What we'll cover

What spending and savings buckets are

The benefits of buckets

How to use buckets to manage debt

If you’re struggling with a credit card balance, student loans or any other type of debt, you may be feeling stuck. Getting out of debt can seem like a daunting task, but you can create a plan to tackle it one step at a time. Ally Bank’s spending and savings buckets are useful tools that can help you chip away at debt and head toward a brighter financial future.

What are spending buckets?

Spending buckets are a feature of Ally Bank’s Spending Account. They function like digital envelopes, allowing you to separate your money for specific expenses.

How spending buckets work

You can create spending buckets for different expenses such as rent/mortgage, car payments, your credit card balance and groceries. You choose what each bucket is for and how much of your money you allocate to each expense. Have the funds automatically distributed each time you deposit money into your account or move them manually.

How to set up buckets to track payments and recurring bills

Ditch spreadsheets in favor of a more visual approach to budgeting. The first step is to decide how much money will go toward monthly expenses as well as any other expenses you want to keep track of with spending buckets. You can then see any unbucketed funds you have left over and decide what to do with that money.

Benefits of spending buckets

You can create a customized spending system with buckets to simplify your money management, eliminating surprises and guesswork. Buckets help you visualize your expenses. Start small with a few buckets and add more as you need them.

By setting aside money for recurring expenses ahead of time, you don’t need multiple accounts or complicated spreadsheets to monitor your spending. Buckets allow you to easily analyze your finances for overspending and customize a flexible plan.

By setting aside money for recurring expenses ahead of time, you don’t need multiple accounts or complicated spreadsheets to monitor your spending.

What are savings buckets?

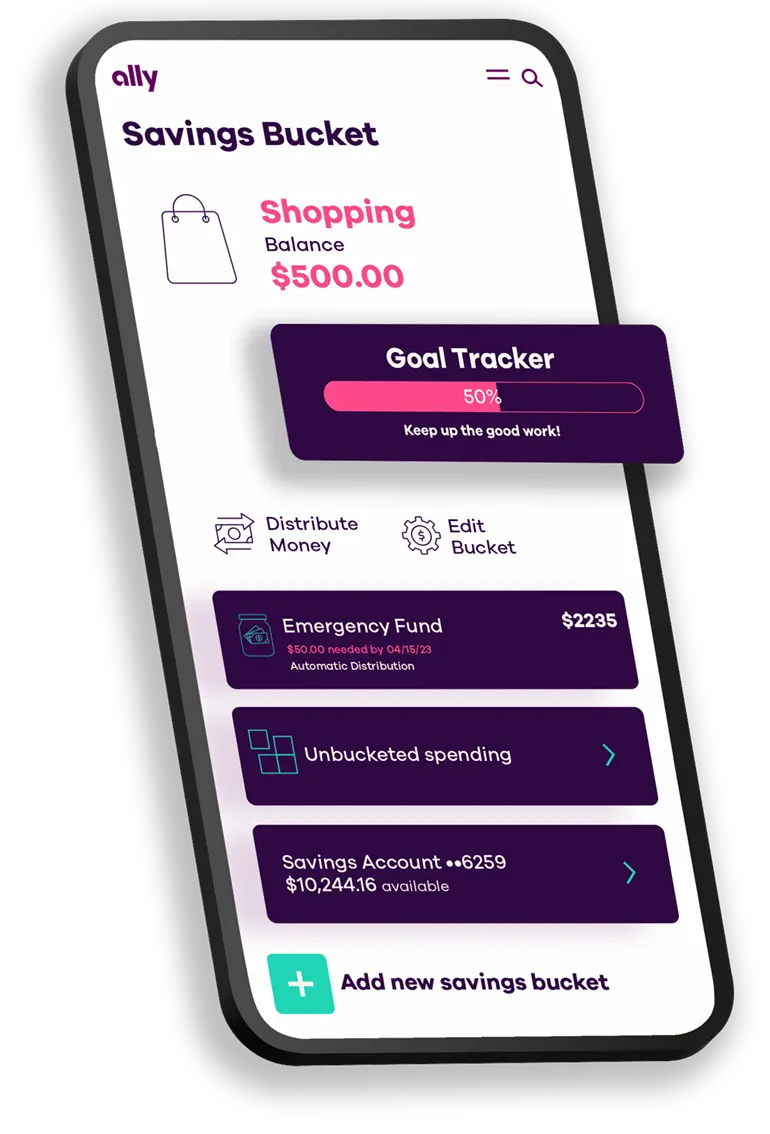

Like spending buckets, savings buckets help you organize and separate your savings goals. Savings buckets are a feature of Ally Bank’s Savings Account.

How savings buckets work

You can create up to 30 savings buckets within one account, each dedicated to a different goal, like an emergency fund, a vacation or higher education. You can name each savings bucket and decide how much of your income you want to allocate to each one. Easily move the funds manually with the distribute tool, or set up automatic contributions.

Benefits of savings buckets

Seeing your savings goals defined can be motivating. As your savings in each bucket add up, you’ll be that much more excited to make your dreams a reality. With savings buckets, you don’t need multiple accounts to save for different goals, and you’ll still earn interest on the total balance of your account.

How to use both spending and savings buckets to pay off debt faster

When your money isn’t organized, it may feel difficult to find even one extra dollar to put toward your debt. Once your fixed expenses and savings goals are clearly designated, you can analyze your unbucketed money for missed opportunities hiding in plain sight. For instance, you might notice you’re spending way more at the grocery store than you thought. Or maybe you’ll see you’re close to hitting your goal for your kid’s college bucket, and you can now redirect some of that money toward your debt.

Using buckets together also empowers you to make shifts as your circumstances change. If your rent goes up, you may need to scale back on your debt payments. Or perhaps you’ll realize you’ve barely watched TV since summer started, so you’ll cut back on streaming services and increase your monthly credit card payment.

Conquer debt with buckets

Want to start climbing out of debt but don’t know where to start? Buckets are a simple, sustainable solution to transform how you manage your money. Start using this valuable tool today to put your debt-busting plan in action.