Everything you need to know about your Ally Bank account, right here.

We know how busy life can be. That's why we've developed innovative tools and features so you can have the best digital banking experience possible. We've got your back. We're your ally.

Easy ways to add money to your account.

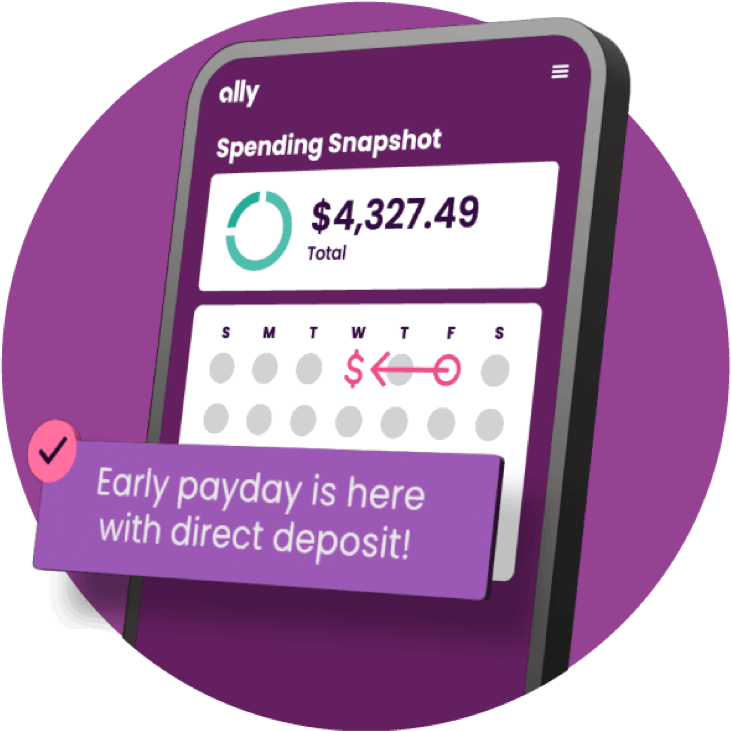

Set up direct deposit automatically.

We've made it fast and easy to set up direct deposit, and most payment providers are eligible. Here’s how to do it for your Spending Account and get paid up to two days sooner with early direct deposit.

Log in to go to our direct deposit page. Then select your Spending Account.

Choose Set Up Automatically to digitally connect with your employer or payment provider.

Follow a few simple steps and you're done.

Direct deposit the paper way.

Using forms is easy too. Just head to our direct deposit page to download our pre-filled form to give to your employer or fill out a blank one yourself. And don’t worry about hunting for account and routing numbers — we’ll give you all the info you need right on our direct deposit setup page.

Log in to get started or find out more .

Your tool kit for spending and saving.

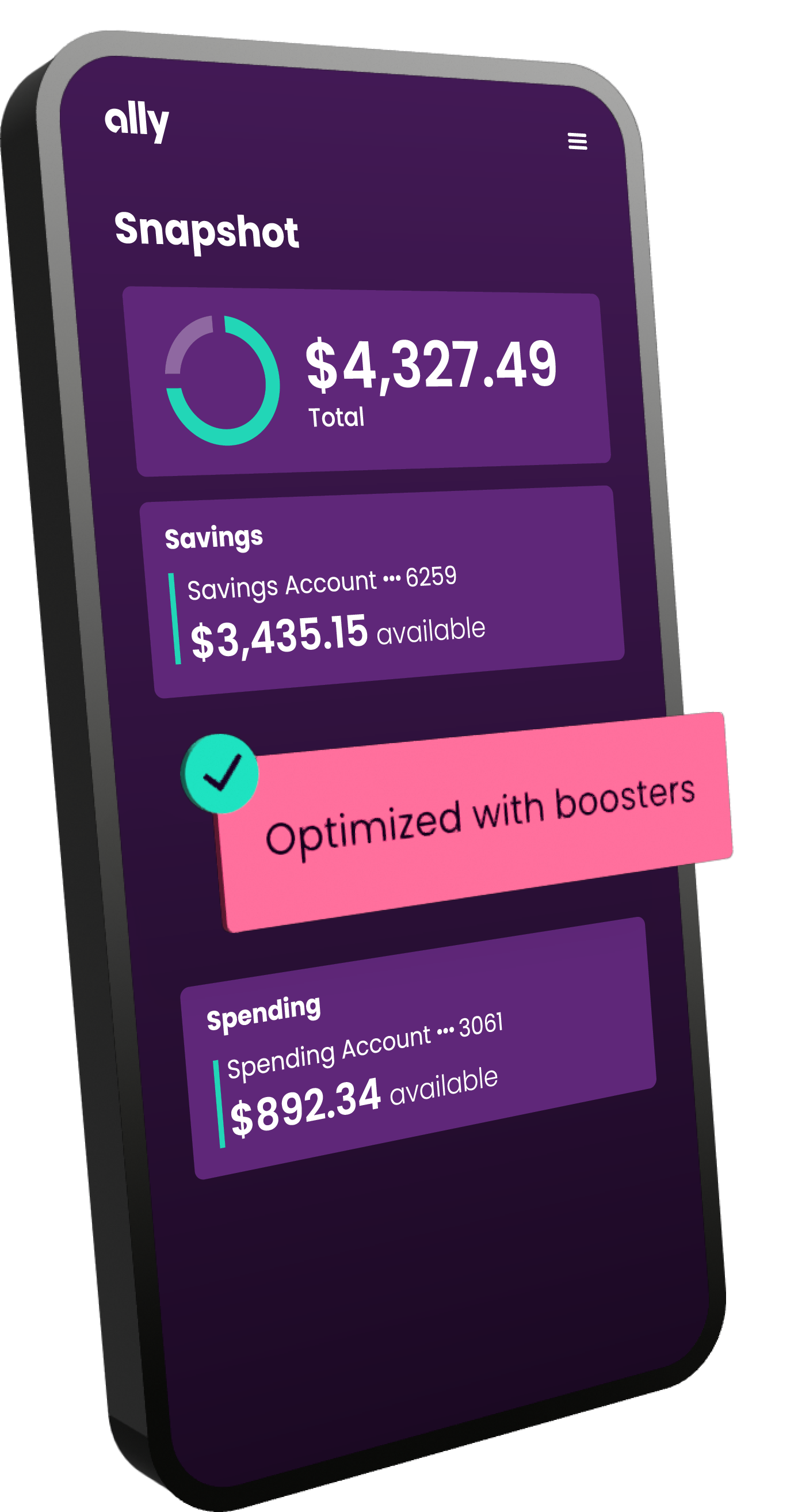

Your Spending and Savings Accounts are packed with tools like buckets and boosters that help you spend smarter and save even more.

-

Spending buckets

Take control of your spending with this feature in your Ally Bank Spending Account. Create buckets for expenses like groceries and utilities so you know how much you have left to spend on everything else. Tag businesses where you frequently spend money, and money will come out of your buckets automatically.

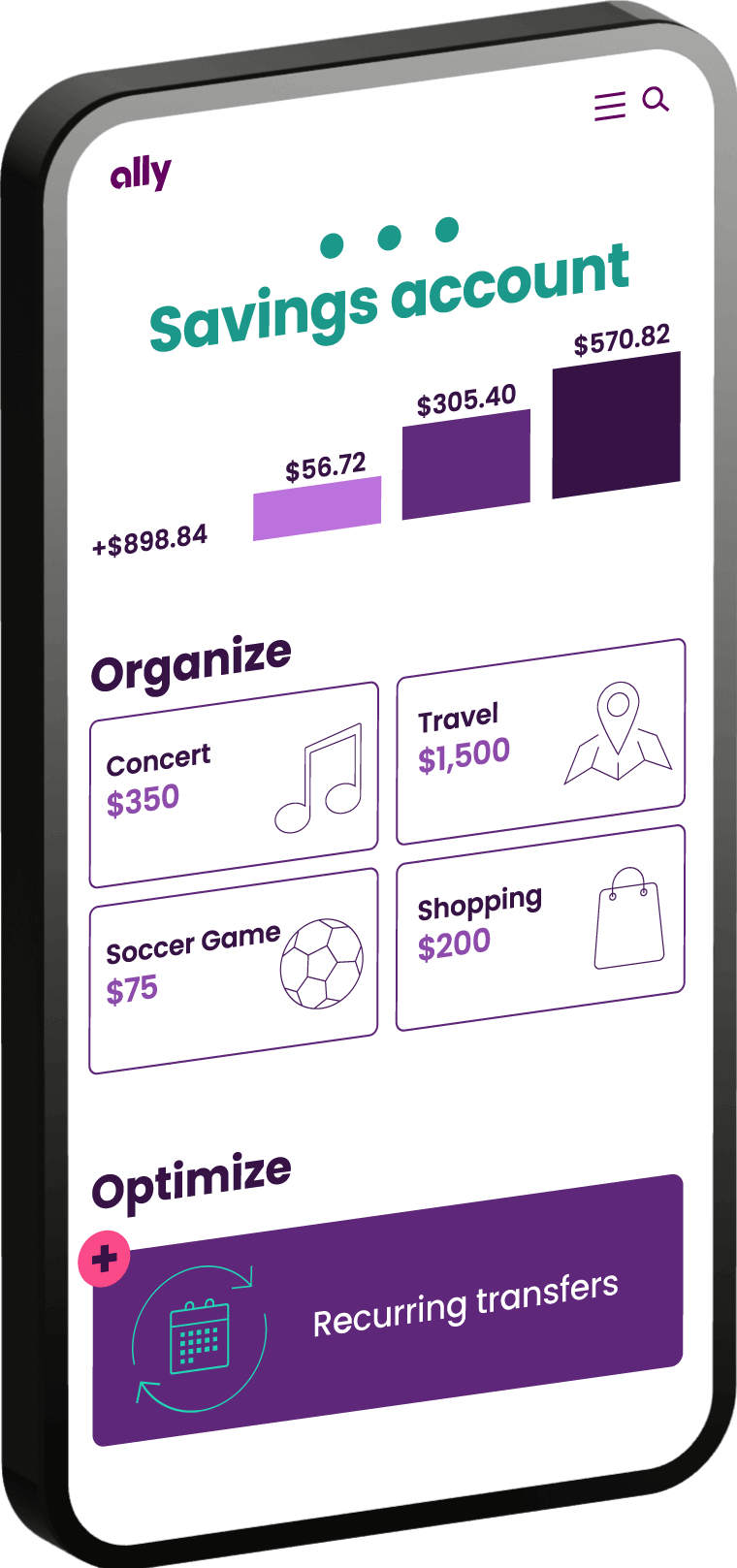

Savings buckets

A feature of your Ally Bank Savings Account, savings buckets let you divvy up your savings into different categories. Choose from 12 existing categories or make your own. You can create up to 30 buckets to save for what matters most to you. Use the goal feature to set your target amount and date — and track your progress.

Manage your money.

You have places to be and people to see. That's why we're always looking at ways to make accessing, spending, and managing your money as convenient as possible.

Access your cash for free.

Why should you pay to get your own money? Use any of the 75,000+ Allpoint® or MoneyPass® ATMs in the U.S. for free. If you get charged a fee at another ATM, we’ll reimburse you (up to $10 per statement cycle).

Protect yourself from overdrafts with CoverDraftSM.

Anyone could lose track of their spending and accidentally overdraft their account. We get it. That’s why we eliminated overdraft fees and added CoverDraft — a fee-free temporary safety net of up to $250.

How it works:

-

In most cases, you qualify for CoverDraft 30 days after depositing $100 or more into your Ally Bank Spending Account.

-

Basic coverage starts at up to $100, but if you set up and receive a qualifying direct deposit of at least $250 for 2 months in a row, you can up your CoverDraft coverage to $250 (you’ll need at least one direct deposit of at least $250 every 45 days to keep this expanded protection).

-

Should you overspend, your next deposit automatically applies to the negative balance.

-

You can turn off CoverDraft or adjust your coverage amount whenever you’d like, as long as you don’t have a negative balance.

-

We’ll give you 14 days to bring your balance out of the negative, and may restrict purchases and withdrawals from your account until you bring your balance back to $0 or more.

Manage CDs online.

-

Keep an eye on CD account on your desktop or the Ally Mobile app.

-

You can change terms and add funds when your CD matures.

We’re serious about security.

Keep your finger on the pulse with account alerts.

Create custom alerts to stay on top of balances, deposits, overdrafts and any suspicious transactions.

Stay informed about fraud safety.

Rule #1: Never share any of your authentication codes or personal info with anyone.

Rule #2: Be suspicious of any emails or texts asking for personal information.

Remember: scams keep evolving and taking on new shapes. Always stay mindful and reach out to us if you need help.

-

Contact our fraud hotline 24/7 at 1-800-971-6037 if you think you've been a victim of identity theft or financial fraud.

Spending buckets are a feature of the Ally Bank Spending Account.

Savings buckets and boosters are features of the Ally Bank Savings Account.

Round ups are a feature of the Ally Bank Savings Account and requires an Ally Bank Spending Account.

Keep in mind, CoverDraft isn't a line of credit or a guarantee. If your purchase isn't covered for any reason (let's say the transaction exceeds your CoverDraft limit, for example), it will be declined - but we'll never charge you an overdraft fee.

Early direct deposit, a feature of Ally Bank's Spending Account, offers eligible direct deposits up to two days sooner.

App Store is a service mark of Apple Inc. Google Play is a trademark of Google Inc.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Deposit products are offered by Ally Bank, Member FDIC.