Get rewarded when your CD renews.

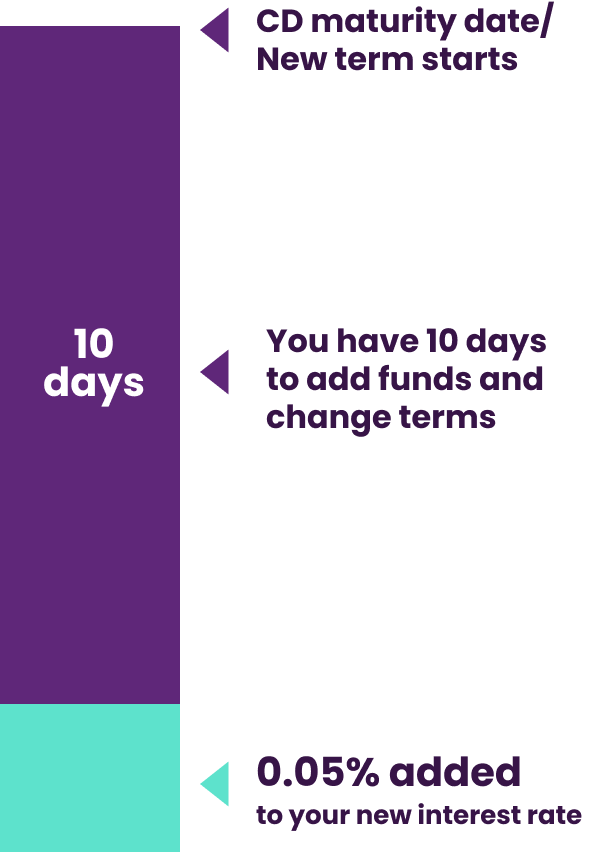

Currently, you’ll get a 0.05% boost to your interest rate when you renew your maturing CD. We'll activate this loyalty reward after your 10-day grace period.

How it works.

If you don’t change your renewal options prior to your CD maturing, we’ll auto-renew your CD to the predetermined term and apply your loyalty reward. But if you made any elections, we'll apply them at maturity. Not sure? Just log in and check — we make it easy to access your account anytime, anywhere.

Before CD maturity.

Think about what you want to do with your money once the CD matures, and set maturity options early to stay ahead of the game. Maturity options include:

-

Rolling over your balance

-

Adding funds

-

Withdrawing a partial amount

-

Changing the term you renew into

-

Choosing where your interest is paid

-

Closing CD at maturity

Setting maturity instructions.

Once your CD is within 12 months of maturity, you can set instructions any time before 9 pm ET on its maturity date. For CDs with longer terms, you can set up an alert to get notified when your maturity date is 12 months away. You’ll be able to set instructions after passing that milestone.

More money means more reward.

Your loyalty reward will apply to both new and existing funds, so it’s a great chance to increase your CD savings. You can schedule a transfer up to one year before your CD's maturity date, and we'll usually initiate that transfer on your maturity date.

After CD maturity.

If you haven’t added funds or changed terms by the time your CD maturity date rolls around, don’t worry. You can still make changes during your 10-day grace period.

The Ally Ten Day Best Rate Guarantee.

When you fund your CD on the same day you open it or on one of the next nine calendar days, you'll get the best rate we offer for your term and balance if our rate goes up within that time. The Ally Ten Day Best Rate Guarantee also applies at renewal.

CD spotlight.

Weighing your options? We’re here to help with the window shopping. You can also compare CDs for more rates.

Ally Bank 5-Month Select CD

Ally Bank 6-Month High Yield CD

Our Annual Percentage Yields (APY) are accurate as of .

More places for your money.

Here are a few non-CD options for you to consider. Check out what Savings and Robo Portfolio accounts have to offer.

Ally Bank Savings Account

%

Annual Percentage Yield

on all balance tiers

Grow your money faster with our smart savings tools, plus enjoy no monthly maintenance fees or minimum balance requirements.

Our Annual Percentage Yields (APYs) are accurate as of .

Ally Invest Robo Portfolio

$100

to start investing

Let our robo advisor do the work so you don’t have to. Tell us your goals, then we’ll pair you with a diversified portfolio: choose no advisory fee with a cash-enhanced portfolio or put more in the market for 0.30% a year with a market-focused portfolio.

Ally Invest securities products are not FDIC insured, not bank guaranteed, and may lose value.

Try both to take advantage of our One Ally Transfer feature.

With both an Ally Bank Savings Account and an Ally Invest Robo Portfolio, you can easily move money from your savings into your Robo Portfolio whenever you want. This helps you stay one simple step away from investing your money anytime.

FAQs

We have answers.

Deposits products are offered by Ally Bank, Member FDIC.

Securities products and services offered through Ally Invest Securities LLC, member FINRA / SIPC . For background on Ally Invest Securities go to FINRA’s BrokerCheck . Advisory services offered through Ally Invest Advisors Inc., a registered investment adviser. Ally Invest Advisors, Ally Invest Securities, and Ally Invest Group are wholly owned subsidiaries of Ally Financial Inc. View Invest disclosures . Securities products are NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE.