Whether it’s your first foray into robo portfolios or you’re a seasoned investor with years of self-directed trading experience under your belt, there’s one thing we’re confident will make your life simpler: automated recurring transfers. In fact, we think automating your recurring transfers simplifies investing because it takes away the stress of transferring money and rethinking the amount every month (or whatever frequency you choose).

Automating recurring investment transfers is also one method of keeping yourself from using your investment funds for other things. You can't spend money that's automatically transferred to another account (without some effort) — and if investing is one of your goals, setting up automatic transfers to your Ally Invest account will get you one step closer.

Read more: Which investment account is right for you?

For new Ally Invest customers

Congratulations, you’re way ahead of the game, because you’re already thinking about automating your investing funds!

Setting up automated transfers to your account is simple — because it’s right there during the account opening process. Once you get to the “Transfers” prompt, jump down to the third bullet in the next section.

For existing Ally Invest customers

Setting up automated recurring transfers from your bank account to your Ally Invest account is quick and easy. Just follow these steps:

Open your Ally app and log in.

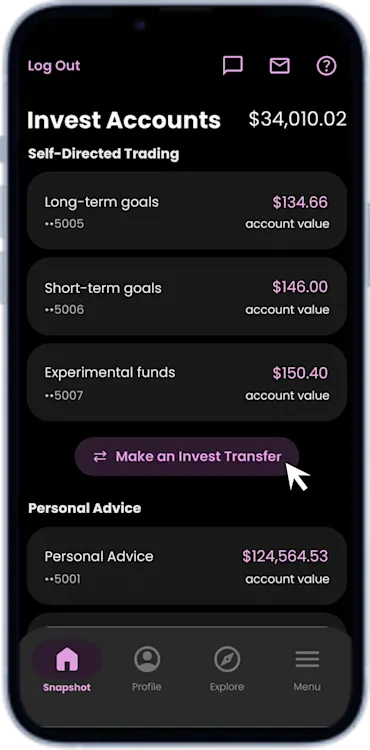

Scroll down and select “Make an Invest Transfer.”

Select “Into an Ally Invest account”

Select which eligible account to which you want to set up a recurring transfer.

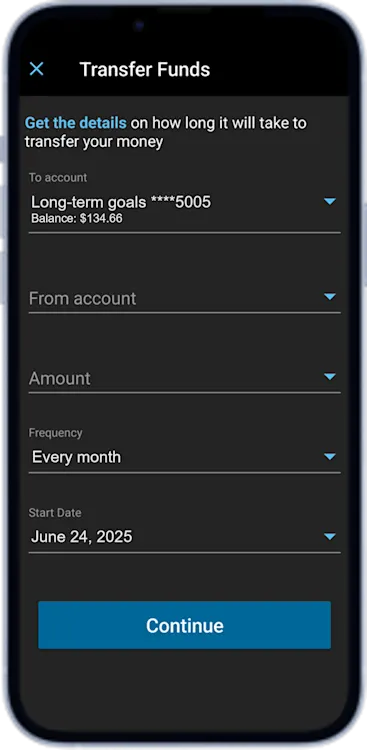

Fill out the following information as prompted:

To Account

From Account (Note: If your From Account is not at Ally, you’ll need to link it at this point. Select “Accounts from other institutions” and follow the prompts. You may be required to log in on a desktop browser.)

Amount

Frequency

Start date (date of first transfer)

Select “Continue"

Review your transfer request and select “Submit"

Your recurring invest transfers are now automated!

If you want to view or edit your recurring transfer after setting it up, select “Transfers” from the Menu options. You’ll be able to see and manage your transfers from there.

Note: If you’re setting up a recurring transfer into an Ally Invest Self-Directed Trading account, the funds will be part of the cash reserves within your account until you choose to invest it in a specific security.

Make room for your financial future

Once you automate your transfers, you may find you have more time and energy to spend on other things — like focusing on new investing endeavors.