What we'll cover

The benefits of starting to invest earlier

Strategies to lower investment risk

Investing tips and terms for beginners

If you're looking for a perfect time to invest, I have a simple answer: There isn't one. But that doesn't mean you can't use time to your advantage. Instead of agonizing over timing the market, try to focus on starting as soon as possible and staying consistent. As you begin investing, consider the following five principles.

Read more: Which investment accounts should you pick?

1. Don't delay

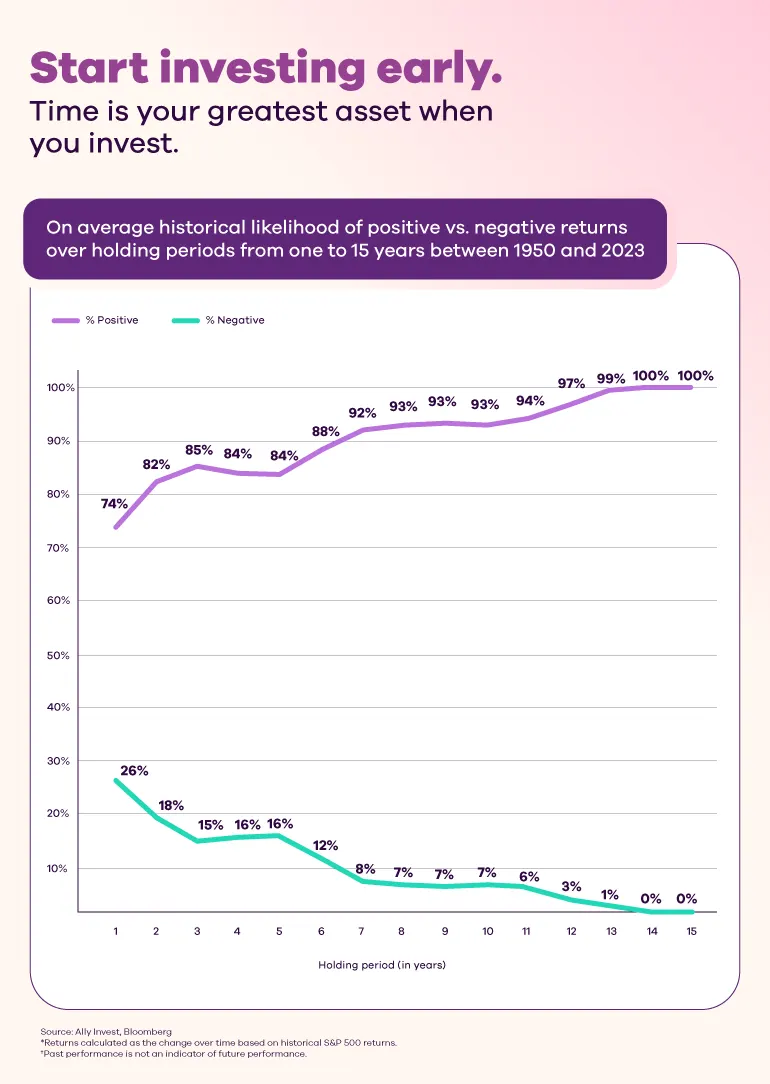

Starting early is crucial in investing, even if you can't invest a lot at first. In a market that has generally gone up more than it's gone down over the years, it's ideal to invest as early as possible. In the long run, your resilience as an investor could matter more than the day you buy your first stock. Historical data backs this up. Take a look:

What does this mean? Through history (between 1950 and 2023, in this case), staying invested for fifteen years has had a 100% likelihood of seeing some return on your investment, based on the S&P 500. While this doesn’t predict future returns, it’s one factor to consider as you think about your investing strategy.

2. Embrace the uncertainty

No one has a crystal ball, but don't let that keep you from focusing on your financial future.

The market's moves are rarely predictable, and it's tough to know for certain where the economy or stocks are heading in the next 12 months. So you have to be prepared for anything when investing.

Over the long term, stocks can provide investors with ample returns from a liquid, robust market. Since 1950, the S&P 500 has risen an average of 8% annually. During that time, investors have endured 11 economic recessions, 10 bear markets (drops of 20% or more) and 24 corrections (declines of 10% or more).

In the long run, your resilience as an investor could matter more than the day you buy your first stock.

3. Diversify

Market swings can be too much to stomach for some investors. That's OK — we all have different risk tolerances. If you're feeling that way, you may consider spreading your money out across a balance of aggressive (such as stocks and ETFs) and more conservative assets (such as bonds). Beyond helping to ease your market stress, diversifying your portfolio can also help insulate it from market volatility because each asset might react different to market moves.

4. Be consistent

Above all, remain calm and remember your goals. Any potential compounding takes time, so patience is the name of the game. It might also be beneficial to set up an investing schedule for yourself and automate it with recurring transfers, so you can stay consistent with your investments.

Consider this: If you started putting $20 a month into a hypothetical, no-fee S&P 500 fund, you could have about $1,500 at the end of five years (assuming the fund grew at an 8% average annual rate each year). Wait another five years, continue to invest $20 a month, and at that growth rate, you could have about $3,700. At the end of 20 years, you could reach $12,000.

5. Think big picture

It may be tempting to jump into hot stocks when they're on the rise, but are they a suitable investment for your own goals? Often, the best strategy for a long-term investor is to keep it simple.

Of course, that can be easier said than done. Life happens, and the case for investing can become blurry during periods of change or tough economic environments. But if you have a plan, you're more likely to think of your goals when the going gets tough.

Read more: Is a robo or financial advisor right for you as your pursue your goals?

What are you waiting for?

Good news: If you're reading this, you've already taken the first step toward pursuing your financial goals through investing. Taking the plunge and making that first investment may seem like a daunting task, but we're here for you.

Remember to know your why and your risk tolerance, and set your money goals before you start and keep these five principles in mind as you navigate the market.

Frank Newman, CFA is the director of portfolio construction and due diligence at Ally Invest. He is responsible for constructing goal-based portfolios tailored to clients' unique needs and situations to help grow their wealth and navigate challenging market conditions with diversified and customized investment portfolios. Frank has a passion for educating investors to help them stay the course with a long-term investment process and ultimately achieve their financial objectives.