When you get a new credit card, purchases might not be the only thing costing you. If you see additional expenses on your statements, you could be feeling the effects of your credit card’s annual percentage rate, or APR. Here’s how it works.

Different types of APR

APR is a percentage that indicates how much it costs to borrow money over the course of one year. This total includes the amount of the loan, interest and some of the fees associated with borrowing, while the interest rate is only the percentage of the loan the lender charges you to borrow money.

With credit cards, APR may not reflect every fee (for instance, late fees and annual fees). In general, though, the higher the APR, the more you’ll pay, but APR can be different based on how you use your credit and the type of credit card you have.

Purchase APR | When you buy something on a credit card, this is the rate applied to the average daily balance, but there is usually a grace period for customers if they pay their statement balance in full by the due date. |

Introductory or promotional APR | This typically applies to purchases made in the first six to 21 months of a new credit card and often increases from 0% to a higher APR after the introductory period ends. |

Cash advance APR | If you withdraw cash at an ATM using your credit card, you will be charged a separate, sometimes higher APR, as well as a possible fee. Transactions like purchasing lottery tickets and sending money orders may also be considered cash advances and incur this APR. |

Penalty APR | While Ally doesn't implement a penalty APR, with other credit cards, you can be charged a penalty APR as high as 30% when you violate a credit card’s terms and conditions, like having insufficient funds or failing to make payments on time. |

Fixed APR vs. variable APR

APR can be fixed, meaning it stays the same for the life of a loan, or variable, which changes relative to the U.S. prime rate. If that index rate goes up or down, your APR follows suit. Credit cards often have variable APRs, while loans typically have fixed APRs.

How to calculate APR

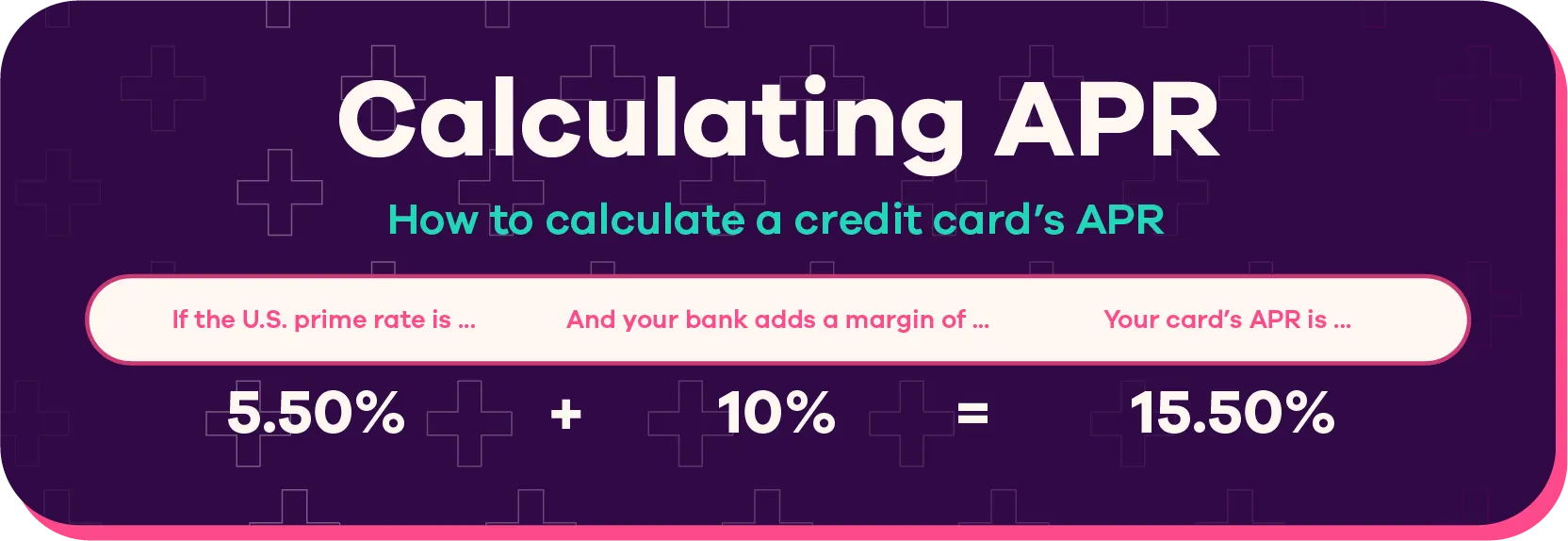

To calculate APR on a credit card, the issuer starts with the U.S. prime rate and adds percentage points, called a margin. The margin usually depends on your credit score, so the higher your credit score, the lower the margin — and vice versa.

How to find your credit card's APR

You can find your APR on your credit card’s statement or terms and conditions, on your issuer’s website or by reaching out to your credit card issuer and asking directly.

Lower what you pay in credit card interest

You might consider a balance transfer if you have an existing balance on a credit card with a high APR. This allows you to transfer your current balance to a new credit card with either a low or 0% APR for a limited time — just be sure to actually pay it down and resist the urge to continue accruing a balance on your high APR credit card.

Save the rate

If you’re planning to open a credit card, compare different APRs to ensure you’re getting the best possible rate. This extra effort can help you keep your credit card costs in check.