Regardless of how long you’ve been house hunting, you’ll eventually reach the home stretch and will need to focus on the small details.

Download your timeline checklist.(PDF 361 KB)

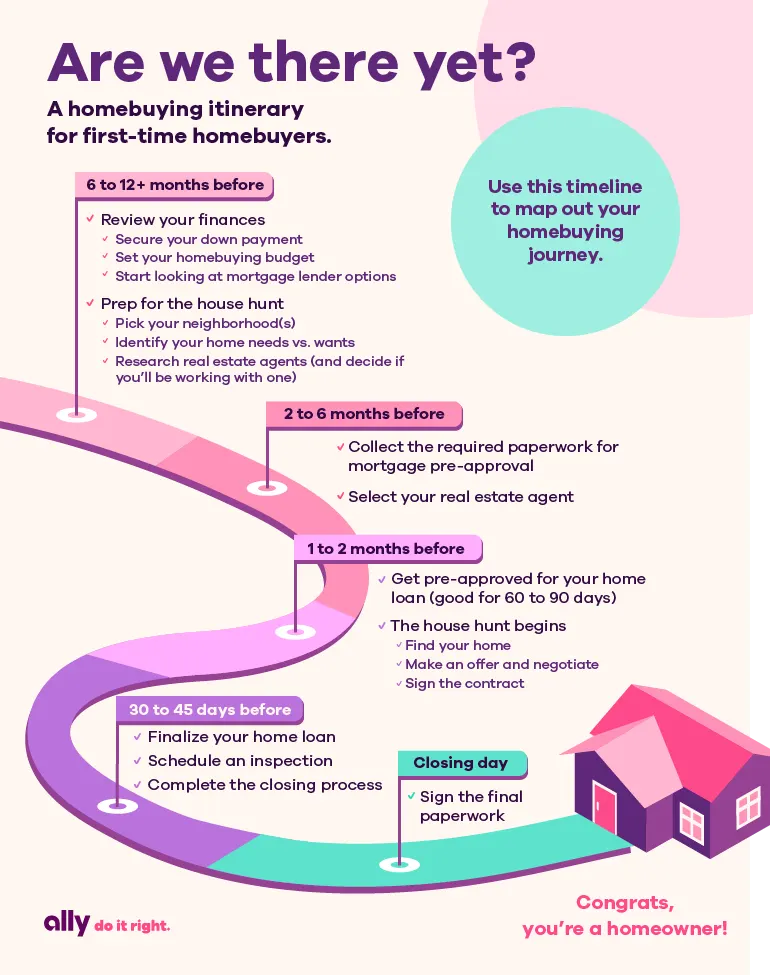

No matter what your homebuying map looks like, these essential steps will help you reach your final destination.

Find the right real estate agent for you

As you embark on your homebuying journey, you’re probably wondering if you need a real estate agent. Especially when purchasing your first home, it can be helpful — and eliminate some of the stress — to have a seasoned pro guiding you through the process. An agent’s network also can connect you with homes that fit your criteria and once you find the right one, they can negotiate on your behalf.

If you decide to use an agent, identifying a strong partner is critical. It’s always a good idea to interview several candidates before picking one who best suits you. When speaking with prospective agents, be sure to ask these key questions to make sure you’ve found your match (and a qualified candidate):

Are you licensed?

How long have you been in the real estate industry?

How many clients are you currently working with?

And don’t forget to ask friends and family for recommendations. Personal referrals can help you narrow the field.

Especially when purchasing your first home, it can be helpful — and eliminate some of the stress — to have a seasoned pro guiding you through the process.

Discover your perfect neighborhood

Whether you’re debating between city and suburban living or comparing school districts, you have a lot to consider when selecting a location. From the grocery store around the corner to the proximity to schools to the coffee shop nearby, a lot of tiny details make up the places we live and work.

As you map out your priorities for your future neighborhood, keep these key elements in mind:

Consideration | Why it matters |

|---|---|

Safety | You want to feel secure in your new home. Online mapping tools can help you in your research. |

Essentials | Think through all of those services you use regularly — grocery stores, pharmacies, gas stations, dentist and doctor options. While they don’t need to be around the corner, you may not want to trek 30 minutes to make your weekly grocery run. |

Commute time | Unless you work from home, you’ll want to take into account how long it will take you to travel to work. If you plan to drive, look at the distance and traffic patterns. If public transit is your preferred transportation method, you might prioritize proximity to train stations or bus stops. |

Schools | If you have kids or plan to start a family, take a look at what schools are nearby and what districts your potential homes are in. Even if you don’t plan to have a family, school districts can affect home value, so it’s worth keeping in mind, even if it’s not a priority. |

Perks | In addition to the must-haves, create some nice-to-haves on your neighborhood wishlist, too. If you love getting a workout in every day, you might want a gym nearby. A nice coffee shop within walking distance could be a selling point. Or maybe you want a little privacy and want a place with a fence or extra acreage. |

Shop for a home with confidence

Once you’re ready to officially start looking, pre-approval on a loan from a mortgage lender can give you a serious financial advantage. You have options when getting pre-approved (which may be considered pre-qualification by some lenders).

You could get a pre-approval letter from a lender, which provides a documented estimate of how much you can borrow to buy a home. A verified pre-approval letter (VPAL) delivers the same, but with even closer scrutiny from your potential mortgage lender. A VPAL shows a serious commitment on your part to any seller you submit an offer to and signals you’re a step closer to an approved loan.

Pre-approval vs. VPAL

At first glance, pre-approval and a verified pre-approval letter (VPAL) may look the same. Understanding the differences may help you find the right fit for your homebuying journey. Keep in mind, the terminology and requirements may change depending on the lender.

Differences | Pre-approval* | VPAL |

|---|---|---|

Info required | Self-reported estimates of your income, assets, etc. | Documents, often including proof of income, recent W-2s, tax returns, pay stubs, bank statements, etc. |

Credit check | Soft credit pull (won't affect credit score) | Hard credit pull (may cause your credit score to drop) |

When to apply | When you want an idea of how much home you could afford | When you are actively searching for a house |

*Pre-approval may be called pre-qualification by some lenders.

Whether you opt for pre-approval or VPAL, both options let sellers know you’re buttoned up and ready to move quickly, which can help you stand out from other buyers.

Put your game face on

Few things beat the joy of finding the right house but walking through those doors and falling in love is just the first step. Now you have to make the seller an offer they can’t refuse (aka a competitive offer). If you’re working with a real estate agent, they can help you determine the value of the property and negotiate the price, but that first offer sets the tone.

In addition to your own budget, when determining your offer, you should also think about:

The quality and characteristics of the home

The location

Price changes

How motivated the seller is

How much you want the home

Forge your own path

The road to home ownership looks different for everyone. Finding your way can be a little scary. Mapping out these critical checkpoints en route to your first home can help you stay motivated and on track.