It’s never too soon — or too late — to get familiar with the retirement savings tools available. Knowing the basics of your Individual Retirement Account, or IRA, can help avoid some missteps.

Here are 10 common mistakes.

1. Underestimating how much money you’ll need

There’s no one-size-fits-all retirement plan, but a general rule is to have enough to cover 80% of your pre-retirement income to maintain your current lifestyle. Our retirement calculator can help you with the math.

Read more: Is a robo advisor or financial advisor the best fit for your investments?

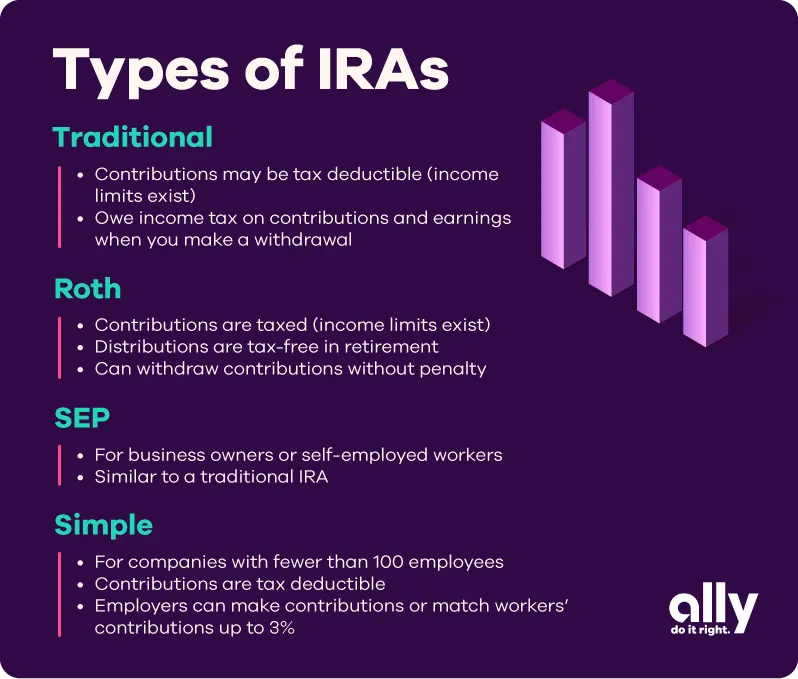

2. Not knowing the differences between IRAs

Traditional and Roth IRAs are among the most popular ways to save for retirement, so consider their unique features before opening an account. Some brokers offer other common account types include SEP and SIMPLE IRAs. Understanding their respective tax benefits, contribution limits and withdrawal guidelines is a good starting point to differentiate between them:

3. Contributing too much

If you have multiple IRAs, contribution limits apply to the total amount, not each account. If you exceed the limit, you’ll incur a 6% excess contribution tax — unless you catch the error before filing taxes and withdraw the money to avoid fees.

IRA account type* | Under 50 | Over 50 |

Traditional and Roth | $7,000 | $8,000 |

SEP IRA** | $69,000 or 25% of compensation (whichever is lower) | Same as under 50 |

SIMPLE | $16,000 | $19,500 |

*for 2024 **contributions made by employer, not individual

4. Not knowing Roth income limits

Roth IRAs have limits on your modified adjusted gross income (AGI). If you fall between these 2024 AGI limits, you can put a reduced amount in a Roth, but if you exceed the upper end of the range, you can’t contribute:

Singles and heads of household: $146,000 and $161,000

Married couples filing jointly: $230,000 and $240,000

Married individuals filing a separate return: $10,000

5. Waiting too long to contribute

The deadline for contributing to your IRA is tax day each year. Contributing as much as you can (up to the limit) as early as possible allows more time for compounding interest to work to grow your savings.

6. Withdrawing too early (or the incorrect amount)

If you withdraw money from your traditional IRA before age 59 1/2, you’ll generally pay income taxes and a hefty 10% early withdrawal penalty. With Roth IRAs, you’ll only pay these early withdrawal costs on your earnings on the amounts contributed to the Roth IRA.

Roth IRAs also require five years to pass from the beginning of the tax year of your first contribution for earnings to be withdrawn tax-free, even if you’re 59 1/2.

Traditional IRAs have a required minimum distribution, or RMD, later in retirement. Failure to withdraw your RMD annually may result in paying the original taxes owed plus a 25% excise tax penalty.

Just like with your other assets, it’s important to designate who will receive your IRA when you pass away.

7. Rollover mistakes and losing money

When it comes to your IRAs, you can:

Transfer, which moves funds from one account to another account of the same type (a Roth IRA at one financial institution to a Roth IRA at a different institution) without taxes.

Rollover funds from one account to a similarly registered account or to a different type of account (such as a 401(k) to a traditional IRA).

Conduct a conversion to change a traditional IRA to a Roth IRA, which results in paying taxes on any untaxed amounts.

Consult with a tax professional or financial planner to help you avoid money-moving mistakes.

8. Forgetting your beneficiaries

Just like with your other assets, it’s important to designate who will receive your IRA when you pass away. Unlike a 401(k) plan, where you’re often required to name your spouse as a beneficiary, an IRA typically allows you to name anyone (unless state laws say otherwise), and you can often name more than one person.

9. Not seeking advice on an inherited IRA

If you are the beneficiary of an IRA, know that rules and regulations are different for inherited IRAs. Your situation will vary based on your relationship to the person who passed, their age and other factors.

10. Missing out on a backdoor Roth IRA

A backdoor Roth IRA is a strategy typically used by high-income earners who exceed Roth IRA income limits. You can create a backdoor Roth IRA in one of three ways:

Contributing funds to a traditional IRA then rolling them over to a Roth IRA (there is no cap on how much you can roll over at one time, although the IRS has more rules that apply)

Converting your entire traditional IRA to a Roth IRA

Rolling over a 401(k) account to a Roth IRA (if your employer allows it)

You’ll still need to pay taxes on any money in your traditional IRA that hasn’t been taxed.

Avoid IRA issues

It comes down to the details with your retirement savings. Strengthening your knowledge will help you become a savvy saver from the moment you open your IRA.