Getting your child off to a good start financially could benefit them over the long term. A custodial brokerage account is an investment tool that can help introduce children to the importance of investing and teach them lifelong habits.

It’s important to note that a custodial account could also be set up as a deposits account (for instance, a savings account, certificate of deposit, etc.), which earns interest over time on the balance rather than investing the money in the market. These can be found at FDIC-insured banks, including Ally Bank, and NCUA-insured credit unions.

If you’re looking to invest for your child, here’s a closer look at how custodial brokerage accounts work and what they offer.

How does a custodial brokerage account work?

A custodial brokerage account is an investment account opened on behalf of a minor and managed by an adult (aka the custodian). These accounts can hold the same types of investments you'd find in a regular brokerage account, but they allow the adult who opened the account to invest money for the child’s benefit.

Take quiz: Learn which investment accounts could be right for your (or your kid’s) goals.

While the child is a minor, the custodian can buy or sell investments as they see fit. But a custodian must act in the best interests of the child when making investment decisions — their control over assets in a custodial account isn't unlimited or unchecked. And they don't control the account forever.

Types of custodial brokerage accounts

You can open a custodial brokerage account at online brokerages like Ally Invest that offer regular brokerage accounts or retirement accounts.

You’ll also need to decide between two account types (requirements vary by state):

The Uniform Transfers to Minors Act (UTMA)

This account allows you to hold virtually any type of asset or property, including:

Stocks

Bonds

Mutual funds

Real estate

Fine art

Intellectual property

UTMA accounts don’t have annual contribution limits, though gift tax may apply. Gifts and transfers are irrevocable, so once the money goes into a UTMA, it can only be spent to benefit the child.

The Uniform Gift to Minors Act (UGMA)

UGMA accounts are more limited in the assets they can contain, but they can include:

Stocks

Mutual funds

Bonds

Cash

Certificates of deposit

Life insurance policies

UGMA accounts can’t hold everything that UTMA accounts can, such as real estate and fine art. The same gift tax exclusion limits apply, and gifts are irrevocable.

While the child is a minor, the custodian can buy or sell investments as they see fit.

Advantages and disadvantages of a custodial account

Like any financial decision, it's important to weigh the advantages against any potential drawbacks before opening an account.

Pros | Cons |

|---|---|

Easy set-up and maintenance | Account assets are irrevocable and non-transferable |

Flexible account type (bank or brokerage) | Limited tax advantages |

Account beneficiary can use the money as they want, once they gain ownership | Custodian doesn't maintain control of account assets |

Tax implications of a custodial brokerage account

Investment income generated by a custodial account, including dividends, interest and earnings from investments, may be classified as the child's income. This income may be taxed in a tiered structure that is more favorable than applying the parent’s rate. For example, in 2024, the first $1,300 of the child’s investment income is exempt from tax, the next $1,300 is taxed at the child's reduced tax rate (the “kiddie tax”) and only investment income over $2,600 is taxed at the parent’s rate.

The adult who opens the account can get a break on gift tax. For 2024, you can gift tax-free up to $18,000 per child as an individual or $36,000 if you're married and file jointly.

Can you withdraw money from a custodial account?

Custodians can pull money out of a custodial account, but only if it’s in the child’s best interests, like for private school tuition or extracurricular activities, for example. Generally, you can't use money to pay for anything you're obligated to cover as a parent, such as shelter, food, necessary clothing and medical care.

How to open an Ally Invest custodial brokerage account

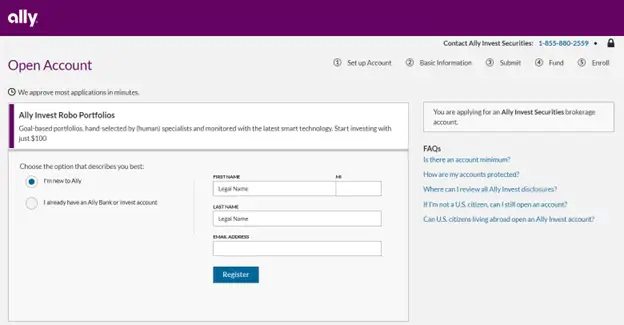

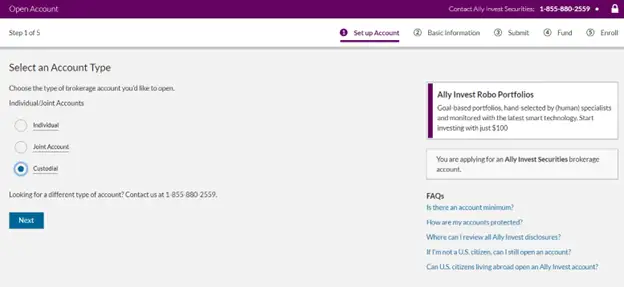

To open a custodial brokerage account with Ally Invest, you first need to choose between a Self-Directed Trading account and Automated Investing. During the account opening process, select “custodial” as your account type and complete the remaining steps.

Alternatives to custodial accounts

When pursuing investments for your family, custodial accounts are just one of many choices available.

If you’d like to get started on estate planning, consider starting a trust for the continuation of your assets.

Though not offered by all brokerages, 529 accounts are becoming increasingly flexible investment vehicles, with new changes allowing for unused 529 savings to be rolled into a Roth IRA.

Some brokerages offer a custodial Roth IRA for your child instead of a custodial brokerage account.

Coverdell education savings accounts (ESA) allow post-tax contributions up to $2,000 each year per beneficiary, and the earnings on these contributions are tax-free. You can also withdraw money tax-free for qualifying education expenses of the beneficiary. You must be below certain adjusted income thresholds set by the IRS to use a Coverdell ESA.

Is a custodial account right for your family?

A custodial account may help you transfer assets to your child and prepare them for the future. They’ll have plenty of time to finesse their finances — and you can make some money memories along the way.