What we'll cover

How to open an Ally Bank Savings Account

A step-by-step guide to set up your account

The benefits of an Ally Bank Savings Account

As you map out your financial future, your savings account can be an essential tool. If you're ready to take advantage of the great rates, straightforward terms and top-notch account security of an Ally Bank Savings Account, we have good news: You can open one in five minutes or less.

Here’s a quick step-by-step guide for opening a savings account at Ally Bank.

Gather the required documents and information

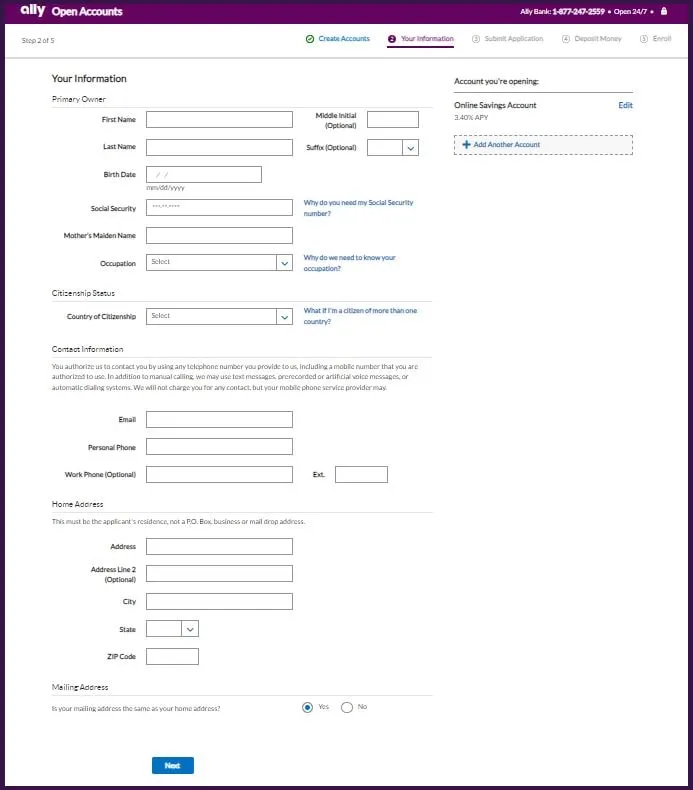

To open your new account, you need to be ready with the following:

Full name

Social Security number

Mother’s maiden name

Occupation

Contact information: email and primary phone number

Date of birth (you must be 18 years of age)

Residential street address (and previous address, if you’ve lived at your current one for less than five years)

Mailing address (if different from your residential address)

Choose account type

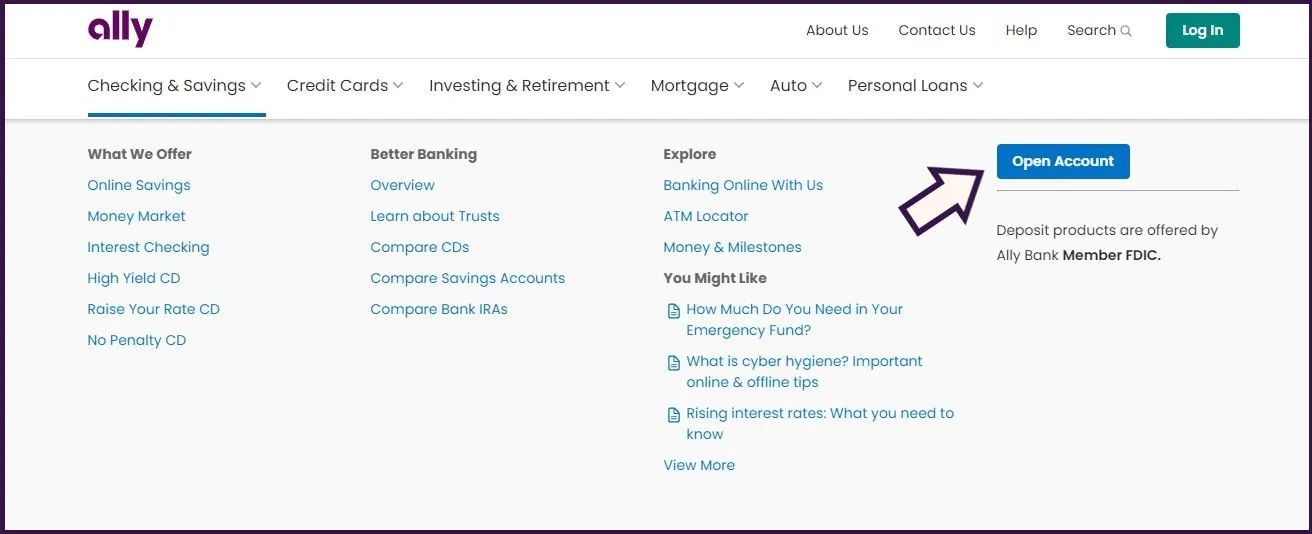

Once you’re on the Ally site, choose the “Checking & Savings” tab from the top menu, then select “Open Account”.

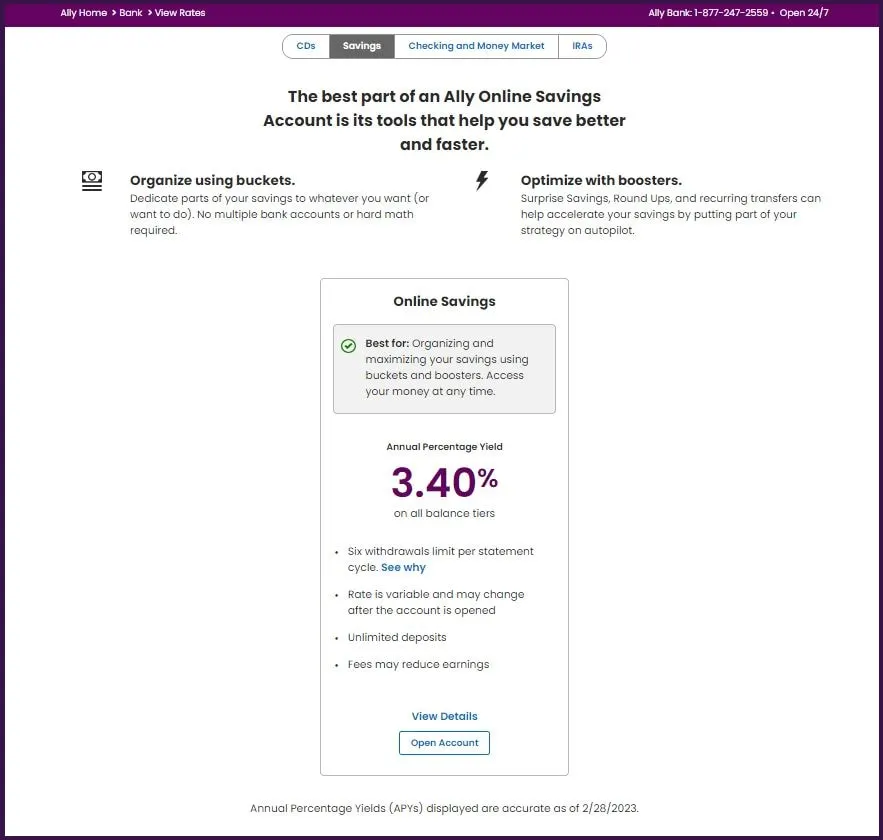

Next, you’ll see options for deposit accounts: CDs, Savings, Checking and Money Market and IRAs. Click on “Savings,” then select “Open Account” and indicate whether you’re an existing Ally Bank customer.

Accurate as of date (02/28/23). No minimum deposit to open or earn APY. Rate is variable and may change after the account is opened. Fees may reduce earnings.

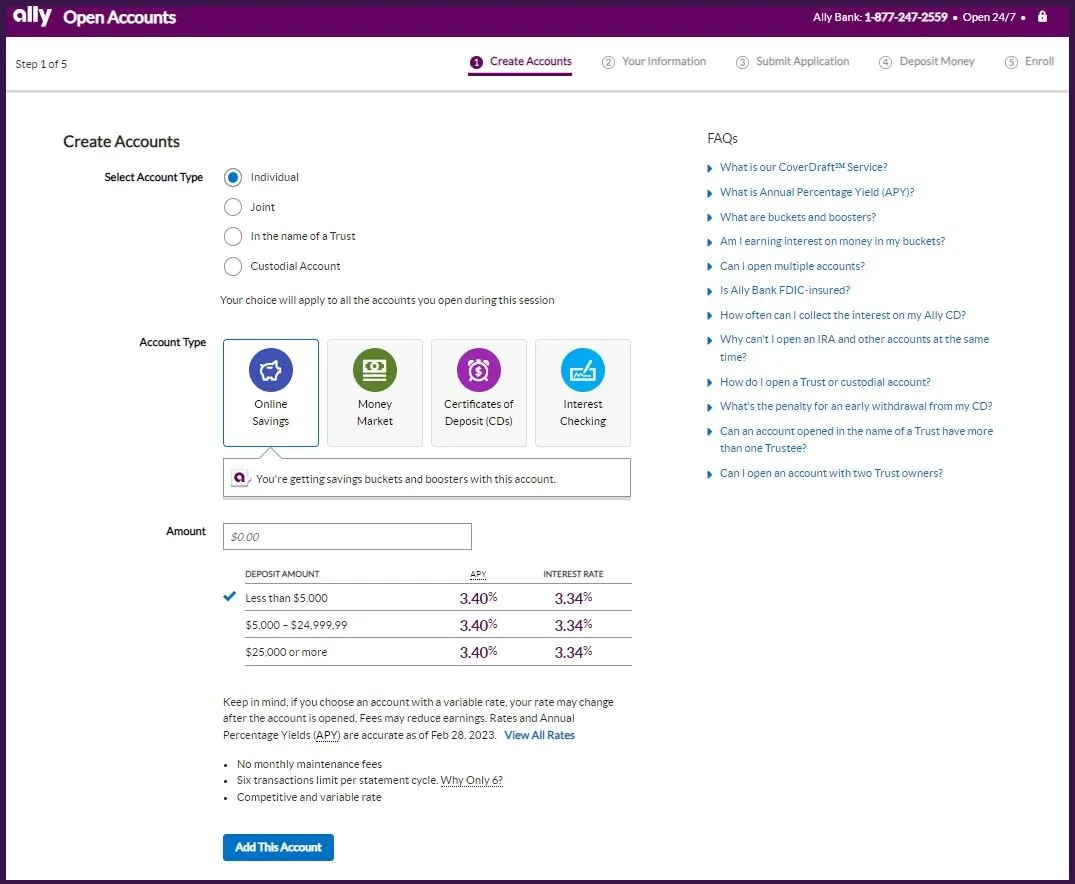

Create your account

On the next screen, you’ll have the option to enter a deposit amount. This is for your own planning purposes and it isn’t set in stone. Keep in mind: There’s no minimum deposit required to open the account, and you can make an initial deposit for whatever amount you choose once your account is open. When you’re ready to proceed, select “Add This Account.”

Accurate as of date (02/28/23). No minimum deposit to open or earn APY. Rate is variable and may change after the account is opened. Fees may reduce earnings.

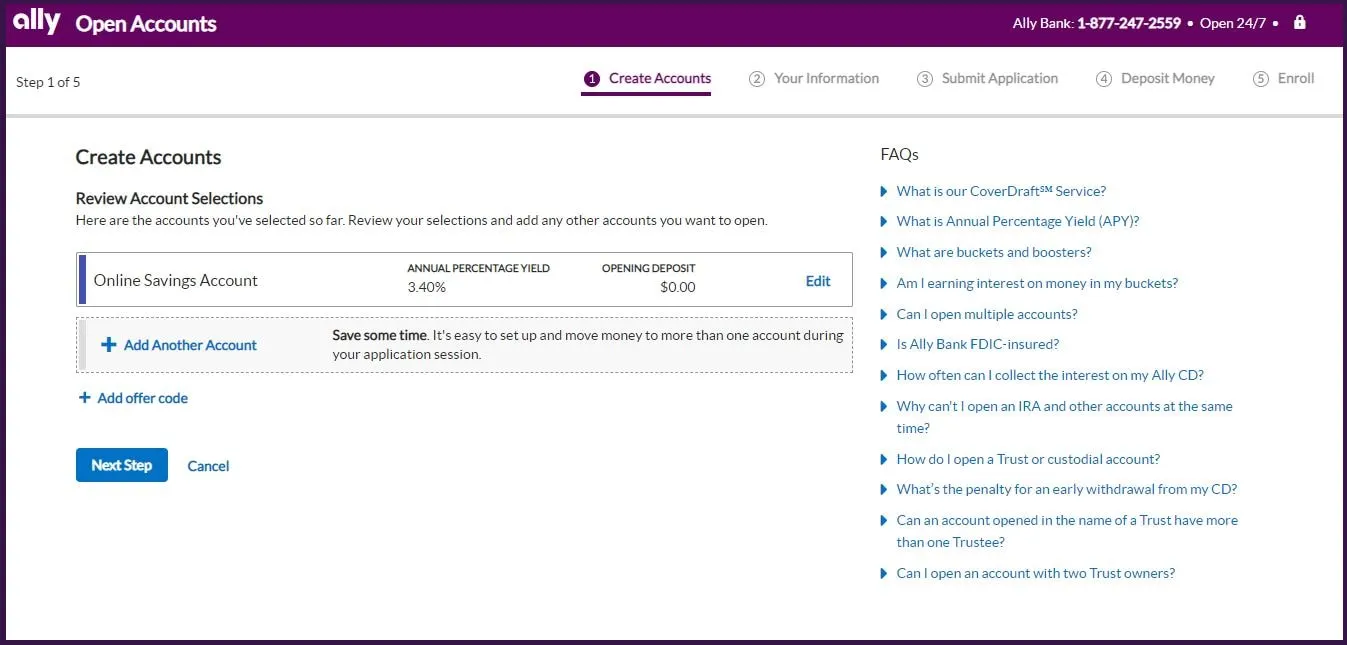

The following screen gives you the option to open the account in the name of a trust or UGMA/UTMA, which means you are opening it on behalf of a third-party beneficiary. And if you’re planning to open multiple accounts, you also can add another account in this section.

Accurate as of date (02/28/23). No minimum deposit to open or earn APY. Rate is variable and may change after the account is opened. Fees may reduce earnings.

If that doesn’t apply to you, move along to the next step.

There’s no minimum deposit required to open an Ally Bank Savings Account, and you can make an initial deposit for whatever amount you choose once your account is open.

Provide personal details

Fill out the requested pieces of personal information for the Primary Account Owner. You also have the option to select up to four joint account owners. (Be prepared to provide their personal information, too.)

Accurate as of date (02/28/23). No minimum deposit to open or earn APY. Rate is variable and may change after the account is opened. Fees may reduce earnings.

Once you’ve entered your personal information, you’ll have a chance to double-check and edit anything that needs fixing. Then, select “Next,” and you’re almost finished.

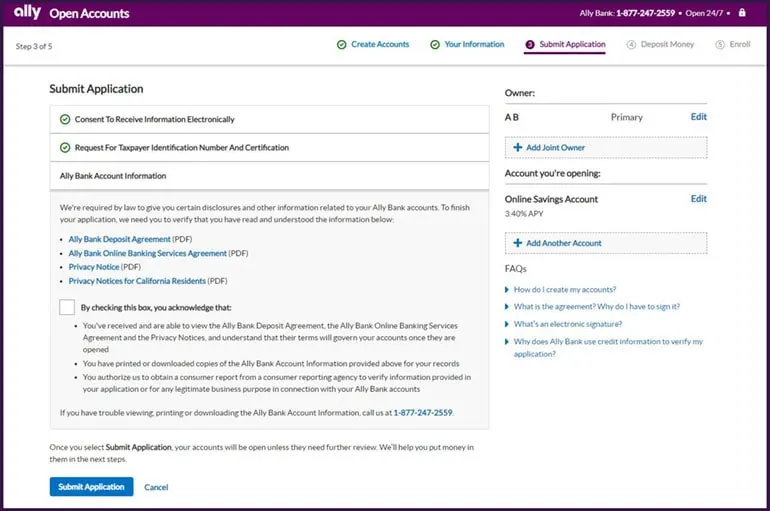

Submit your application

Now, you’re nearly there. It’s time to agree to receive information electronically and certify that your Social Security Number or Tax Identification Number (TIN) is accurate. Then you’ll get a chance to review legal disclosures.

Once you review the disclosures, check the box, select “Submit Application,” and you’re all set.

Accurate as of date (02/28/23). No minimum deposit to open or earn APY. Rate is variable and may change after the account is opened. Fees may reduce earnings.

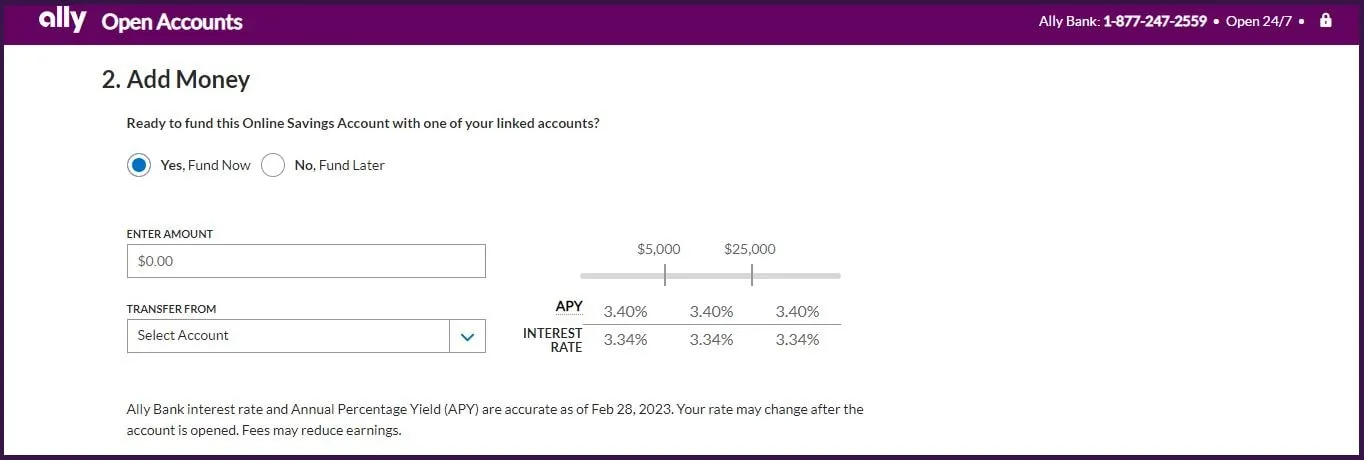

Fund your account

Once you’re approved, it’s time to make a deposit and start saving. You can choose to transfer funds from other accounts, wire money, use Ally eCheck Deposit℠ or mail us a check.

Accurate as of date (02/28/23). No minimum deposit to open or earn APY. Rate is variable and may change after the account is opened. Fees may reduce earnings.

Welcome to saving your way

As part of your introduction, you’ll receive a welcome kit in the mail detailing the terms of your account, instructions for online access and answers to common questions.

You can download the Ally Bank Mobile app to keep your account details right at your fingertips. You’ll have easy access to capabilities like depositing checks, transferring funds or finding an ATM on the go.

In the meantime, take a look at all the perks you’ll get as an Ally Bank Savings Account owner. And remember, you can get help with your new account any time at Ally.com or call live, 24/7 customer care at 877-247-ALLY (2559).