Everyone loves a deal. And with coupons, discount codes and blowout sales, there are plenty of tricks to save a little cash when shopping. But one of the best ways to find the lowest price is mapping out optimal purchasing times, especially for high-cost items. Keep an eye on the calendar to help you spend less on cars, furniture, wedding rings — and even your next home.

Every sale has its season

When gearing up to make a major purchase, don’t rush into it. For many items, the time of year can make a big difference on the price tag.

Read more: Keep your eye on the prize by visualizing your savings goals.

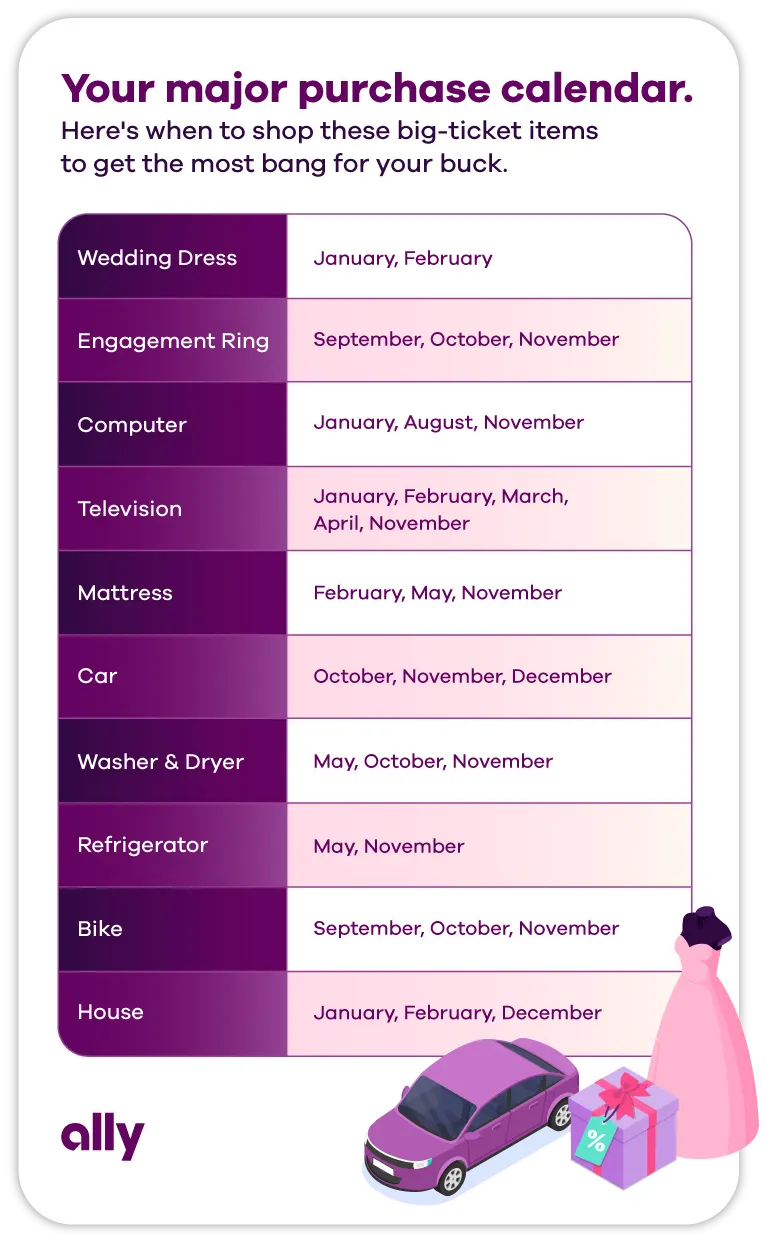

Many shoppers are familiar with the huge deals available during the Black Friday weekend after Thanksgiving, but specific items see significant sales during other times of the year. For example:

Back-to-school season could be your best bet for deals on laptops.

When you’re planning to put a ring on it, you’ll want to time your jewelry shopping between the year-end holidays and Valentine’s Day.

If you’re in the market for a new home, you’ll probably be able to snag the best price in the winter months.

Many of these deals come down to simple supply and demand. Products like kitchen appliances, bikes, boats and much more go through sales cycles based on consumer interest. When the demand for an item is lower than the supply, or when sellers are ready to replace stock with the latest models, they’ll often lower the price. Don’t discount the benefits of putting in a little extra research to find the best timing for your wallet.

Save the SMART way

You may have heard the acronym “SMART” in reference to goal-setting: Specific, Measurable, Achievable, Relevant and Time-bound. These guidelines are helpful for financial goals, too. A clear, reasonable deadline for when you want to make a purchase can help you budget and save in the weeks, months or years beforehand.

For example, if you know you want to buy a new car next October, understanding how much you need to save by that time can help you tailor your budget with precision. But without a concrete timeline, you could end up scrambling for cash, putting off your purchase or accruing credit card debt.

The more time you have to build up funds, the less you’ll have to stash away each month. Plus, if you're saving for multiple goals, having timelines for each one can help you divvy up your savings. Setting SMART goals can help you balance your priorities while saving for different phases of life, growing your emergency fund or planning a vacation.

Preparing for your purchases is key

Planning your purchases also enables you to use different strategies and savings tools to your advantage.

Our buckets and boosters tools, both features of Ally Bank’s Savings Account, can also help you save for your next big spend. Buckets are like customizable digital envelopes that let you set multiple goals and keep them separated — while still accessible in one place. Boosters accelerate your ability to save by automating the process for you. Over a 12-month period, people who have used our Smart Savings Tools grow their Savings Account balances 2x more on average than those who don’t.

Spend with confidence

Planning a major purchase can be exciting — and getting a good deal on something you’ve been saving toward makes it even more rewarding. When you have a big item on your wish list, remember to use your budget and calendar to your advantage.