What we'll cover

The definition of REITs

The different types of REITs available to you

Pros and cons of this investment vehicle

When you hear the words “invest in real estate,” what comes to mind? Is it a second home, a plot of land, a rental apartment complex or a luxury hotel?

Even if you already invest in stocks and bonds and have an IRA and/or a retirement fund, you may only associate investing in real estate with owning and selling physical properties or making money on rental income. And for many, that might seem totally out of reach.

The good news is investing in the real estate market is much more realistic than you may realize — and it’s becoming increasingly popular with younger generations. In fact, millennials are more than twice as likely to prefer investing in real estate than boomers.

As real estate prices and rent costs are on the rise, you may wonder how you can break into the market. One way? Real estate investment trusts, a.k.a. REITs.

What is a REIT?

A REIT is a company that owns (and usually operates) a real estate property that generates income. Those properties can exist in a number of sectors, like health care facilities, retail centers or apartment complexes, to name a few.

The way REITs work (and how investors make money from them) is quite simple: A REIT owns and typically manages a space, which it leases to tenants. The REIT collects rent from its tenants and distributes that income in the form of dividends to the invested shareholders, who then pay the income tax on their earnings. But qualifying as a REIT tax-wise is a little more complex.

To qualify as a REIT, a company has to comply with a number of requirements set by the Internal Revenue Code, including (but not limited to):

At least 75% of total assets must be invested in real estate

At least 75% of gross income must come from rent collected from real property, interest on mortgages financing real property or sales of real estate

At least 90% of taxable income must be returned to shareholders as dividends each year

Have a minimum of 100 shareholders

Have no more than 50% of its shares owned by five or fewer individuals

Incorporating real estate holdings into your investment portfolio is a great way to add diversification — and REIT investing makes it relatively easy. As investors also generate wealth through high dividend yields, it’s no wonder approximately 87 million Americans are invested in REIT stocks.

Types of REITs

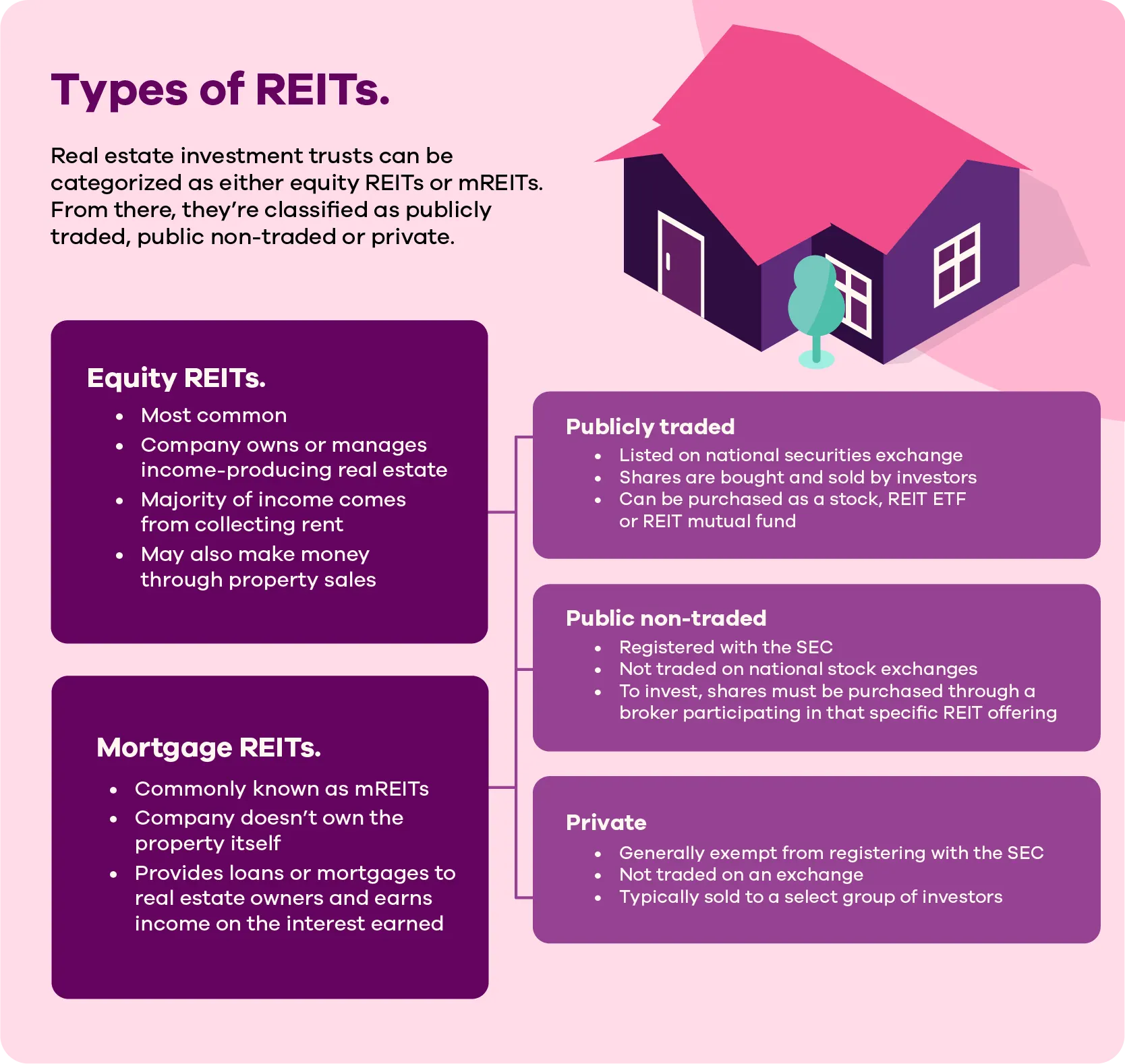

In the market, you may come across REITs that operate in many different sectors, like retail or infrastructure. But no matter the industry, REITs generally classify as equity REITs, mortgage REITs, or a hybrid of the two.

Equity REITs

Equity REITs are the most common. These companies own or manage income-producing real estate and the majority of their income comes from collecting rent on properties.

Mortgage REITs

Mortgage REITs (commonly known as mREITs) differ from equity REITs in that they don’t own properties themselves, but rather provide loans or mortgages to the real estate owners. mREITs primarily make money through the interest earned on the mortgage loans and the cost of funding the loans.

Both equity and mREITs then fall into one of the following three categories:

Publicly traded: Publicly traded REITs are listed on a national securities exchange, where their shares are bought and sold by investors. These REITs are regulated by the Securities and Exchange Commission (SEC).

Public non-traded: Public non-traded REITs are registered with the SEC, but they are not traded on national stock exchanges, making them less liquid than their publicly traded counterparts.

Private: Private REITs are generally exempt from having to register with the SEC, and they are not traded on an exchange. These are typically sold to a select list of investors.

How to invest in REITs

Publicly traded REITs are bought and sold on an exchange and you can purchase shares in a REIT through a broker, just as you would any other stock. Or you can invest in REITs through a REIT mutual fund or REIT exchange-traded fund (ETF).

To invest in a public non-traded REIT, you must purchase shares through brokers or financial advisors that participate in that specific REIT’s offering.

Pros of REITs

If you’re considering investing in REITs, you’ll want to know the benefits they can provide you and your investment portfolio. Number one? They’re an opportunity to enter the real estate market without having to deal with the time, headaches and expenses of managing a physical property and collecting rent.

REITs can also be an excellent source of diversification, because they’re largely unrelated to other markets and don’t usually correlate with their ups and downs. A diversified portfolio helps protect you against risk during market volatility by spreading investments across asset classes and types of investments.

For those whose investment strategies are focused on generating income from their investments, REITs can be an important portfolio asset. That’s because they pay regular dividends, typically quarterly.

Compared to investing in physical real estate properties, REITs may offer a lower-risk investment opportunity. Because they’re easily traded on the market, publicly traded REITs are far more liquid than actual properties, which can be quite difficult and time-consuming to buy and sell. And since REITs are regulated by the SEC and regularly audited, they are a highly transparent investment.

Cons of REITs

It’s important to remember that any and all investments are inherently risky at some level. When it comes to REITs, you should be aware that the ups and downs of the real estate market can influence the success of your investments. And mREITs especially can be sensitive to a rise or fall in the federal interest rate.

One drawback of REIT holdings is that while you can rely on regular earnings from dividend yields, you will have to pay taxes on all dividend earnings, which are taxed as regular income. And, since REITs must return at least 90% of taxable income to shareholders, only 10% is left to be reinvested in purchasing new holdings — meaning these investments typically don’t provide much capital appreciation long-term.

Break into the market

You don’t have to be a real estate mogul, a D.I.Y. home flipper or a landlord to invest and build wealth in the real estate market. You don’t even need to own any physical properties at all.

If you’re new to investing or an old pro, investing in REITs can increase the diversification of your portfolio and provide you regular, dividend-based income. That’s why we offer you plenty of REIT investment options through our Self-Directed Trading accounts. Whether you’re interested in investing in individual stocks or commission-free ETFs, you can find a REIT that fits both your investment portfolio and your goals.