What we'll cover

The definition of dollar-cost averaging

Reasons to use this investing strategy

Implementing it into your portfolio

If you're new to investing, it's easy to get overwhelmed by the in and outs. Simple but crucial strategies like dollar-cost averaging could help build confidence for even the most novice of investors.

What is dollar-cost averaging?

With this approach, you invest a set dollar amount at regular intervals (like on a monthly basis, as part of your budget). The goal is to make investing a habit, take the emotion out of it and help you avoid the temptation to time the market.

When you invest a consistent amount regularly, you put money in the market whether it's high or low. The idea being, as the market fluctuates, your average purchase price will hopefully even out.

Read more: Could your investment strategy benefit from an advisor?

How does dollar-cost averaging differ from lump-sum investing?

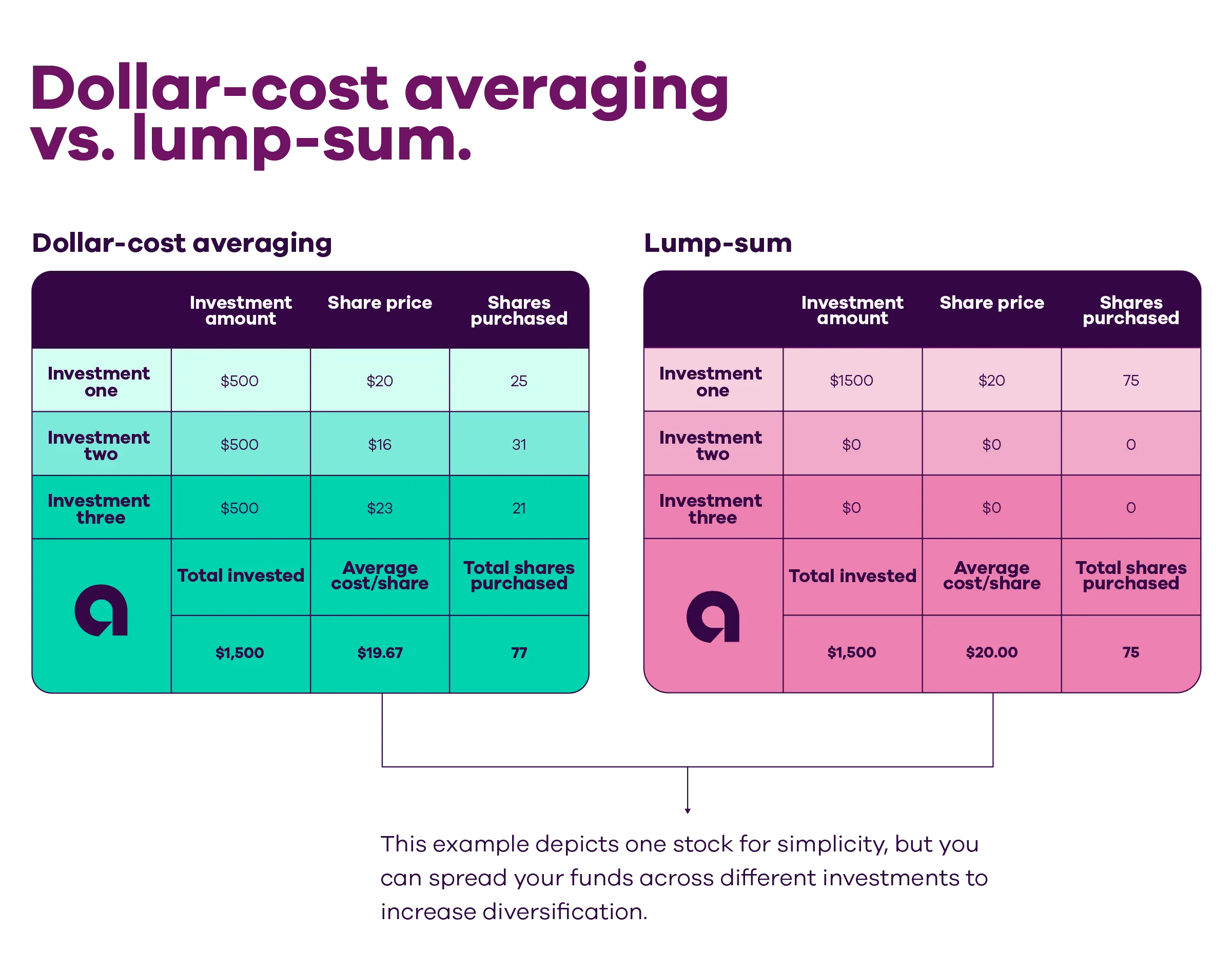

The goal of dollar-cost averaging can be understood more clearly when compared to the lump-sum investment strategy. The latter approach is better suited for the more risk tolerant investor because you invest as much as you can all at once.

Ultimately, you may invest the same amount with both lump-sum investing and dollar-cost averaging, but your purchases will be spread out over time with DCA, making it more palatable to the risk averse investor.You can get a sense of dollar-cost averaging in the hypothetical example below.

What are pros and cons of dollar-cost averaging?

Dollar-cost averaging may help investors navigate market riskby spreading out their investment activity over time. As with any investing, this strategy comes with inherent risk, but having a plan to stay consistent can help alleviate some of the stress associated with the market.

On that note, the consistency of dollar-cost averaging can help keep the long-term investor from trying to time the market. Instead, you can focus on keeping your portfolio balanced and diversifed and continue learning more about investing.

When it comes to picking an investing strategy, it comes down to what you're comfortable with in combination with your goals, risk tolerance and time horizon.

How do I get started with dollar-cost averaging?

If you're ready to give this investment strategy a try, start with these simple steps.

1. Set investment goals and understand your risk tolerance

Take the time to define what your ultimate financial goal is. Maybe it's wealth-building for your kids or for your future home. Write it down. This can help keep you focused on the bigger picture.

Additionally, understand your risk tolerance before you start investing — that way you know whether to gravitate more toward high or low risk investments.

2. Choose the right investment assets

Next, decide where you'll be investing your money. A diversified portfolio is key. Consider a mix of mutual funds, index funds, exchange-traded funds (ETFs) and more to ensure your investments remain balanced.

3. Determine investment frequency

Now decide how often you want to invest. Is it every other week or maybe once a month? There's no right or wrong answer, so base your timing on what makes sense for your finances.

Just remember, consistency is key. Once you set your cadence, stick with it. Better yet, with Ally Invest Self-Directed Trading you can automate those payments to make the process even less stressful.

4. Monitor

Dollar-cost averaging removes a lot of the emotion that can come from a more actively managed portfolio. But this investment strategy doesn't mean you can set it and forget it. Keep an eye on the progress you're making. While consistency is key, you may want to make some adjustments over time.

If you're able, consider increasing the amount of your regular contributions. Or, if your investments are underperforming over a longer period, it might be time to reevaluate your portfolio. You won't want to make significant changes frequently, but you should keep an eye on your portfolio.

Build your financial future

Dollar-cost averaging can't ease all of your investment-related anxieties, but this patient, disciplined approach may help you invest with a little less nail-biting.

Before you invest, you should carefully review and consider the investment objectives, risks, charges and expenses of any mutual fund or exchange-traded fund (ETF) you are considering. ETF trading prices may not necessarily reflect the net asset value of the underlying securities. A mutual fund/ETF prospectus contains this and other information and can be obtained by emailing support@invest.ally.com.