Wealth can seem like a word that only belongs to those who already have it. The gap between saving for now and investing for the future might feel overwhelming, but you can take steps toward your goals with some planning and focus.

Read more: Which investment account is right for you?

1. Make investing a habit

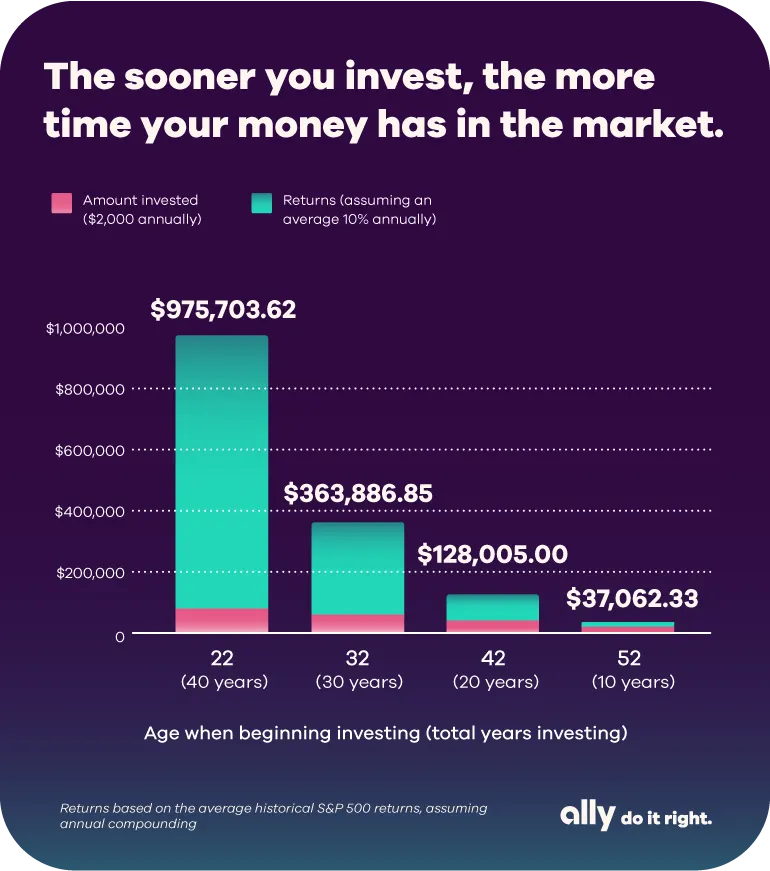

When you’re feeling good about your saving strategies, such as filling your emergency fund and automating funds to your savings account, you might be looking toward the next step in investing. As you’ve probably heard: It’s never too early or too late to start investing. Here are a few things to think about for your financial routine:

Start small: Begin with as little as $100. Sometimes the first step is the hardest.

Automate investments: Set up automated transfers to your investment account, so you don’t have to think about it

Take advantage of compounding: Although not a guarantee, history has shown that the earlier you start, the more you can reap the benefits of compounding returns over time

2. Assess and manage your risk

Understanding your risk tolerance is crucial to being comfortable investing:

Know your risk level: Determine how much risk you’re comfortable with based on your life stage and financial goals

Diversify your portfolio: Spread your investments across various securities to help balance risk and reward

Strategic risk-taking: Once you’re comfortable, you might consider taking calculated risks that fit your portfolio, goals and strategy

3. Level up your nest egg

As your portfolio develops, consider these tips:

Work with a financial advisor: Once you reach a certain asset threshold, a financial advisor can help you manage your wealth more effectively

Use available tools: If a financial advisor isn’t an option yet, leverage research or projection tools within your brokerage accounts

Stay informed: Continually educate yourself about financial strategies and stay up-to-date on financial news and trends

4. Manage your debt and build credit

Pursuing wealth can be a matter of more than investing — it also has to do with your overall financial health. If you’re working on paying down debt, having a debt payoff strategy in place can help you stick with it. Even as you work to set aside funds for the future, it’s important to avoid taking on more debt.

Eliminating your debt also helps you build credit, which in turn, improves your financial standing for things like applying for a mortgage, personal loan or credit card.

Financial planning is a journey that requires patience and consistency. By strengthening your strategies and knowledge, you can continue to pursue your financial goals and find greater financial comfort and confidence.