Intimidated by budgeting because you don’t know where to start? These flexible, easy-to-use budget templates will help you get organized around your spending and saving so you can begin building your financial future.

How to choose the right budgeting method

Think of a budget as a tool you use to accomplish your financial goals. Maybe you want to get out of debt, save for a down payment on a home or go on a dream vacation. When you allocate your spending with these goals in mind, you'll have the motivation you need to put your budget into motion.

Depending on what you’re planning for, your budget will look a little different. Keep your goals in mind as you select your preferred budgeting method.

Read more: Budget smarter with automated tools like buckets and boosters

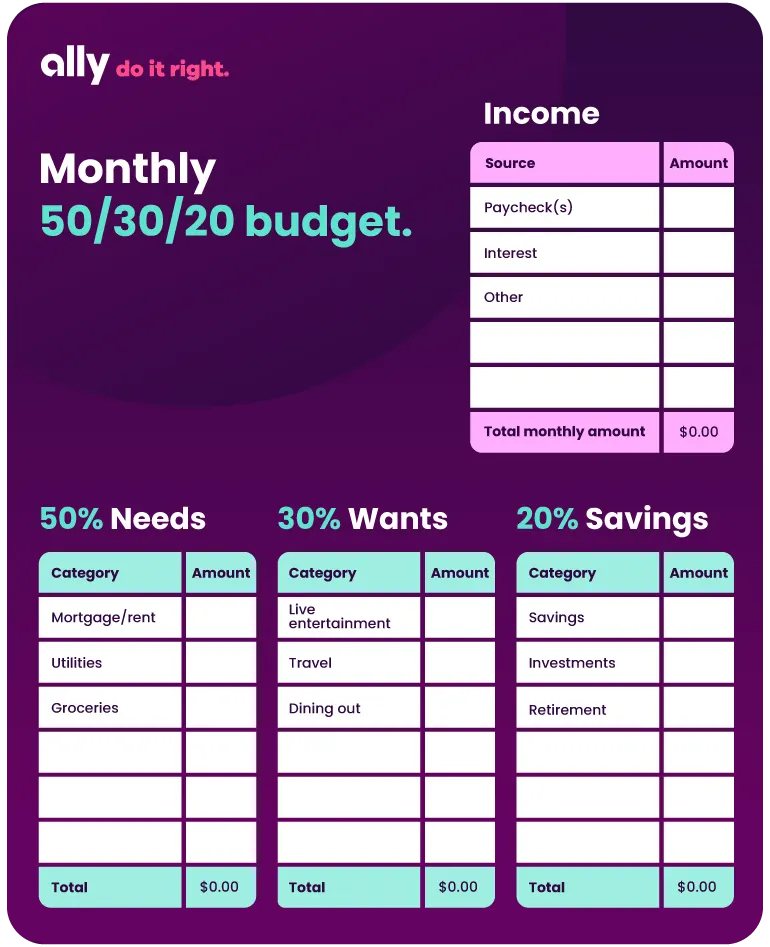

50/30/20 budgeting

The 50/30/20 rule is one of the most popular methods for building a budget. It’s super simple and highly flexible, meaning it can be used for regular monthly budgeting or when saving up for a particular goal.

With this method, your spending is broken up into three main categories:

50% goes to needs (rent, groceries, etc.)

30% goes to wants (restaurants, subscriptions, etc.)

20% goes to savings and debt (paying off student loans, starting a vacation fund, etc.)

If you have specific savings goals in mind, savings buckets, a feature of the Ally Bank Savings Account, can help you stay on track.

Zero-sum budgeting

A zero-sum budget gives a purpose to every dollar. This budgeting method is great for hands-on budgeters who prefer to keep a close eye on their finances. With zero-sum budgeting, you use your last month’s income to budget for the month ahead. The goal is to avoid “leftover” funds being rolled over and spent indiscriminately. For example, if you make $5,000 in January, you should aim to budget that amount for February, spread among your regular expenses, want-to-haves and savings.

Keep in mind - if your income or expenses vary month to month (we’re looking at you, holiday season), you’ll find this budget style requires more active maintenance.

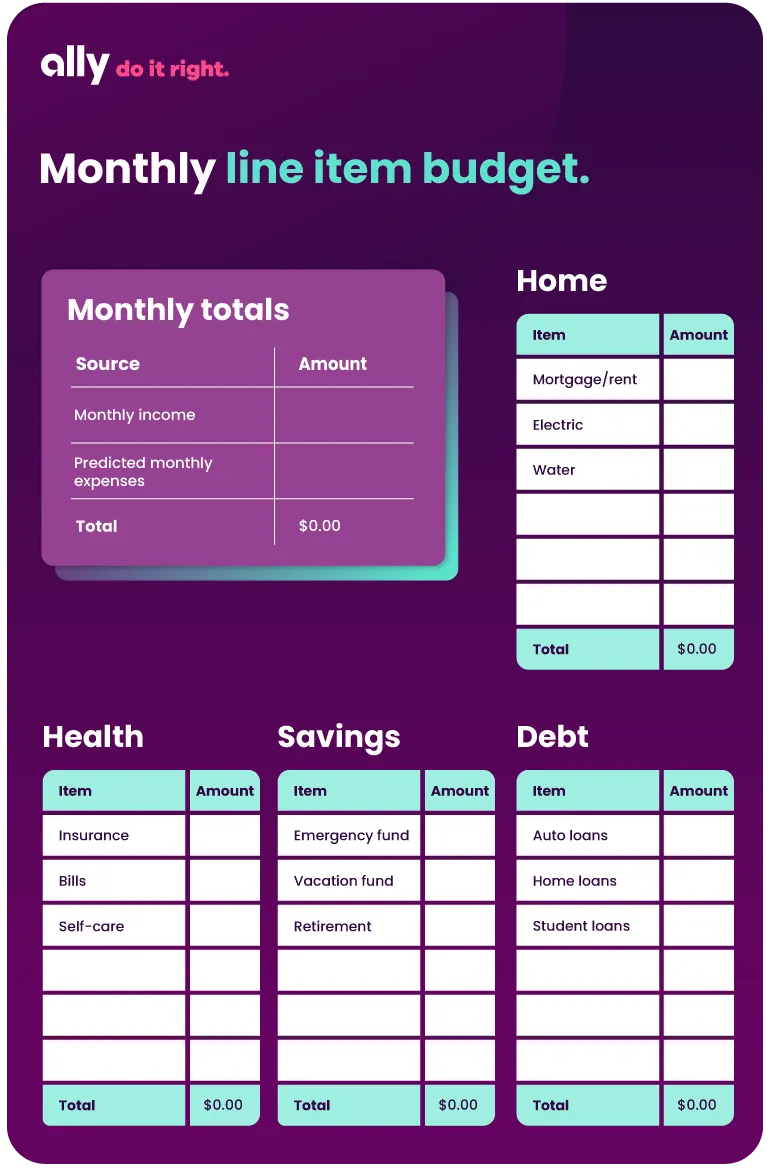

Line-item budgeting

If you believe the devil is in the details, you might thrive with a line-item budget. Getting into the nitty-gritty of your personal finances can help clarify your spending and saving habits as you work toward specific goals.

Start by creating a list of your fixed monthly expenses. Then break up your other expenses into categories such as home, health, debts and savings. Within each category, designate specific line items and allocate a dollar amount to each. Tools like Ally Bank’s spending buckets can help you easily keep track of where your money is going, making the budgeting process easier.

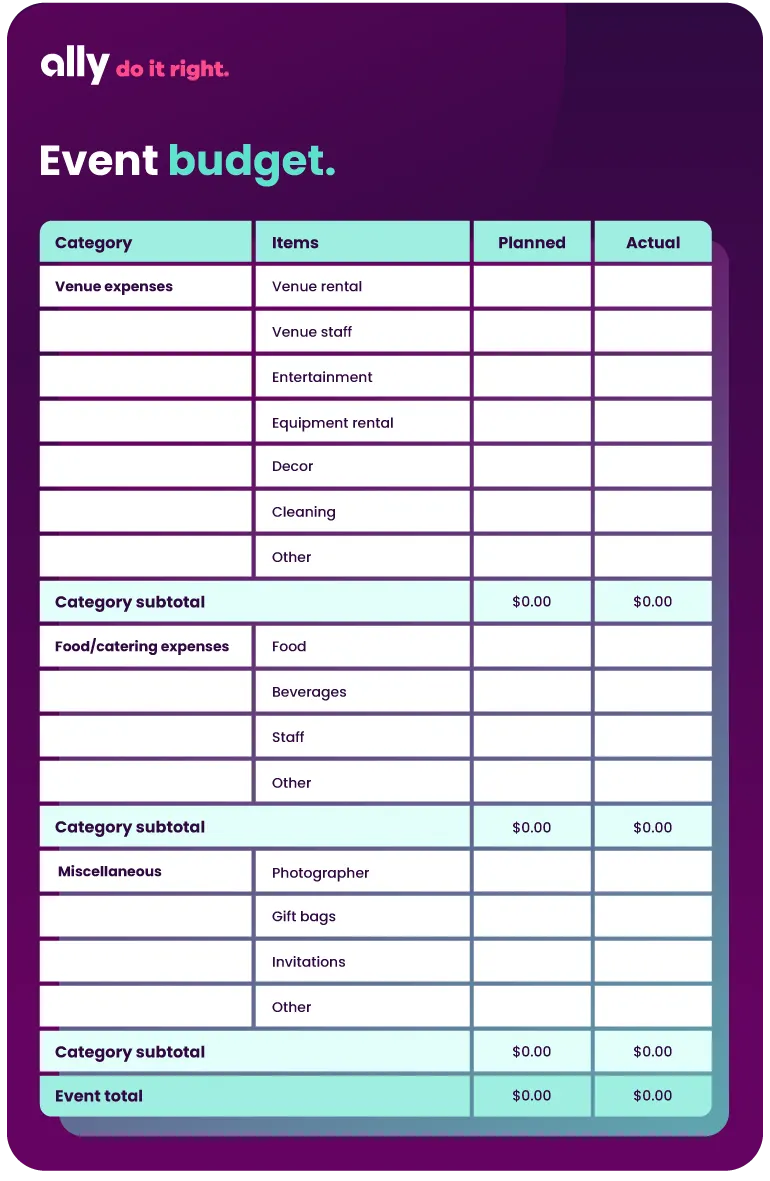

Specific event budgeting

Planning a major event like a wedding or a milestone birthday party? Getting your budget in order ahead of time will help keep the financial stress at bay so you can enjoy your special day. Break up your budget by category and line item, and you’ll get an at-a-glance view of where your money is going. Doing so can also help you identify potential areas to save — maybe you can DIY your decorations or opt for a smaller guest list.

You’ll likely need two different entries in your budget: an estimate of how much you hope or plan to spend on a specific item, and what it actually ends up costing. Then, you can adjust your budget as necessary along the way.

Benefits of a budget template

Starting from a blank page can be difficult. Any of these budget templates can help you simplify your finances by providing a jumping off point. Smart tools like Ally Bank’s Buckets and Boosters can also streamline the process and minimize those everyday hurdles that might get in the way of your budgeting success.

With a clear structure, you can keep track of your spending and improve your financial planning. Once your budget is laid out, look to identify areas for improvement — maybe you’ll spot a category you’ve been overspending on, or find some opportunities for saving that you didn’t know you had!

Expect the unexpected

Along the way, unplanned challenges — medical emergencies, career change or job loss — can throw a wrench into your best-laid plans. As you move through life, your approach to budgeting will change. Reprioritizing goals and finding the right budgeting method for you is important at every life stage.