Money market account vs. savings account: Which should you choose?

What we'll cover

What money market accounts and savings accounts are

The difference between them

The pros and cons of both types of accounts

Your saving habits have paid off and now you have a chunk of change to set aside. Where should you put your money? You have plenty of options, from stocks and bonds to money market accounts and savings accounts.

In this piece, we'll zoom in on money market accounts and savings accounts.

What's the difference between a money market account vs savings account? Which offers the best place to park the money you dream of using someday?

Let's walk through the definitions of money market vs savings account, some of the differences and some of the pros and cons between the two. We'll also work through which accounts typically offer the highest interest rates and ultimately how to choose the right type of account based on your objectives.

What is a money market account?

A money market account sometimes called a money market deposit account or a money market savings account, is an interest-bearing account that acts like a hybrid between a checking and savings account. Depending on your financial institution's requirements, you may have to maintain a minimum balance or put down a minimum deposit amount to open this type of account.

Money in an FDIC-insured bank, such as Ally Bank, is covered up to $250,000 per depositor, per qualifying account ownership category (for instance, money market deposit accounts).

Generally, you can access your money in several ways through a money market account:

Check

Debit card

Electronic transfer or draft

ATM withdrawal

Other methods allowed by your bank or credit union

Keep in mind, it's important not to confuse a money market account with a money market mutual fund, which is offered at an investment firm. Money market mutual funds are not insured by the FDIC.

Read more about money market accounts

What is a savings account?

A savings account is an interest-bearing deposit account that serves as a holding place for your money, whether you're saving money for an emergency or a vacation. You can access money or move it to your account by depositing checks, using a mobile banking app or through direct deposit. You can generally use your savings account to transfer money in and out of other accounts with the same bank or at other banks.

Just like a money market account, a savings account at an FDIC-insured bank, such as Ally, is covered up to $250,000 per depositor, per qualifying account ownership category.

In the past, you could only make six withdrawals per month from non-transaction accounts (such as savings accounts), per Federal Reserve Regulation D. Now, the Federal Reserve allows financial institutions to decide whether they apply any withdrawal limits. Your financial institution may still charge an excessive withdrawal fee if you go over the withdrawal or transactions limit per statement cycle, but some transactions may not count against this limit. For instance, Ally Bank is currently refunding the $10 excessive transaction fee associated with withdrawals and transfers exceeding the limit of six.

What’s the difference between money market account vs. savings account?

How should you choose one over the other? It's a great question, and as with most personal finance questions, it's just that — personal.

Walking through these two main differences between money market accounts and savings accounts could help you decide which makes sense for your personal situation:

Access differences: The primary difference between a money market account and a regular savings account is how you access your funds. Money market accounts usually allow you to write checks and use ATM and debit cards for withdrawals, just like checking accounts. With a savings account, you typically have ATM access but can’t write checks. You may need to take money out via electronic transfer or by calling the bank. (If your bank has a physical branch, you may also make withdrawals in person).

Interest rate differences: You may also encounter different interest rates for each type of account. Sometimes money market accounts offer slightly higher rates than savings accounts. However, a money market compared to a high yield savings could be a completely different story. A high-yield savings account could offer up a higher interest rate compared to a traditional savings account. It simply depends on the financial institution, which is why it's a good idea to shop around.

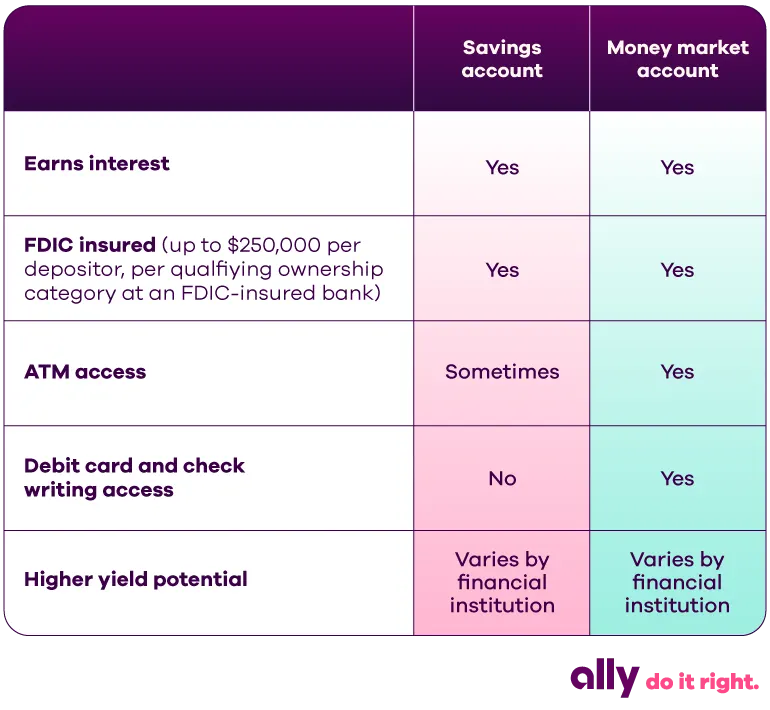

Look at the chart below for a quick overview of the differences between these two types of accounts:

Pros and cons of money market accounts and savings accounts

Let's weigh the pros and cons of money market vs savings accounts so you can easily see the differences between the two.

Money market account pros and cons

Let's start with the benefits of a money market deposit account — and reasons this account might not be the right fit — to help you weigh your opportunities.

Pros of a money market account

FDIC insured: As mentioned, you can get FDIC insurance up to the maximum amount allowed by law for money market accounts.

Interest rates: You may earn higher returns with a money market account, though it depends on the financial institution's interest rate.

Additional perks: If you already have an account at a particular financial institution, you may have access to advantages such as fee waivers, account-to-account transfers and more.

Easier access: Money market accounts allow you to access your money easier through debit cards and checks.

Cons of a money market account

Minimum balance requirements: Some banks require you to maintain a minimum balance to avoid a monthly fee. Your interest rate or other perks may even decrease if you don't adhere to the monthly minimum balance requirements. Ally Bank doesn’t have minimum balance requirements for money market accounts.

Rate changes: Interest rates for money market funds often vary with fluctuations in the prevailing market.

Savings account pros and cons

What are the pros and cons of savings accounts? Let's dive right in.

Pros of a savings account

Interest on your deposits: You can earn interest on your deposits, even if they are small deposits.

Easy to open and access: It's easy to open a savings account — you can apply online, by phone, in person or even by mailing in an application. You may be able to get an account set up in just 10 minutes by applying online. It's also easy to access your savings account once you open it, though you can't write checks to access money in a savings account.

FDIC-insured: You can get FDIC insurance up to the maximum amount allowed by law for savings accounts.

Cons of a savings account

Variable interest rates: Interest rates may vary, depending on the wider market, just like money market accounts.

May have transaction limits: You may not have unlimited withdrawals from your savings account per statement cycle. Check on transaction limits for any savings accounts you're considering.

May charge fees: What fees does a savings account carry? Read the fine print (the disclosure documentation) for each account. Try to find accounts that typically earn higher rates and have no or low monthly service charges. With our Ally Bank Savings Account, we charge no fees for maintenance, overdraft, low balance, ACH transfers or cashier’s checks. And for the fees we do charge, we’re up front about them (for instance, fees for expedited delivery for mailed items, outgoing domestic wires and account research). Check your account details for a complete fee schedule.

Which type of account offers the highest interest rates?

Generally, money market accounts offer higher interest rates than regular savings accounts, but that's not always the case when comparing to high-yield savings accounts.

It's worth it to research competitive rates for either type of account. Compare the annual percentage yield (APY), which calculates the total amount of interest you can earn in a year. Don't compare interest rate to APY, which will give you an apples-to-oranges comparison instead of an apples-to-apples comparison. In addition, check out monthly maintenance fees and minimum deposit requirements.

Keep in mind that online banks (such as Ally Bank) don’t have the overhead of traditional brick-and-mortar banks, so online banking may give you higher rates on both savings and money market accounts.

Which account should you choose?

Now that you’ve compared both types of accounts, have you decided which type best meets your needs? Do you just want a safe place to grow your balance while you keep stashing money away? Or do you need a little more flexibility in how you access your funds? That may be the determining factor.

Ultimately, it's a personal decision. Below, we'll outline when it's best to use a money market account vs. a savings account, depending on your situation.

When it's best to use a money market account

A money market account might make sense when you want to write checks on an account, but not as many as you would with, say, a traditional checking account.

For example, if you were saving for a home with a money market account, you could write a few checks for related expenses, such as a home inspection or good faith deposit, from your account balance without having to transfer funds from another account.

When it's best to use a savings account

A savings account might work best when you want to put cash away for an emergency fund or future major purchase — if you don’t need to access your money often.

The right bank makes a difference

The right bank makes all the difference, whether you're looking at a money market account or savings account. With an Ally Bank Savings Account, you can access tools to strategize your savings goals … or maybe a Money Market Account is more your speed. Be thoughtful about your goals and needs, and you’ll be setting yourself up for success.