Unlock savings with everyday spending.

Our Spending and Savings Accounts offer tools that work with each other to help you meet your goals faster.

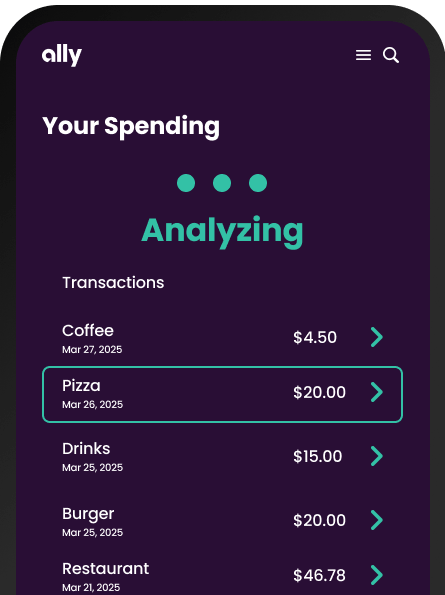

Spend smarter, save more.

Turn everyday spending into savings with Ally Bank’s buckets and boosters.

Surprise Savings

We watch your linked checking accounts for safe-to-save money, then transfer it to your savings.

Round Ups

We track transactions to round up to the nearest dollar, then transfer to your savings.

Spending and Savings Buckets

Set aside money for what matters to you, and get the true picture of your spending and savings.

Spending Account.

An interest checking account that helps you meet your spending goals.

Features

-

Keep more of your money with no minimum balances, no hidden fees and no overdraft fees, ever

-

Get paid up to two days sooner with early direct deposit

-

Pay no fees at 75,000+ Allpoint® and MoneyPass® ATMs in the U.S., and get reimbursed up to $10 per statement cycle for fees at all other ATMs nationwide

-

Peace of mind with the maximum FDIC insurance allowed by law

Savings Account.

Help your money work smarter.

Features

-

Get a competitive, variable rate with no monthly maintenance fees

-

No minimum balance requirements and 24/7 support

-

Savings buckets to help visualize your goals

-

Set-it-and-forget-it boosters to help you grow your money faster