Whether you’re adding money to a savings vehicle such as a high-yield savings account or a certificate of deposit, you’re probably hoping it will grow over time. That’s where compound interest comes in — it’s a simple yet powerful tool for making your dollars and cents add up faster.

What is compound interest?

Interest can either be the price you pay to borrow money or the earnings you make from investments or savings. As opposed to simple interest, compound interest is what you earn on your initial principal amount and your accumulated interest. When it comes to how much interest you’ll earn, the percentage is often expressed in annual percentage yield, or APY.

How compound interest works

Let’s say you deposit money in a savings account or certificate of deposit. Your initial deposit earns interest, then each time the interest compounds, you earn additional interest on the principal and on the interest you’ve already accrued. This additional interest helps you save more money over time.

Read more: Learn how an interest checking account fits into your financial toolkit.

What determines compound interest?

Interest rate is a significant factor in calculating compound interest, but it doesn’t tell the full story. When you’re shopping around for accounts, for instance, you should compare APYs. The APY gives you a better idea of your potential earnings because it takes the frequency of compounding into consideration.

Compounding interest periods

Interest can be compounded daily, monthly, quarterly or annually, depending on where you keep your savings. The more often interest compounds, the faster your money grows.

Note when your interest is credited, which is when it’s added to your account balance. Only once the interest is credited will it begin to earn additional interest.

How to calculate compound interest

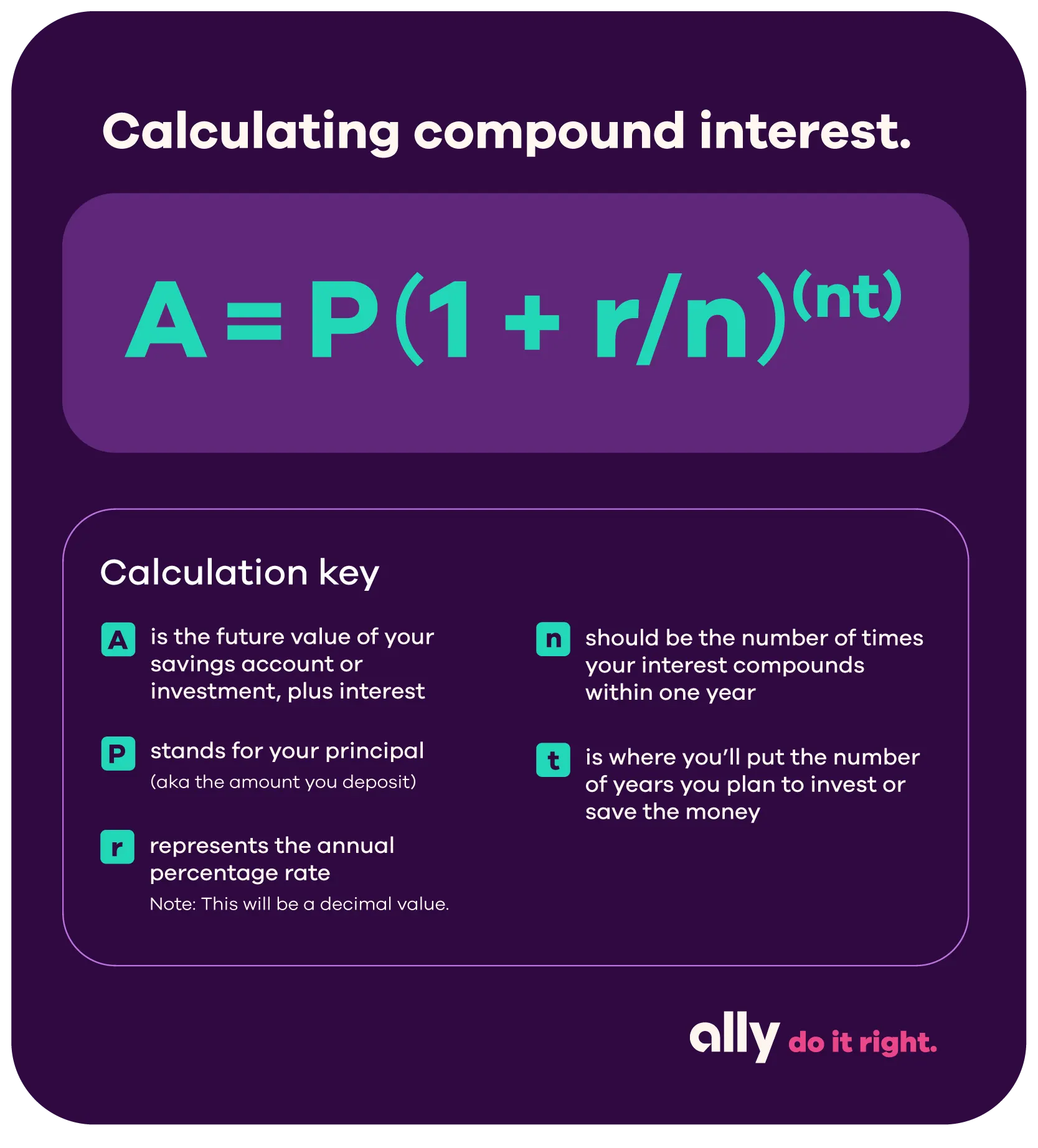

For the math lovers, you’ll be glad to know there is a specific compound interest formula you can use to calculate compound interest on savings.

You can also plug the numbers into a compound interest calculator like this one. With a calculator, you can easily see how interest compounded daily compares with interest compounded annually or monthly. You can also test different scenarios and see how much interest you can earn based on interest rates and deposit amounts.

Why compound interest is important

Compound interest helps you grow your money over time — and with larger deposits over many compounding periods, the effect can really add up. Let’s look at the following example of a $1,000 initial deposit (amounts rounded to the nearest dollar):

Examples of compound interest

What does all of this look like in your everyday finances? Compound interest may be at work in many parts of your financial life.

Savings accounts, CDs and money market accounts

The place you most often encounter compound interest is likely your savings account. Depending on your bank and account type, your interest may be compounding daily, weekly, monthly or even annually. If you’re not sure, ask your bank. In our products like Ally Bank Savings Accounts, CDs and M oney Market Accounts, we compound interest daily. This can give your savings an advantage over deposit accounts that compound interest just quarterly or annually.

401(k) accounts and investment accounts

Any money you’ve put in a 401(k) account is benefiting from compound interest. How often it compounds depends on the types of investments in your portfolio.

Student loans, mortgages and personal loans

Unlike the previous examples where interest increases your investments and savings, interest on your loans may mean you pay more over time. Some private lenders may use compound interest on your debt. If you’re not sure, review your lending agreement or reach out to your lender to better understand how interest will affect what you owe.

Credit cards

A common application of compound interest is on credit card debt. Most issuers compound interest charges daily, which is part of why it’s so important to stay on top of your credit card payments and avoid making charges beyond what you can afford.

Compound your future

Where you keep your money makes a difference — and finding a savings or other investment account that provides compound interest can help you increase your savings. Knowing what to look for as you research your choices is a great start to finding the right one for you.