What we'll cover

How credit scores affect the rate offered for auto financing

The credit scores auto finance companies review

Ways to buy a car with imperfect credit

Ready for a new set of wheels? Before you start venturing out to dealerships or shopping for cars online, there's one important step you must take: Checking your credit.

If you plan to finance a vehicle, you should be prepared for finance companies to pull your credit scores. So what credit score is needed to buy a car?

How credit scores affect auto financing

The minimum credit score to buy a car can vary by finance company. Generally, a score of 600 or better can help you qualify for auto financing. However, you might need a much higher score to get the lowest rates.

That’s because credit scores are a snapshot of how responsibly you manage debt. When you apply for auto financing, the finance company wants some reassurance that you'll pay back what you borrow. A good credit score can suggest that you're more likely to be able to pay in full and on time. As a reward for your good credit history, finance companies may extend the lowest rates when approving you for auto financing.

A lower score, on the other hand, can make you appear riskier in the finance company’s eyes. To compensate for the added risk, finance companies might charge higher rates. That's one of the biggest drawbacks of getting a car with bad credit, since it means that financing the car can end up being more expensive over time.

Which credit scores do finance companies use?

Credit scores are generated using different credit scoring models. Those models calculate scores based on the information that's in your credit reports. A credit report is a collection of details about your debt.

Two main credit scoring models could be consulted when you apply for auto financing:

FICO® Score

FICO Scores are considered the gold standard for credit scoring. Ninety percent of top finance companies use them for credit scoring decisions.

The FICO score model ranges from 300 to 850, with 850 being a "perfect" score. FICO scores are based on five factors: payment history, credit utilization, credit age, credit mix, and credit inquiries.

Lenders might use FICO Auto Scores to check your credit for auto financing. This score has multiple versions, based on the different factors used to generate it. You can ask your finance company which of these scores, if any, are used for financing decisions.

Generally, a score of 600 or better can help you qualify for auto financing.

VantageScore

VantageScore is a credit scoring model developed by the three major credit bureaus: Equifax, Experian and TransUnion. VantageScore also operates on a range from 300 to 850, though they aren't identical to FICO Scores.

While VantageScore considers things like payment history, credit usage and credit age, they're weighted differently in the overall score. VantageScore 4.0 also uses trended data to evaluate credit behaviors over time as an indicator of future risk.

Like FICO, VantageScore has an auto financing-specific scoring model. This model is designed to provide a clearer assessment of payment risk, including for people who may be considered "unscorable" because they have thin credit files.

Average auto financing rates by credit score

Credit scores can directly influence the rates you pay for auto financing. The higher your credit score, typically the lower your rate.

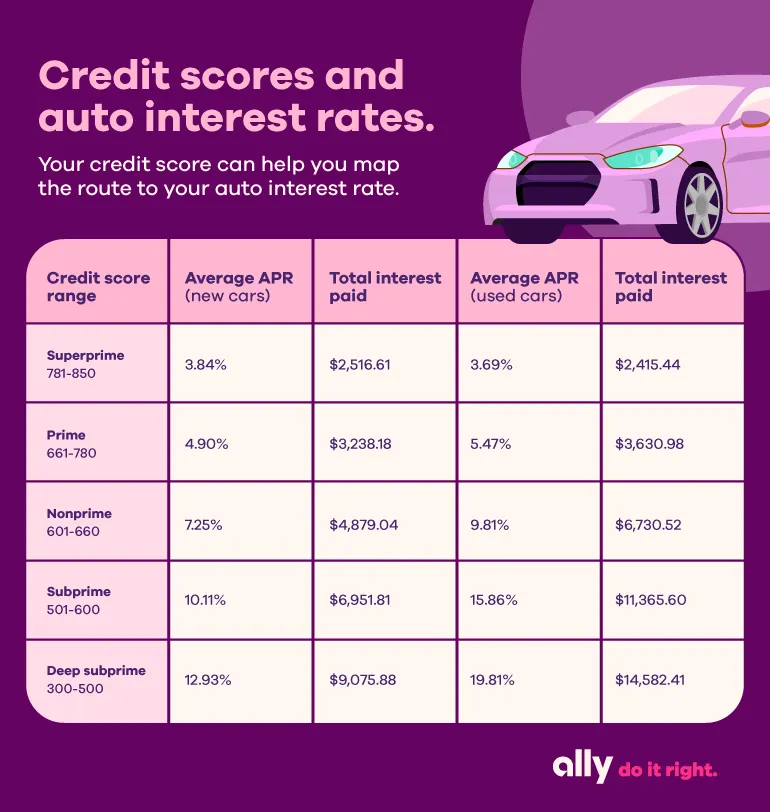

Let’s say you’re looking to purchase a car and need to finance $25,000 with a five-year term. Based on your credit score, you could pay anywhere from $2,516 to $14,582 in finance charges. Take a look at these estimates:

As you can see, borrowers with the lowest credit scores tend to carry the highest costs of borrowing. Note that these numbers do not include amounts paid toward a down payment or other costs due at the time you purchase the vehicle, such as sales tax or registration.

How to buy a car with bad credit

Getting a car with bad credit isn't impossible but it can be expensive if you end up with a higher rate. That’s why you should always work to build and maintain a good credit score. To prepare for the costs of borrowing:

Budget for a higher rate

Factoring a higher rate into your monthly outlays can help you get a better idea of what your buying range should be, pricewise, and help you avoid ending up with a car payment you can’t afford. You can use a simple monthly car payment calculator to estimate your finance charges and monthly payment.

Consider having a cosigner

A cosigner is someone who agrees to sign a vehicle financing contract with you. If you have a cosigner with good credit, it could work in your favor. That’s because finance companies can look at both of your credit scores when determining whether to approve you and, if so, what rates you'll pay.

Keep in mind: A cosigner is equally responsible for the debt if you default on payments, so both of you could face collection actions and negative credit score impacts if you fail to pay your monthly bill.

Shop around for preapproval

Being preapproved for auto financing means that a finance company has done a cursory review of your credit and income to determine what kind of financing terms you might qualify for. Preapproval doesn't lock in a specific rate, but it can tell you which finance company is likely to offer the best deal.

Tip: Look for preapproval options that don't require a hard credit check since they can show up on your credit report and can trim points off your score. Soft inquiries, on the other hand, usually won't affect your credit.

Other factors that can help you buy a car

Credit scores matter, but they're not the only things finance companies consider. If your score isn't where you'd like it to be just yet, these moves can help you compensate for it.

Make a larger down payment

Your down payment is an upfront payment towards the total cost of the vehicle you are wanting to purchase. The larger your down payment, the less you have to finance. So even if the financing you qualify for carries a higher rate, your down payment could reduce your overall finance charges. Plus, borrowing a smaller amount could also result in a lower monthly payment.

Ally works with numerous dealers to offer auto financing for creditworthy car buyers. You can buy with flexible terms that keep your monthly payments where you want them.

Provide documents showing financial stability

Finance companies want to know that you have the means to repay the amount you owe under your contract. Providing proof of steady, consistent income could help convince a finance company to extend more favorable terms. Documents you might be asked to provide include:

W-2s

Monthly pay stubs

Profit and loss statement(s) if you're self-employed or run a business

Investment income statements

If you don't have steady income because you're a student, a stay-at-home parent, or you're just side hustling versus working a full-time job, you might not have this type of paperwork. In these instances, you could share bank or investment statements to demonstrate you have accumulated savings.

Compare financing rates outside of the dealership

The dealership might be the first place you look to for auto financing, but it's important to compare rates with other financing providers. Check rates with your bank or online auto lenders to see what is available.

For example, you might look at the rates where you bank. You can also cast the net wider to include online auto lenders to see what rates are available.

Comparison shopping might draw out the car-buying process, but if you’re able to qualify for less costly financing, the time will have been well spent.

Build your credit before car shopping

Because your credit score is an important factor when financing a car, it’s wise to take steps to help increase your credit scores (like paying bills on time and keeping older accounts open) before applying for auto financing. Doing so could help increase your odds of approval. It could also help you land a better rate — putting you that much closer to driving off in the make and model of your choice.