The Fed rate cuts are the latest positive economic news. But why don’t you feel the upswing immediately? Let’s look at a few key economic indicators to unpack the state of consumers’ wallets.

Read more: What you need to know about falling interest rates

1. Inflation is improving, but buying power is low

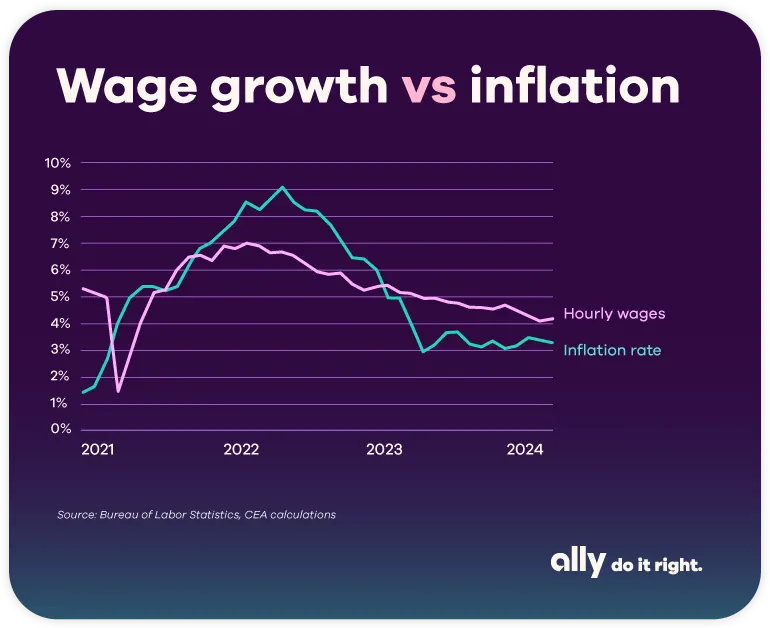

After sharp rises to the monthly inflation rate in 2022, the amount inflation has increased each month has been (slowly) declining. That’s a good sign for consumers, but the effect of previous increases still lingers.

Consumer purchasing power is low — meaning that a dollar buys you less than it did a year or two ago. You feel that pinch every time you check out at the grocery store.

2. Wages are higher, but so is unemployment

In addition to persistent inflation, wage growth is another important economic factor. The good news is that hourly wage growth now exceeds inflation after a few years of falling behind. But the recent history of lagging wage increases and high prices posed challenges for many consumers. As time passes, the positive effects of this change should be more significant as time goes on and people have some time to recover.

That being said, if you’re directly affected by layoffs and unemployment, increasing wages may not immediately benefit you. Since the start of the year, the unemployment rate has slowly risen — another factor the Fed considers when potentially changing interest rates. The good news: Lower rates may boost hiring, ensuring more consumers have access to these improved wages.

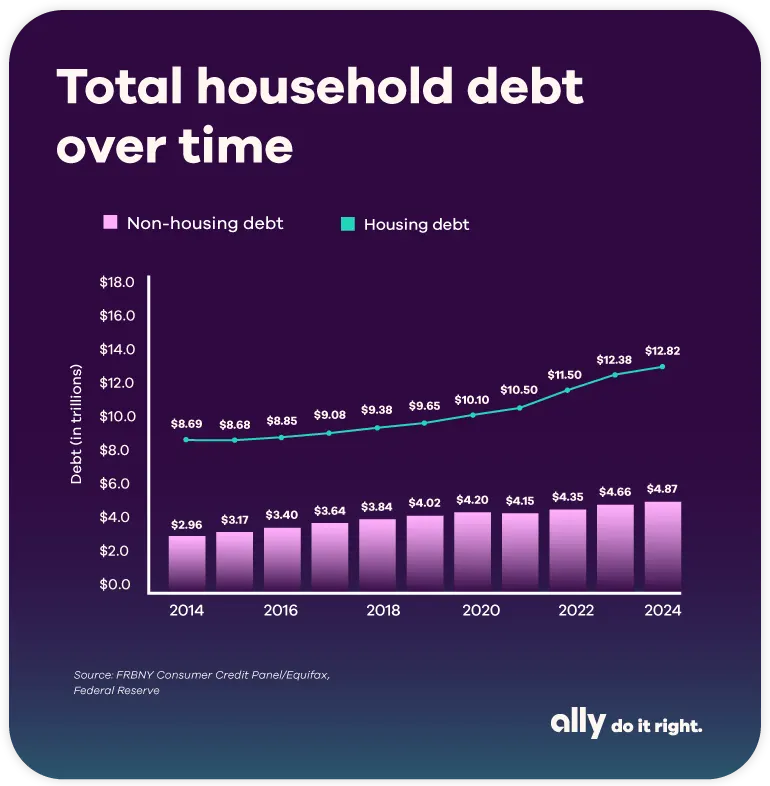

3. Debt interest is lower, but total debt is high

As rates decrease, you may see an effect on your credit card debt interest, though it may take some time.

Keep an eye on your card interest rates — if they start creeping down, see how much money you’re saving each month on interest. Consider whether you can put that money toward more aggressive repayment of that debt.

No matter the rates, stay the course

If you aren’t feeling the benefits of lower interest rates right away, try not to stress. Gradual rate changes likely won’t have an immediate impact on your day-to-day life. While many consumers may feel stuck in the current rate environment (which, while high for recent years, is not as high as it has been historically), the Fed’s rate reductions don’t mean you should automatically rush out to splurge.

Maintaining strong financial habits like paying down your debt and starting to invest are steps you might consider, regardless of rates. And if you are one of many homebuyers waiting for lower mortgage rates to start looking for a home, keep your home budget top of mind.