFs and mutual funds are basket-like investments that can hold hundreds or thousands of securities (stocks, bonds, commodities, currencies, etc.)

Fund types can vary: You can invest in equity, fixed-income or balanced funds through ETFs and mutual funds. What does this mean? Equity funds are more volatile, while fixed income funds offer more stability. Balanced funds allow you to enjoy a mix of both — growth and stability.

Promote diversification: As mentioned, diversification involves spreading your investments across various asset classes. The idea being if a particular security underperforms, other, higher-performing securities would, ideally, take over to "cover" the underperforming securities.

Charge fees: The investing associated with mutual funds and ETFs does come with a cost in the form of fees, including expense ratios, which includes fees such as for administration, redemptions, purchases and possibly a shareholder fee.

Open-end funds: Mutual funds and ETFs are open-end funds because they're always available for purchase. There's an unlimited number of shares available and new capital can always flow into the fund.

Differences between ETFs and mutual funds

On the surface, mutual funds and ETFs appear to be the same. In fact, ETFs evolved from mutual funds as investors sought products with different features, such as lower fees. However, there is more than one difference between ETFs and mutual funds, including:

Mechanics: ETFs are very similar to stocks in that their price fluctuates daily and investors can buy and sell shares at any point during the trading day. In contrast, the price of mutual funds is set once every 24 hours at the end of each trading day. This is when their price is determined by the total value of the portfolio divided by the number of shares — otherwise known as net asset value (NAV). So, while you can submit purchase orders for mutual funds throughout the trading day, you won’t know the actual purchase price until day’s end.

Minimum and automatic investments: While buying mutual funds and ETFs can sometimes be cheaper than purchasing one share of a large company, some mutual funds require a minimum investment. These vary per brokerage. Since ETFs are traded like stocks, the minimum amount you need is the price of the single ETF share you’re looking to purchase, plus any commissions your broker charges. Most brokers offer commission-free ETFs.

Fund fees: Mutual funds are often still more expensive than ETFs, but there could be a reason for that. They may include 12b-1 fees, which essentially are compensation for fund advisors' efforts to sell a given fund. Mutual funds can be either actively or passively managed. The investing associated with mutual funds and ETFs does come with a cost in the form of expense ratios, redemptions, purchases and shareholder fees.

Taxes: You pay taxes on dividend income, and capital gains if you sell mutual funds or ETFs for a profit. But ETFs are usually more tax efficient than mutual funds because they experience fewer taxable events. This is because a mutual fund manager buys and sells securities in the fund based on the investment objectives, as opposed to an ETF manager, who accommodates for investment inflows and outflows. Mutual fund sales of appreciated securities result in capital gains paid to shareholders.

Mutual fund and ETF categories

You can invest in several types of mutual fund and ETF categories, including equity funds, fixed-income funds and balanced funds.

Equity funds are fully invested in stocks and meant for investors looking for growth or dvidend-paying stocks. Fixed-income funds typically invest in bonds and short-term securities, such as CDs and money market accounts, and are designed for those who want to avoid the risk associated with stocks. Balanced funds invest in a mix of stocks and bonds.

Equity funds | Invested in stocks Are considered riskier with the potential for more significant returns |

Fixed-income funds | Invested in bonds Are considered to be safer and can provide potentially more reliable returns |

Balanced funds | Invested in a mix of stocks and bonds May be considered more balanced in risk |

While this list is a high-level overview of different mutual fund and ETF options, one of the more appealing aspects of these investment options is the range of subcategories you can choose from.

Popular mutual fund and ETF subcategories

Some of the most popular subcategories include global/international, specialty and index funds.

Global/international | Groups of stocks/bonds from across the world or specific regions (Europe, Asia) |

Specialty/sector | Technology, health care, real estate, etc. |

Index | Track indexes, such as the Dow Jones Industrial Average or the S&P 500 |

Global/international funds

Want to invest internationally but don’t know where to begin or which companies to invest in? There’s a mutual fund or ETF for that, so you don’t have to choose just one. Depending on the brokerage company you invest with, you may have a wide array of choices ranging from a total international fund — which includes investments from across the world — or funds composed of assets from specific areas like Asia or Europe.

Specialty funds

Also referred to as sector funds, specialty funds allow investors to put their money in specific areas of the economy, like technology, health care, finance and real estate, to name a few.

Index funds

Thanks to index mutual funds and index ETFs, investors can replicate the daily movements of the whole stock market rather than risk purchasing individual stocks. The Dow and S&P 500 are indexes comprised of different companies, so index funds that track these are designed to do no better or worse (minus any expenses) than the market itself. Since the market has shown to rise over the long run, this can be an attractive strategy.

The pros and cons of a mutual fund

Mutual funds offer diversification — more than you'd get from a single stock. Your money is spread out among perhaps hundreds (if not thousands) of different stocks and/or bonds within the fund, and you can choose to invest in numerous funds. Funds are also liquid, meaning you can gain access to them more easily. A professional money manager also makes decisions about what to include in an actively managed fund, leaving you off the hook for making every decision.

Mutual funds are a way for everyday investors to have access to professionally managed funds at a relatively lower cost. They can be less risky than individual stocks and therefore might be a good investment strategy for those with long-term goals, such as retirement or college savings.

Mutual funds often come with some higher expense ratios of 1% or more, which can cost thousands over time. Your broker may also charge you a commission, in addition to a sales charge. Distributions on mutual funds can tax you at either the ordinary income rate or capital gains rate, depending on how long you hold your mutual funds. Another downside to mutual funds is that they trade once a day, after the market closes at 4 p.m. Eastern time, which puts a limit on when you can trade.

The pros and cons of an ETF

ETFs can offer all the benefits of mutual funds — professional management, diversification, a plethora of choices — for lower fees and more tax efficiency. They’re also typically cheaper than mutual funds, and they offer more flexibility since they can be bought and sold much like stocks.

One consideration when it comes to ETFs is the market price, which doesn’t always correspond to the intraday value of the underlying securities. Pricing and value of ETFs is dependent on the ETF spread. The ETF spread refers to the difference between the bid and the ask. The spread may be higher than the value of the underlying securities, which means you may not want to transact at that time.

An indexed ETF can stray from its associated index, which means that tracking errors can occur. ETF managers who deviate from the securities in an index often see the performance of the ETF differ from it.

Something for every investor

Though mutual funds and ETFs are often confused with one another, they do have differences. However, diversification is key when it comes to investing, so you might consider buying both mutual funds and ETFs to better spread out your money and hopefully maximize your potential return.