Visualization works by creating images or scenarios in your mind to bring ideas and goals to life. For instance, some athletes use visualization to improve performance and boost their confidence. Fortunately, this strategy isn’t limited to performance on the field – you can actually apply the same psychology to your savings goals.

Read more: How Ally Bank’s buckets and boosters can help you save

Why you should visualize your savings

When used in goal setting, visualization helps create a clear mental image of your desired outcome, increasing motivation and focus toward achieving that goal. It can also:

Help with setting realistic and achievable savings milestones

Encourage discipline and consistency in saving money

Make the journey towards financial goals more enjoyable and engaging

4 steps to visualize your savings

Here are some tangible ways you can incorporate visualization into your savings strategies.

1. Define your savings goals

What are you hoping to accomplish? Save for a down payment? Pull off a debt-free wedding? Or how about your dream to retire early? Whatever your goal, the first step is clearly identifying it. Once you know what you’re working toward, it’s easier to envision yourself succeeding.

2. Create a vision board

Dig up any pictures that represent your savings goals and place them where you’ll see them frequently — for instance, on a Pinterest board or a physical bulletin board. Repeatedly seeing these images will trigger you to visualize and maintain motivation for saving.

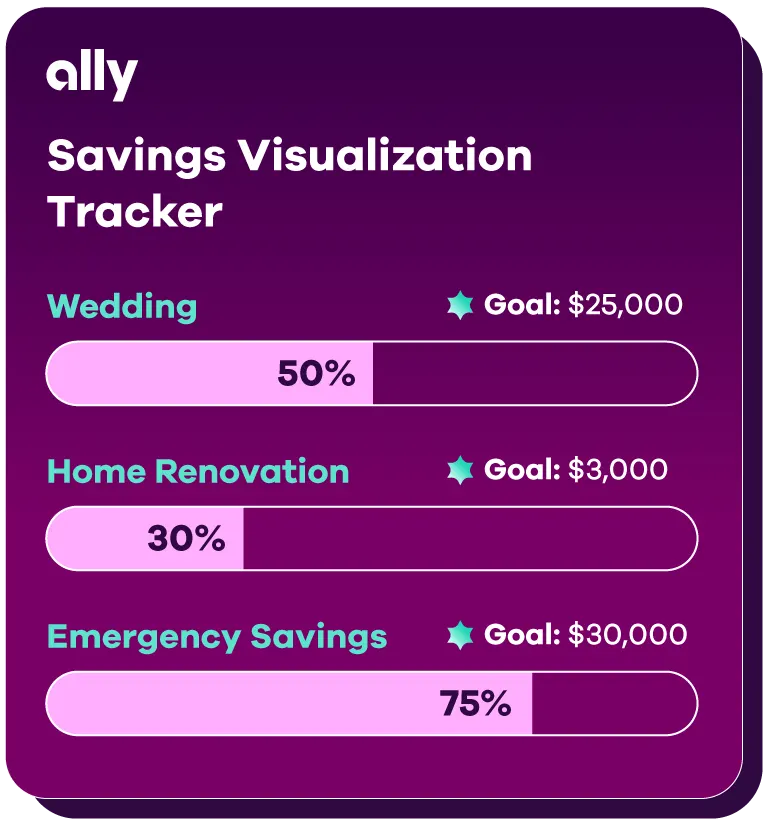

3. Use a savings tracker

Create a visual representation of your savings goal, like a progress chart or a digital tool like buckets in an Ally Bank Savings Account. With buckets, you can save for multiple goals simultaneously without tracking issues or account complexities. Create custom “envelopes” for each goal directly in your Ally Bank Savings Account — think emergency fund, vacation fund or a down payment fund.

As you contribute to each bucket, you can see the progress toward each individual goal, giving you a clear picture of your savings journey.

4. Monitor and adjust regularly

Life circumstances and priorities inevitably change. But keeping track of your finances can help you have a leg up when you need to make adjustments. By continuously checking in with your goals and adapting as needed, you can ensure your goals remain realistic, relevant and achievable.

Additional tips for effective savings visualization

If you’re ready to approach your savings goals in a new and effective way, following these steps can help:

Imagine the process and success: It can be easy to only visualize the finish line, but envisioning the steps that will get you there is just as important.

Understand spending impacts: When you’re tempted to make an impulse purchase, visualize the amount of money you could be adding to your savings or the progress you would be making toward your goals instead.

Make it a family affair: Involving family in visualization techniques can foster a sense of shared goals and collective motivation. It can also help them provide the necessary encouragement, understanding and assistance to help you stay focused and committed to your savings objectives.

The sky’s the limit

Visualization is an easy-to-implement strategy that helps you bring your goals to life and strengthen your everyday saving habits. Start envisioning your financial goals today.