What we'll cover

The definition of a put option

Strategies to buying and selling puts

Different types of pull options

You’ve probably heard the phrases “what goes up, must come down” and “all good things must come to an end” when someone talks about the end of a bull run in the stock market.

Both of those statements infer that your investments can only grow in value when the market is rising. But what if there were ways for you to potentially make money, even when the market is bearish? Turns out, there are. And one of those ways is called a put option.

What is a put option?

Simply put (pun intended), a put option is a contract that gives the option buyer the right — but not the obligation — to sell a particular underlying security (e.g. a stock or ETF) at a predetermined price, known as the strike price or exercise price, within a specified window of time, or expiration.

Buying put options can be a way for a bearish investor to capitalize on a downward move in the underlying asset. But if you buy too many options contracts, you could actually increase your risk. Options may expire worthless, and you can lose your entire investment.

Quick tip: Options trades are affected by changing conditions and investors should have an awareness of the factor’s driving change in an options price, like intrinsic value and time value. The Greeks, a series of handy variables, may help you better position yourself accordingly when you utilize them.

Puts vs. calls

Put options are basically the opposite of call options, which give the option buyer the right to buy a particular security at a specified price any time prior to expiration. Here's an easy way to remember the difference:

Puts = putting the security away from you (selling)

Calls = calling the security toward you (buying)

How do put options work?

You can buy put options contracts through a brokerage, like Ally Invest, in increments of 100 shares. (Non-standard options typically vary from the 100 share increment.)

Let’s say you think the market value of XYZ technology company will decline within three months from the $100 a share they are trading at today. A put option gives you the right to sell at your strike price of $100 within those three months, even if the stock price falls below that amount.

Assume you exercise your put option when the stock falls to $90: Your earnings are $10 per share, multiplied by 100 shares, or $1,000.

Since your options contract charges a premium of $2 a share, you’ll need to deduct $200 ($2 x 100 shares) from your profit, bringing your profit to $800, minus any commissions your brokerage may charge.

Quick tip: When the market price of your underlying stock falls below break-even (the strike price minus the premium you paid, excluding commissions), it is profitable.

But if the underlying stock price rises, your put option could be worthless and there’s no point in exercising it. In this situation, you’ll suffer a loss because you’ll be out the $200 premium you paid for the put option contract, plus the commission amount.

This trade is known as a long put strategy.

Put option example

Buying and selling puts: Strategies and examples

Like call options, specific strategies exist for put options. And it’s common to combine them with call options, other put options and/or equity positions that you already hold. Some of the more common strategies include protective puts, put spreads, covered puts and naked puts.

Protective puts

A protective put (also known as a married put) lets you shield the securities you own from price declines. How so? You continue to hang onto your existing shares (taking a long position), while also having put options, which can be thought of as an insurance policy (or a hedge) against price declines.

For example, say you bought 300 shares of XYZ technology company for $75 a share and three put option contracts with a strike price of $70, a premium of $1 per share and an expiration date six months from now.

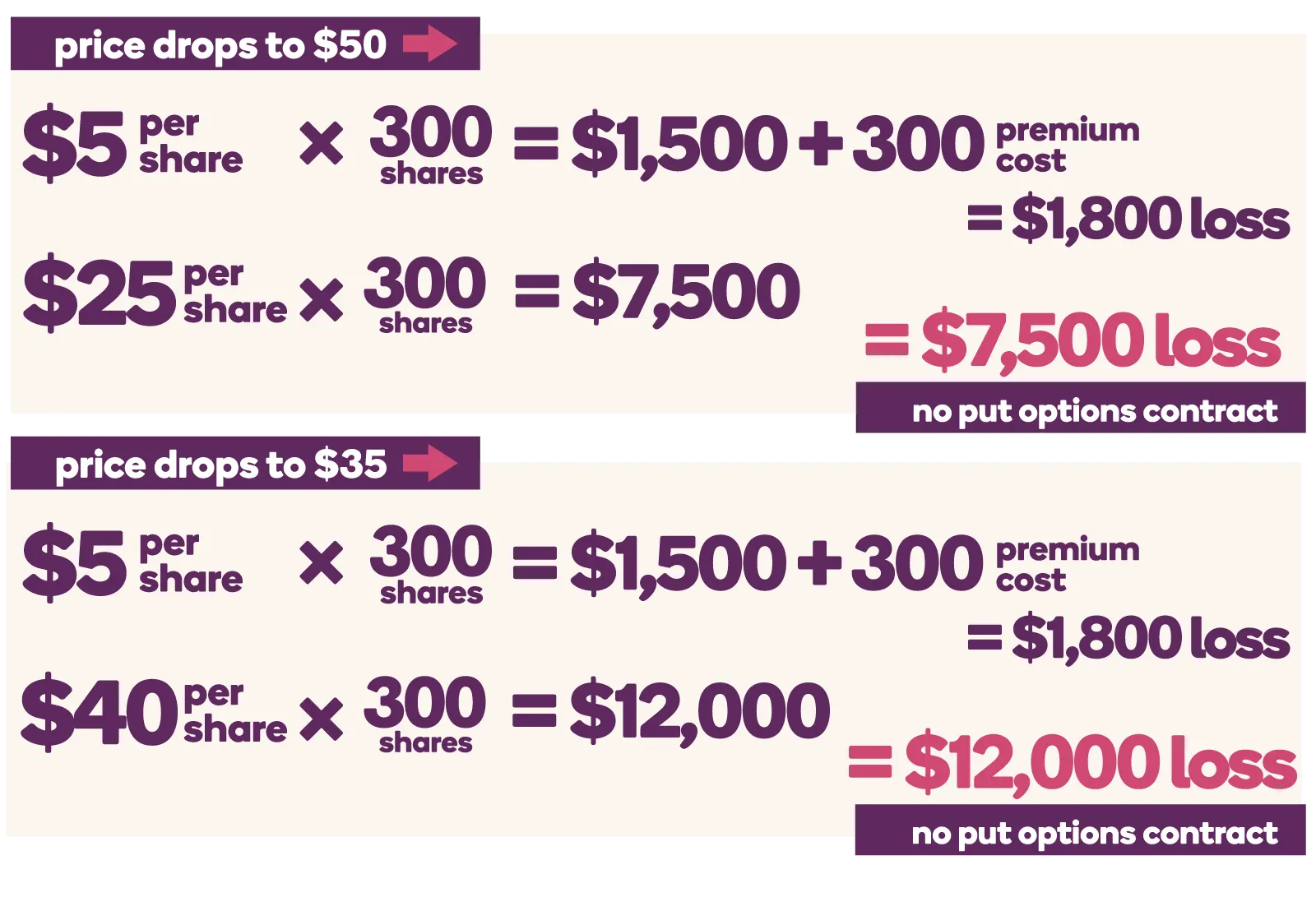

After four months, the market price drops to $50 per share. As an option holder, you can exercise the put option and sell your stock at the strike price of $70, and you’ll only lose $1,800 ($5 per share multiplied by 300 shares equals $1,500, plus the premium cost of $300, or 3 contracts x 100 x 1).

What if the stock’s price falls even further, to just $35 per share? Your losses are still capped at $5 per share, or $1,800, since you can sell your stock at the strike price of $70. That’s referred to as your maximum loss.

With no put options contract in place, the loss would be greater, since there’s no cap. For instance, if the price dropped to $50 per share, you’d lose $7,500, and if the price dropped to $35 per share, you’d lose $12,000.

What happens if the stock’s price per share increases? Assume the same tech stock rises to $90 per share. That’s $20 per share more than your strike price, so you wouldn’t want to exercise your put option — you’d just let it expire.

(Since you bought the options contract, though, you’ll lose the $300 premium paid: $1 per share multiplied by 300 shares.)

Instead, you’ll sell your stock at the market price, netting you a profit of $4,200. ($15 multiplied by 300 shares, minus the premium cost of $300).

Since potential growth of a stock is limitless, you can say that the profit potential of a protected put is also limitless, minus the premium paid.

Put spreads

There are two types of put spreads: bull put spreads and bear put spreads. When executing a spread, you are both a buyer and seller.

A bull put spread is an options strategy you could use if you expect the underlying asset to experience a moderate price increase. To employ this strategy, you first buy a put option (paying a premium), then you sell a put option (on the same security) with a higher strike price than the one you bought, receiving a premium for the sale. The maximum net profit is the difference between what you receive from selling the put and what you pay for buying the other.

On the other hand, a bear put spread is a strategy used when you expect a moderate to large price decline in the underlying asset. You purchase put options and sell the same number of put options for the same security and with the same expiration date, but at a lower strike price. The maximum profit is the difference between the strike prices, less the cost of purchasing the puts.

Naked puts

If you think a stock’s price will remain unchanged or will rise, you may want to consider a naked put option (or uncovered put or short put).

With a naked put, if you receive the underlying securities, they will be at the strike price. Here’s how a naked put works.

Remember XYZ tech company? Let’s say you think the stock will stay flat or go up, so you sell a naked put option with a strike price of $90. In exchange for accepting the obligation to buy 100 shares of XYZ at $90, if XYZ drops below the strike price, you receive an option premium of $1 a share, or $100. If the share price is above the strike price of $90/share and the option expires, you keep the option premium you received, and you are relieved of your obligation.

Quick tip: The main goal of trading naked put options is to collect the option premium as income, so you don’t want to employ this strategy if you think the stock’s price is trending downward.

It’s a different scenario if the underlying stock price falls below $90. In theory, the price could go all the way to zero and you would be obligated to buy 100 shares of XYZ at the strike price of $90.

Put options risks and alternatives

As mentioned, put options can be a way to improve your earnings during a down market (or even during a single security’s downturn). But options trading isn’t for beginner investors. Sure, it can provide flexibility, opportunities and a certain level of risk reduction, but options trading itself is not risk free.

To be an options trader, DIY investors, like those with a Self-Directed Trading account, should first learn the ins and outs of options trading before jumping in. That’s because, when it comes to options, it’s easy to make small mistakes that can lead to adverse outcomes. Our Options Playbook can be a great place to build your foundation of knowledge, strategy and confidence.

Time decay is one risk. Each day, the value of your option is decayed by time. In other words, the closer your contract gets to its expiration date, the less time there is for the security to move in one direction or the other.

Quick tip: One strategy to mitigate time decay is to use longer options contracts of three to six months or sell your contract the closer you get to the expiration date.

Another risk is implied volatility, which shows how volatile the market could be in the future. If you’re trying to figure out the chance of a stock reaching a specific price by a certain time, implied volatility can help you enter an options trade knowing the market’s opinion.

Volatility — the amount a stock price fluctuates — is also another such risk. Should the price of the underlying security be highly volatile and fluctuate in the opposite direction that you thought it would, you could end up in a loss.

Put options vs. short selling

One alternative to buying puts is short selling, as you’re betting against a stock in both cases. But they’re not the same type of trade.

Some investors prefer options trading because you don’t need to borrow a security, like you do with short sales. And the downside to put options is capped at the amount you spend buying the contract. Remember: The buyer of the put option has a right, but not an obligation, to sell the stock if they have a put option. So even if they miscalculate and the stock rises, they are only out the premium.

Short selling is different because your losses can continue to mount until you buy the stock to close the position.

Let market ups and downs work for you.

While some fear a downward turn in the market, put options can be a way for bearish investors to take advantage of downward price moves of stocks. They’re not without risk, but they can be the silver lining in a slumping stock market.