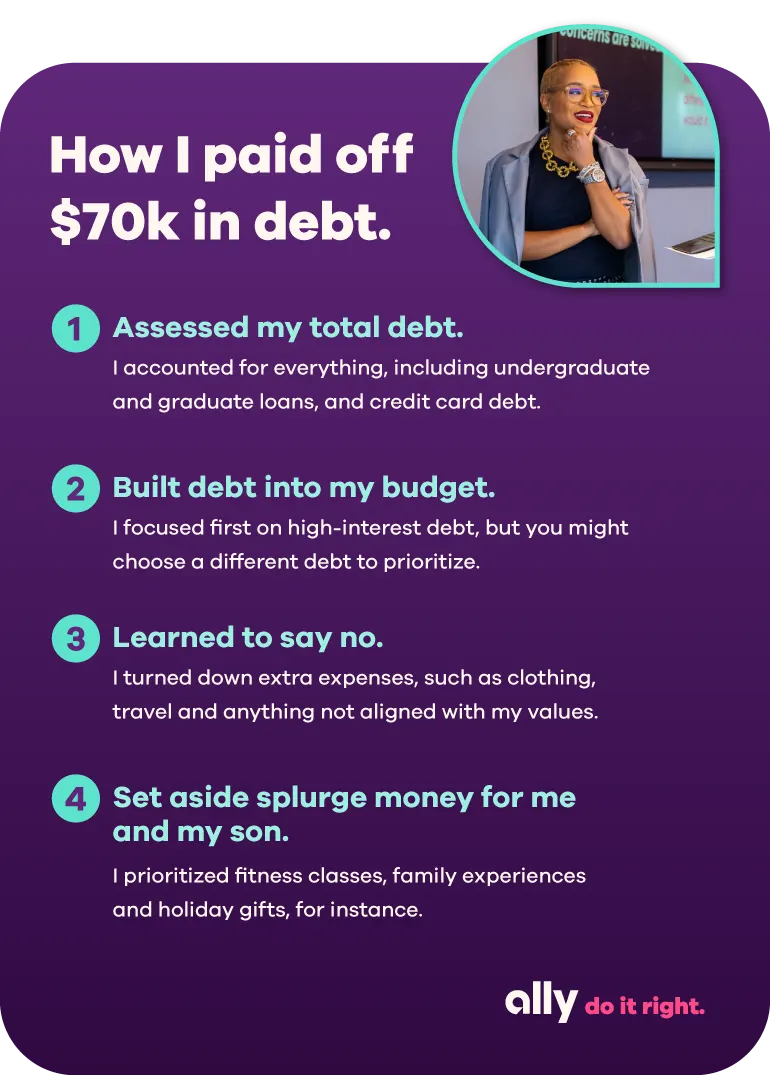

With all the responsibilities that come with being a parent, paying off debt can quickly go by the wayside. But as a mom, I know that with focus and diligence (and a plan), you can make progress toward eliminating your debt. By sharing what worked for me, I hope you’ll be able to apply some of my learnings to your own life.

Build your confidence with open conversations

After completing my grad school program, I was about $70,000 in debt. That included loans from my undergraduate degree, graduate school and credit card debt. I wanted to focus on the high-interest debt first, but I assumed being debt-free was years down the road. After all, I was recently out of school and raising a young son. I had other things on my mind.

But my coworker, who had completed the same graduate program, told me she had paid off her loans in two years. I knew we made similar salaries, so I was curious about how she pulled it off. She told me she made debt pay down a top priority in her spending plan — which also meant learning to give a hard no to other spending opportunities. Her story gave me the motivation I needed to focus on my own debt.

Open conversations about debt can help relieve some of the significant debt stress many of us keep to ourselves — and generate ideas on how to pay it off. Without my colleague's candor, I might not have gained the confidence in my own ability to pay off my debt.

Understand your money story

If debt payoff is a priority for you, too, consider first working through your money story. The feelings and memories you connect to finances can play a significant role in your current behaviors, whether that’s money avoidance, shame or overspending. Identifying your money story can help you determine roadblocks and challenges, so you can overcome them.

My money story helped guide me toward taking control of my financial future for myself and my family. My parents did everything they could to ensure I had a quality education, and I wanted the same for my children. An important first step on that journey was tackling my own debt.

Make a plan and learn when to say no

As you focus on paying down what you owe, you'll likely need to shift your priorities and put debt near the top of your list. Developing a plan can help you say no to any opportunities outside of your plan. This can be challenging when it seems like everyone else has it all: vacations, cars, clothes and houses. But a key skill to achieving a debt-free life is simply learning when to say no. And remember: Being open with your loved ones will likely show you just how many other people are tackling debt themselves.

That doesn’t mean you can’t still have small indulgences and treat yourself. I know that my fitness classes are important for my mental and physical health, so I make them a financial priority — and I'll invite my friends to come, too, which gives me a chance to socialize. Remind yourself of your values and priorities to spend mindfully. Using tools like Ally Bank’s spending and savings buckets can help you set reasonable limits for your splurges.

Using tools like Ally Bank's spending and savings buckets can help you set reasonable limits for your splurges.

When I started out, I set boundaries to prioritize eliminating my debt — I drove my same mid-level sedan for 10 years, even as my friends upgraded to newer, more luxurious vehicles. I said no to travel opportunities. And after about five years, I did pay off my debt, which set me up to pursue new goals with more freedom.

Keep up the energy

Now that I've successfully paid off my debt, I'm shifting focus to new goals. For me, I'm now working on paying off my mortgage and amping up my two kids' college education funds, as well as maxing out my 401(k) and Health Savings Account.

Another financial goal is always on the horizon. And while that can seem daunting, it can also be the fuel that drives you to reach your money milestones. Set your sights on what you want to work toward and start taking the steps that will get you there — no matter how small.