You saved for your down payment. You house hunted. You found your dream home. You made an offer … and it was accepted!

Now it’s time to close on your first home. The home stretch is full of critical final steps toward you becoming a homeowner. You got this.

Tip: If you’re just getting started on your journey to buying your first home, explore other parts of our first-time homebuyer’s guide.

Part one: Start with these 3 key steps

Part two: Essential house-hunting checklist

Master your mortgage application

If you were pre-approved, you’ve already chosen a lender. Now that you’ve found your home, it’s time to complete your application.

Now it’s time for the underwriting. During this step, we’ll verify all your information (see the next section for more on the necessary paperwork). Once your loan’s confirmed, we’ll send you a Closing Disclosure. All that’s left is for you to review, approve and sign the final paperwork in person on closing day.

The home stretch is full of critical final steps toward you becoming a homeowner.

Get your paperwork in order

You’ve learned a lot on your first homebuying journey, and those lessons likely include the multitude of documents required to buy a home. Unfortunately, there’s no shortcut, but we can help you out with a master list of the most important documents you’ll likely need (and should have on hand if they apply to you):

Proof of income (W-2 wage earnings; self-employed, freelancer, or independent contractor income; real estate income)

Tax returns

Social Security number

Bank statements

Retirement and brokerage account statements

Monthly debt payments

Real estate debt

Rent payments

Divorce decree

Bankruptcy or foreclosure documents

Protect your purchase

Before you can officially close on your home, a home inspection provides essential final checks for you, your lender and likely your home insurance provider.

This official assessment, conducted by a certified home inspector, can tell you everything you need to know about your potential new home’s makeup and condition. They’ll check everything from the roof to HVAC, plumbing, the foundation and all the essential safety and structural elements of your home.

This final step can give you peace of mind that you’re buying a quality property. Keep in mind that any required updates may call for renegotiating with the sellers.

Don’t forget the fees

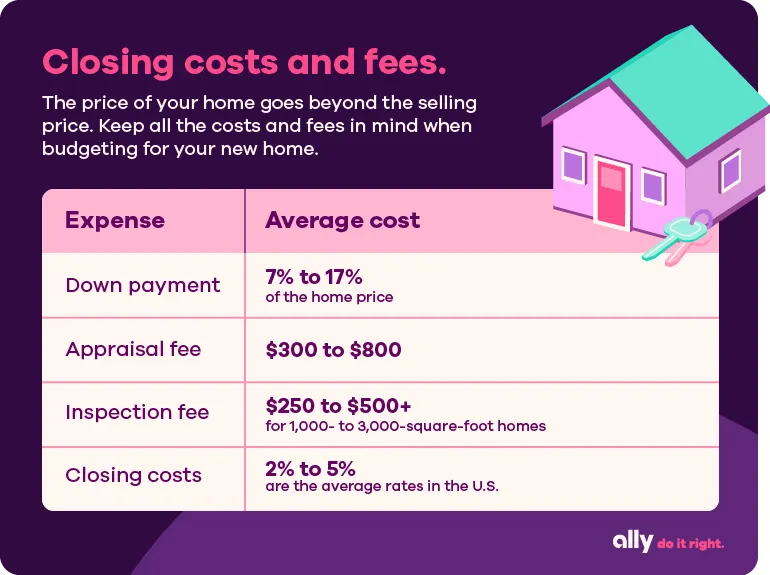

Remember, the purchase price is only one of the costs of buying a home. When you buy something as large as your home, you don’t want to be caught off guard by any unexpected expenses, especially the closing fees.

When it comes to the down payment, it’s often thought you need to put down 20% of a home’s price, but that’s not required. According to data from the National Association of REALTORS®, the typical down payment by buyers tends to range from 7% to 17%.

If you want a conventional loan and your down payment is less than 20% of the home’s purchase price, then your lender will likely require private mortgage insurance (PMI). Your PMI payment can be added to your monthly mortgage bill. There also are some types of loans that don’t require PMI, so be sure to explore your options with your lender.

In addition to your down payment, closing costs are fees you have to pay at the close of the sale. These cover things like the loan origination fee, loan application fee, lender’s attorney fees and appraisal fee, to name a few.

Closing costs can often range from 2% to 5% of the home’s purchase price. So, if you’re buying a $200,000 home and your closing costs are 5%, you’d need an additional $10,000 for your closing fees.

As you prepare to close on your purchase, don’t forget to budget for these other expenses.

Finish strong

You’ve come a long way on your journey to your first home. Once you’ve assembled your paperwork, signed your last form and have those keys in hand, don’t forget to celebrate. Congrats, new homeowner!