LGBTQ+ Money Matters

Finances focused on you.

Members of this community sometimes face a steeper climb on their financial journey. We rounded up our resources and other handy tools that keep those perspectives in mind.

Choosing a family.

4 min read

Parenthood and financial resilience.

The finances behind building a family.

Contemplating kids? Get the full picture on the cost of raising a child.

4 min read

Build your knowledge.

Your business.

5 min read

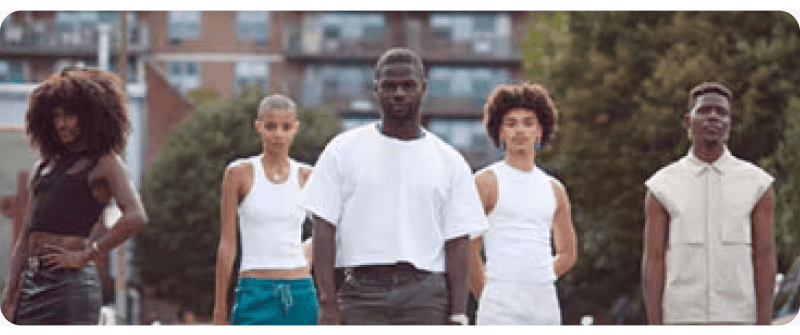

Find out what happens when finance meets fashion.

Be your own advocate.

Find employers committed to equality by using the Corporate Equality Index from the Human Rights Campaign Foundation.

More on that.

No place like home.

4 min read

Love and home renovation.

Your dream home can be a reality.

If a new home is on your horizon, get a sense of what expenses to expect.

6 min read

Don’t settle when you’re settling down.

Research cities with inclusive laws and policies using the Municipality Index and the State Scorecards provided by the Human Rights Campaign Foundation.

Tools to thrive.

WorthIt , financial wellness by the HRCF

SAGECents , financial wellness for elders by SAGE

Your Rights , legal and financial guidance for elders by SAGE

Stay engaged with Ally and the LGBTQ+ community.

Let's link up.

A FEW THINGS YOU SHOULD KNOW

Ally Financial Inc. (NYSE: ALLY) is a leading digital financial services company, NMLS ID 3015 . Ally Bank, the company's direct banking subsidiary, offers an array of deposit, personal lending and mortgage products and services. Ally Bank is a Member FDIC and Equal Housing Lender , NMLS ID 181005 . Credit products and any applicable Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Programs, rates and terms and conditions are subject to change at any time without notice.

Ally Servicing LLC, NMLS ID 212403 is a subsidiary of Ally Financial Inc.

Securities products and services offered through Ally Invest Securities LLC, member FINRA / SIPC . For background on Ally Invest Securities go to FINRA’s BrokerCheck . Advisory services offered through Ally Invest Advisors Inc., a registered investment adviser. View Invest disclosures . Ally Bank, Ally Invest Advisors, and Ally Invest Securities are wholly owned subsidiaries of Ally Financial Inc. Securities products are NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE.

Before you invest, you should carefully consider the investment objectives, risks, charges, and expenses of any mutual fund or exchange-traded fund ('ETF') you are considering. ETF trading prices may not necessarily reflect the net asset value of the underlying securities. A mutual fund/ETF prospectus contains this and other information and can be obtained by emailing support@invest.ally.com .

Ally and Do It Right are registered service marks of Ally Financial Inc.