Options trading is considered a more advanced investing technique for those who are attuned to the markets, are comfortable with taking risks and understand that, while options can provide diversification, they also have unlimited loss potential.

Understanding options

If you're looking for a simple options trading definition, it goes something like this: Options trading gives you the right or obligation to buy or sell a specific security on or by a specific date at a specific price. An option is a contract that's linked to an underlying asset, such as a stock or another security.

Read more: Consider an Ally Invest Self-Directed Trading account for your DIY investing interests.

Options contracts

Options contracts are structured with specific terms, including the underlying asset, the strike price, the expiration date and the premium. These terms define the rights and obligations of the buyer and seller.

When an option reaches its expiration date and isn't exercised, it may automatically expire worthless (which means the seller loses the premium and possibly a commission, while the buyer receives the premium).

How to trade options: Getting started

Should you choose to try options trading, these would be the basic steps to get started. However, be sure you research all the variables, so you have a strong understanding of the concepts beforehand, as well as the significant, potentially unlimited, risk that comes with options trading.

1. Opening a brokerage account with options trading capabilities

Opening a brokerage account differs from opening an options trading account, especially if you plan to trade on margin (borrowing money from your broker to trade). Options trading brokers may want to see your investment objectives, trading experience, personal financial information and types of options to trade.

Brokerages often have different levels of options trading approval based on your experience and financial situation. Higher levels allow for more complex strategies.

2. Choosing an options strategy based on objectives

There’s a huge variety you can choose from, so do your research on different strategies and stocks, make sure you’re aware of all the disclosures, and decide on the risks you’re willing to take before choosing a path.

3. Selecting your strike price

The strike price refers to the price at which the underlying security can be bought or sold (aka exercised) in your options contract.

4. Making your trade

Finally, the buyer pays the premium and broker commission and takes ownership of the contract, while the seller receives the premium and is now under obligation, should the buyer exercise the option contract.

How to read a stock option quote

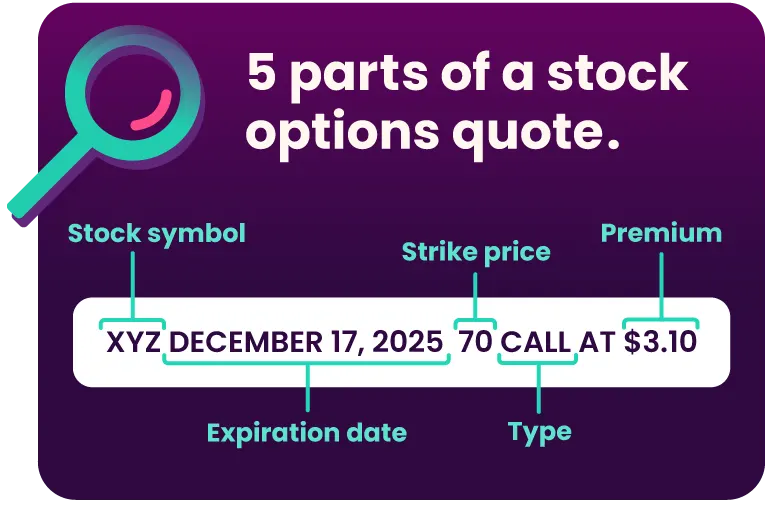

There are five parts of a standard stock options quote:

Stock symbol refers to what's used to identify the underlying asset attached to an options contract.

Expiration date is the date on which the option will expire.

Strike price is the price per share of the underlying security when exercised.

Type refers to the type of option involved, i.e., call or put.

Premium is the cost to buy the option's contract itself (and the amount the seller receives).

How options pricing is determined

You can calculate options pricing using two different models. But at its core, options trading prices are based on intrinsic value and time value.

An option's intrinsic value represents its profit potential based on the difference between the strike price and the asset's current price. Time value measures how volatility may affect an underlying asset's price until expiration.

The stock price, strike price and expiration date can all factor into options pricing. The stock price and strike price affect intrinsic value, while the expiration date can affect time value.

Types of options

You can trade options via an online brokerage account, but before you start, you’ll want to form a solid knowledge base. You can start by getting familiar with the different types of options you can trade. The two basic categories of options are calls and puts.

What is buying a put?

When you buy a put option, you have the right (but not the obligation) to sell the underlying security at a fixed strike price. As the seller of a put option, you have the obligation to buy the underlying security at a fixed strike price should the buyer choose to exercise the contract.

Put options can be American-style or European-style. With American-style options, the buyer can exercise the contract any time up to the expiration date. European-style options allow you to buy the asset on the expiration date only.

Put options example

For example, say you buy a put option for 100 shares of ABC stock at $50 per share with a premium of $1 per share. Prior to the option's expiration date, the stock's price drops to $25 per share. If you exercise your option, you could still sell the 100 shares at the higher $50 per share price, and your profit would be $25 x 100 (less the $1 per share premium) for a total of $2,400.

On the flip side, if the stock's price rises, you'll be out your premium, plus any commission.

Let’s look at the seller’s side of this example: As the seller, you would receive the premium of $1 per share, regardless of the buyer’s decision to exercise the option. If they do exercise it, you would be obligated to buy the underlying security at the strike price of $50 per share, despite the stock price drop.

What is buying a call?

A call option gives you, as the buyer, the right, but not the obligation, to buy an underlying security at a designated strike price within a specific period. As a call option seller, you have the obligation to sell the underlying security at the designated strike price should the buyer choose to exercise the contract.

Call options also have expiration dates. The same style rules (American or European) apply when you can exercise them.

Call options example

For example, say you buy a call option for 100 shares of ABC stock with a premium of $3 per share, but you're hoping for a price increase this time. Your call option contract allows you to buy shares at $50 each. Meanwhile, the stock's price climbs to $100 apiece. You could use a call option contract to buy that stock at a discount, saving yourself $4,700 ($50 x $100, minus the $3 per share premium).

If the stock's price dropped and the option contract expired, you'd still be out the premium cost of $3 per share, plus any commission.

From the seller's perspective, you would receive the premium of $3 per share, regardless of the buyer’s decision to exercise the option. If they do exercise it, you would be obligated to sell the underlying security at the strike price of $50 per share, despite the rise in stock price.

Options trading strategies to know

Once you've mastered options trading basic concepts, you may be interested in more advanced options trading strategies. As you become more comfortable with options trading, your investing efforts may include some other commonly used techniques.

Covered calls

A covered call strategy has two parts: You purchase an underlying asset. Then, you sell call options for the same asset. As long as the stock doesn't exceed the strike price, you can realize profits by selling call options for your assets. On the flip side, even if the stock price does rise above the strike price, you would be obligated to sell to the buyer at the strike price if they exercised the contract.

Married puts

A married put strategy involves purchasing an asset and then purchasing put options for the same number of shares. This approach gives you downside protection by allowing you the right to sell at the strike price.

Long straddle

A long straddle strategy involves buying a call and put option for the same asset with the same strike price and expiration date at the same time. You can use this approach when an investor is unsure which way prices for the underlying asset are likely to move.

Managing risk with options trading

As with any other investment strategy, options trading has its lists of potential benefits and risks, and it's important to understand these to try to avoid making costly mistakes.

Why trade options?

Here are some of the reasons investors consider options for their portfolios:

Leverage: Options trading tends to offer more flexibility, allowing you to invest with smaller amounts of capital — however, note that there’s risk of loss if you’re required to buy or sell the security at the strike price.

Hedging: Options might create downside risk protection and add diversification to your portfolio, though options trading comes with its own risk, sometimes unlimited.

Income generation: Certain strategies may be used to gain profits, if successful, however, you must first be comfortable with the associated risk of losing funds.

Liquidity: Options (for certain stocks) may be more liquid than other investment vehicles.

Risks of options trading

There’s a reason options trading is considered advanced. Here are some of the risks associated with this strategy:

Potential for loss: Options trading can be much riskier than other investments and can expose you to unlimited loss.

Volatility: Volatility can wreak havoc on options pricing and can be difficult to predict.

Complexity of strategies: Some options strategies are complex and require an advanced knowledge to execute properly — let alone turn a profit.

Before you pursue options trading, consider how it aligns with your overall goals and risk tolerance, and take care to learn as much as you can before you dive into this advanced investing technique.