What we'll cover

What it means to max out a 401(k)

Pros and cons of maxing out a 401(k)

Quick steps to take to max out your plan

Retirement looks different for every person, but regardless of your goals, it’s important to understand the different steps you can take to pursue them, whether that's sticking to a budget, regularly investing your money or something else. Maxing out your 401(k) is another possible item to factor in.

If you're curious about adding this method to your retirement savings plan, learn about making the most of your contributions. And if you're looking to add this strategy to your own retirement plan, consider working with a tax professional.

What is a maxed out 401(k)?

Maxing out your 401(k) means making contributions up to the annual limit the IRS sets. For 2024, you can contribute a maximum of $23,000 to your 401(k) (up from $22,500 for 2023). You can add another $7,500 in catch-up contributions if you're 50 or older (unchanged from 2023).

If your employer offers a matching contribution, different limits exist for how much an employer can add on your behalf.

Read more: How to get started investing

The benefit of maxing out a 401(k)

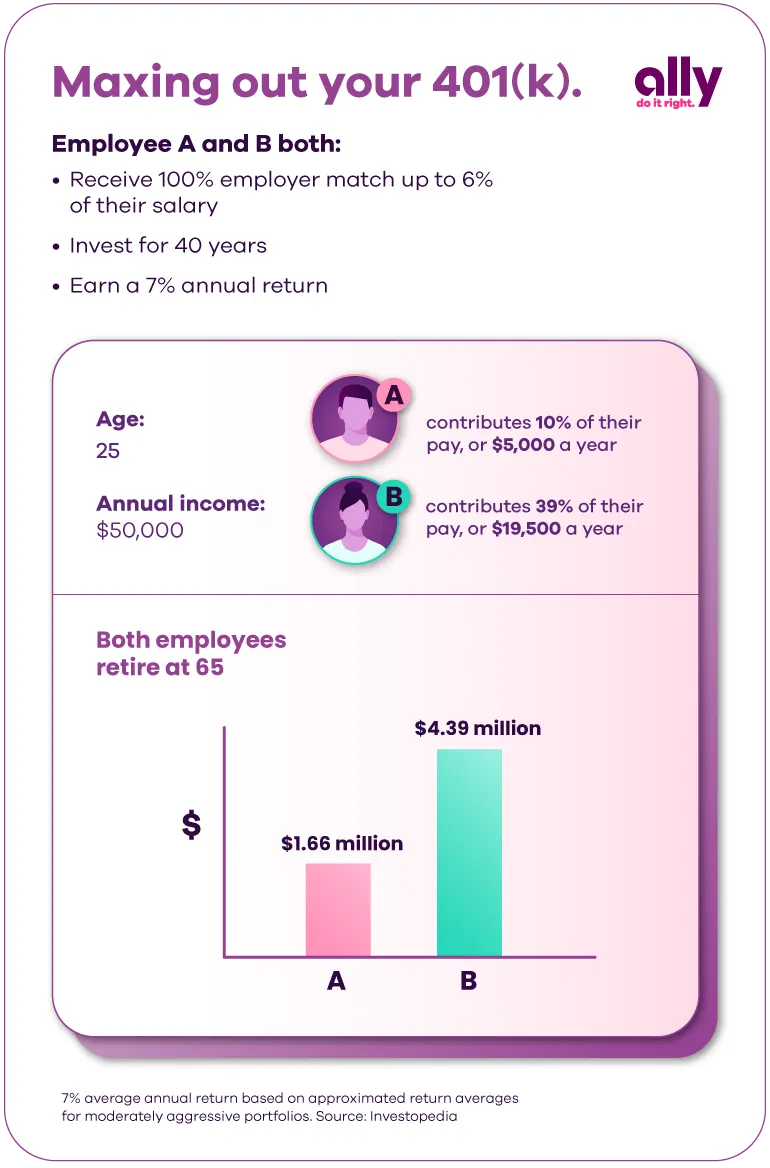

There's a straightforward reason to max out your 401(k): The more you contribute, the greater potential for your retirement savings to accumulate. Let's look at an example:

This is a hypothetical example, of course, and it doesn't account for the added value of catch-up contributions. It shows how much more you could end up with for retirement if you contribute the full amount to your 401(k) annually.

Disadvantages of maxing out a 401(k)

Maxing out a 401(k) is not a realistic goal for everyone. If you make $50,000 a year, contributing the maximum would leave you with $30,500 to live on. That could be challenging, especially if you live in a city with a higher cost of living, have debt you're paying off or are pursuing multiple goals.

Additionally, if you're limited in how much you can save for retirement, a maxed-out 401(k) could prevent you from taking advantage of other retirement investing choices, like individual retirement accounts (IRAs).

Should I max out my 401(k)?

When deciding whether to max out your 401(k), look at your bigger financial picture. After all, retirement may be decades away for you, and you may have other, more immediate financial goals you want to prioritize. Consider:

How much do you have saved for emergencies? Are you comfortable with the amount?

How much debt do you have? What percentage of your income goes to debt repayment each month?

Do you have other financial goals you're working on, such as buying a home or putting away money for your child's college expenses?

Does your financial plan include insurance, disability insurance and a will or trust?

How to max out 401(k) contributions

A maxed-out 401(k) can help you feel more secure about your retirement future. If you're interested in maxing out your plan:

Examine your budget and how much you have beyond your monthly expenses.

Look at how much of your pay you're currently contributing to your 401(k) and how much more you would need to contribute to reach the limit.

Go back to your budgetand ask yourself if upping your contribution is possible. If yes, contact your 401(k) plan administrator or visit their website to request an increase in your contribution rate.

If not, take a closer look at your spending for areas you can reduce.

Quick tip: If you can't immediately contribute the maximum amount to your 401(k), you might also consider increasing your contributions by 1% each year until you reach the annual limit.

Even if you decide not to max out your 401(k), it's important to understand all the choices available to you for your retirement savings plan. Nothing gives peace of mind like knowing you're doing as much as you can to prepare for your financial future.