Saving goals, budgets and bank account balances might not seem like fodder for a date night conversation, but they’re critical components to a financially healthy relationship — and they don’t have to be boring, awkward or taboo. In fact, we prefer them not to be, and that’s where our couple's savings challenge comes in.

By adding in a dose of friendly competition, some shared goals and a prize that gets you and your partner jazzed, money talks can be a lot more exciting. It’s the perfect way to break the ice around money and get you both closer to your savings goals.

First things first: savings styles

This challenge is all about saving, so before you get started, take some time to think about how and why you save. We all have different motivations and preferences when it comes to our savings and spending habits. Knowing your style can help you figure out the best way to approach your individual savings, and seeing your partner’s may help you understand how to best encourage them.

Take our quiz to learn more about your saving style.

Setting up your budget and savings challenge

You can format a couple's savings challenge in countless ways, depending on your goals, timeline, and how creative and in-depth you want to get. There’s really no right or wrong way to go about it as long as you’re, well, saving.

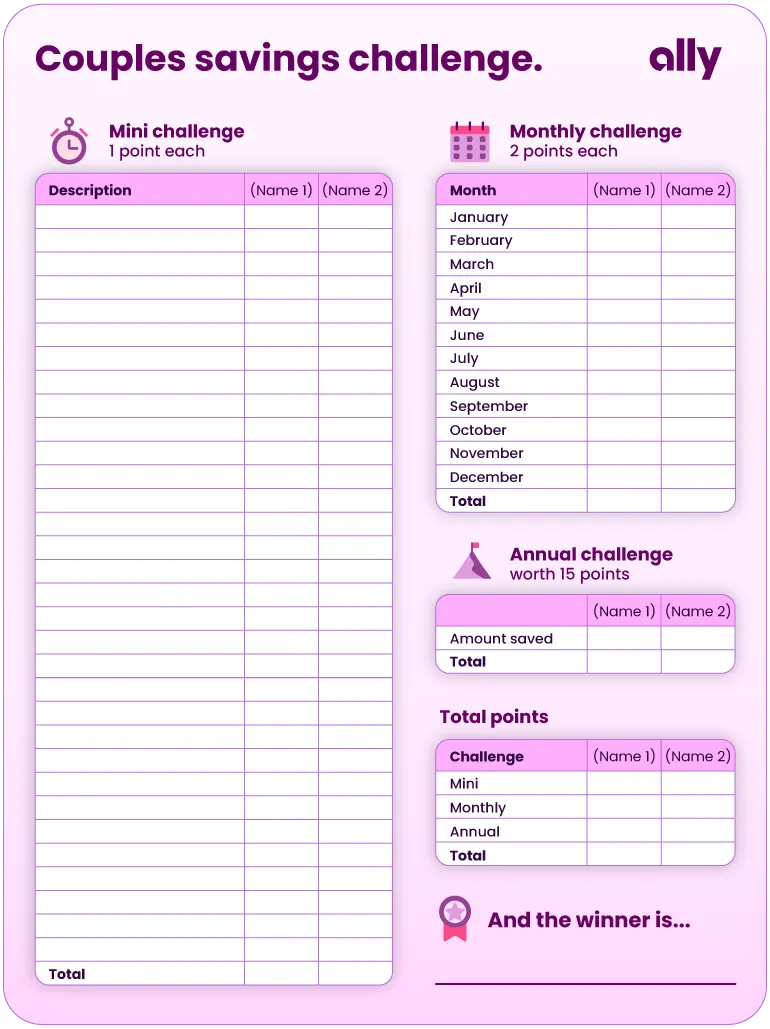

We put together this flexible savings competition you and your partner can use as a starting point or simply as-is. First, screenshot this scorecard to use throughout the challenge, then follow the steps to play!

Step 1:

To begin, align on one to three savings goals with your partner. Ideally, they are joint goals — perhaps buying a car, taking an overseas vacation or growing your emergency fund.

Step 2:

Next, agree on your end point. For our savings challenge, we recommend setting a goal of a certain amount saved or who can save the most overall in a certain amount of time (our scorecard goes up to one year).

Step 3:

Decide on a prize (or multiple). While it could just be the satisfaction of winning, it may be more fun and motivating to set an actual reward — and even better if the reward is related to one of your goals. For example, if your goal is to travel somewhere, the winner may get to pick the destination or have greater control over the itinerary.

Savings challenge: breakdown and scoring

Now that you’ve established the fundamentals for your challenge, let’s dive into how it will work. We’ve broken this competition down into three parts:

Mini challenges

Monthly savings

Overall savings

Each element has points associated (which we’ll discuss shortly) and we’ve provided a score sheet to help keep you on track.

Mini challenges

These will keep you engaged throughout the challenge and allow you to get creative with your savings. We recommend trying one or two mini challenges per month. Example mini challenges include:

Who can reduce their dining-out spending the most for two weeks

Who can get a monthly bill reduced the most (like internet or cell phone)

Who can stick closest to your shared budget for one week

Who can plan the most budget-friendly date night

Who can stretch $20 (or other dollar amount) the farthest at the grocery store

These short-term savings sprints are all about looking for small ways to impact your budget and put cash back in your pockets (or savings accounts) alongside your partner. The challenges above are a few ideas to get you started, but don’t be afraid to come up with your own.

Value: 1 point per challenge

Monthly savings

This portion of the challenge is designed to help you make sure each month counts, while giving you flexibility throughout the year — because, let’s be honest, some months are just more expensive than others. You can set up the monthly challenge in one of two ways:

See who contributes the greatest amount to your savings goals

Set individual savings targets for the month and see who saves the most

Value: 2 points per challenge

Annual challenge

Ideally, you’ll keep the challenge going for a year, so you can really look back on your journey. Check out how close you both got to the targets you set for your agreed-upon goals. Even if one of you had some slow savings months, a last-minute deposit could score you a big comeback.

Value: 15 points

To determine your bragging-rights-secured winner, add up all the points from each element. No cheating!

Making the most of your competition

We built this challenge to help you and your partner stay motivated to save year-round, while ensuring everyone has a chance to win regardless of your saving style. Whether you thrive on quick challenges where the reward is swift or are a consistent, long-term saver, you have a variety of opportunities to earn points.

Plus, you have plenty of avenues to make this challenge your own, so it can best serve your goals and timelines. That might mean shortening it to six months or adding in additional mini challenges — it’s all about what works for you and your partner and the ways that you both save.

As you save for multiple goals (or individually save toward one shared goal), Ally Bank’s buckets and boosters are incredible tools to keep you organized and push your progress forward. In your Ally Bank Savings Account, you can create up to 30 separate savings buckets, complete with your choice of name, savings goal and target date. It’s a simple way to stay motivated and reduce the need for any mental math. And with boosters, you can supercharge your savings through recurring transfers, round ups and surprise savings.

With your savings on autopilot, this challenge just got a whole lot easier.

The winner shares it all

At the end of the day (or, in this case, year), everyone in your relationship wins. You’re saving toward shared goals, and the quicker you reach them, the sooner you both get to reap the benefits. Anyone ready for a second round?