What we'll cover

What a trust is

How to decide if you need one

How to set up a trust

Trusts have long been thought of as an inheritance tool meant only for the super wealthy, thanks to the “trust-fund baby” stereotype. But what is a trust, and do you actually need a supersized bank account to set one up? No, anyone who wants to leave precise instructions on how their assets should be managed after they’re gone can set up a trust. It serves as a tool to manage the wealth you’ve built throughout your life after you’re gone — helping the people, causes and organizations that have meant the most to you.

What is a trust and how does it work?

It’s used to decide how a person’s money is managed and distributed. A trust is a fiduciary relationship in which a grantor gives the trustee ownership of property or assets. Often set up for use after a person dies, a trust can also be used while someone is still living.

Trusts can hold cash and a variety of financial assets: savings accounts, stocks, property, collectables, other investments — whatever you decide you want to leave to your beneficiaries. To establish a formal trust, the first step is to speak with a financial professional or an estate attorney to review your options.

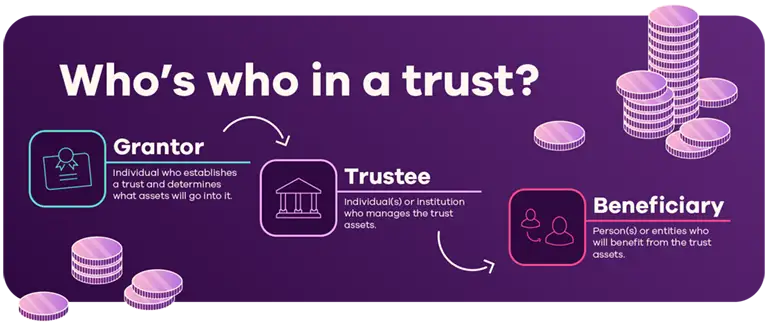

Three key parties involved in a trust

Learn more about the three main roles involved in a trust: the grantor, trustee and beneficiary, and how they function together.

Grantor

The grantor is the person who establishes a trust and determines what assets will go into it.

Trustee

The trustee is a person or institution who manages the trust assets — sometimes for a fee — until its purpose has been achieved. The trustee has a fiduciary responsibility to oversee the trust and ensure the guidelines established by the grantor are followed. Essentially, the trustee is legally obligated to be honest and trustworthy. Any action the trustee takes must always stay true to the instructions in the trust agreement, even after the grantor’s death.

Beneficiary

A Trust is created for its beneficiary. At some point, the beneficiary will receive proceeds from the Trust in accordance with its terms. The beneficiary may be a person — a child, grandchild, family member, or others — but it can also be a charity or business.

Two types of trusts — Revocable trusts vs. Irrevocable trusts

When it comes to trusts, grantors can get as specific as they want: Land Trusts, IRA Trusts, Qualified Personal Residence Trusts, Charitable Trusts, etc. But all trusts are one of two types: Revocable or irrevocable.

Trusts can hold cash and a variety of financial assets: savings accounts, stocks, property, collectibles, other investments — whatever you decide you want to leave to your beneficiaries.

With a revocable trust, the grantor controls the trust’s assets during their lifetime. They can add to or remove property from the trust, change its beneficiaries and even dissolve it.

The specifics of an irrevocable trust are less flexible. Sure, you can modify or, in some circumstances (which vary by state), dissolve it — but it can be much more difficult.

Aside from the finality of irrevocable trusts, the main difference between revocable and irrevocable trusts involves taxes. Assets in revocable trusts are still considered the grantor’s property, so they continue to pay taxes on the income generated by the trust assets, and the trust assets are still considered part of the grantor’s estate for estate tax purposes. Irrevocable trust assets are generally no longer considered part of the grantor’s estate and any income or capital gains taxes owed on trust assets are paid by the trust. By removing assets from the grantor’s estate, an irrevocable trust can help reduce or avoid estate taxes at the grantor’s death.

Trust vs. will

While these two estate planning options have a lot in common, they also have some key differences. Wills take effect upon the death of the grantor, while trusts can be used both while the grantor is living and after their death. Another major difference is that a will can dictate matters unrelated to finances, such as who will be the guardians of minor children or instructions for your funeral and burial. Trusts cannot.

You can have both a will and a trust. In fact, a will can even direct an executor to create a trust and appoint a trustee. Your will might have provisions to create a trust for your child that they cannot access until they reach a certain age, for example. You can also have a will and a living trust, which is simply a trust that’s created while you’re alive.

What are the advantages of a trust?

Trusts can help you avoid probate

One reason some people prefer trusts is so they can circumvent probate, which is the judicial court’s process of deciding upon the validity of a public document. By avoiding probate, your assets will be distributed as you intended that much faster.

Any assets included in a trust do not need to go through the probate process, as long as the assets were added before the grantor’s death.

Trusts can help you control your assets

Do you ever dock your kid’s allowance because they forget to take out the trash? Instead of giving them the full $10, you only pay them $8. And if they don’t do any of their chores, you give them zip.

Allowances serve as an incentive. If your child does X, Y and Z, you’ll pay them handsomely (for a 7-year-old, anyway). Similarly, trusts can allow the grantor to control the assets long after they’re gone.

While some trusts are set to allow the trustee to make withdrawals from the trust for distribution to beneficiaries, others are set up with strict rules and restrictions determined by the grantor.

What are the disadvantages of a trust?

More paperwork

Trusts can be complicated to set up and generally require more time, effort and paperwork than a will, for instance. You’ll want to take care to ensure the trust is abiding by all laws and keep detailed records of property, portfolios and any other assets that will be part of the trust.

Cost

The expense necessary to create a trust may be a drawback. You will need to hire a financial professional or estate attorney to establish the trust, and you may hire an individual, bank or financial institution to manage its ongoing execution as well.

Creditors

Trusts do not stop debtors from trying to collect any debts you may owe. If you die and owe debt, creditors can file a lawsuit to collect the debt, which could leave your beneficiaries in an uncomfortable situation.

Ready to take the next steps?

To keep your legacy intact, consult with your trust professional to create a trust. Then follow the simple steps in our guide to open an Interest Checking Account, Online Savings Account or Certificate of Deposit (CD) in the name of your trust with us.