What we'll cover

How much people typically spend on gifts

Gift preferences by occasion

How your budget factors in

Have you ever been at a wedding and found yourself whispering to a trusted friend, “How much did you spend on the gift?"

If so, you're not alone. We asked 1,000 people about their gifting habits. According to our 2023 survey, more than half of people consult friends and family on how much to give. And about a third of gifters will research online or on social media for guidance.

You want to commemorate your loved ones' special moments by giving the perfect gift, but you also need to consider your own financial situation. To help you find that sweet spot, here's what our survey unwrapped and some additional tips to consider.

Read more: Have more money for gifts by saving smarter

How much is typically spent on gifts?

The amount put toward a gift varies from person to person and the celebratory event being commemorated. Sometimes, you want to give a little extra to your loved one. For those instances, we asked people what they give when they want to spend more than usual.

Cash or gift: Which is preferred?

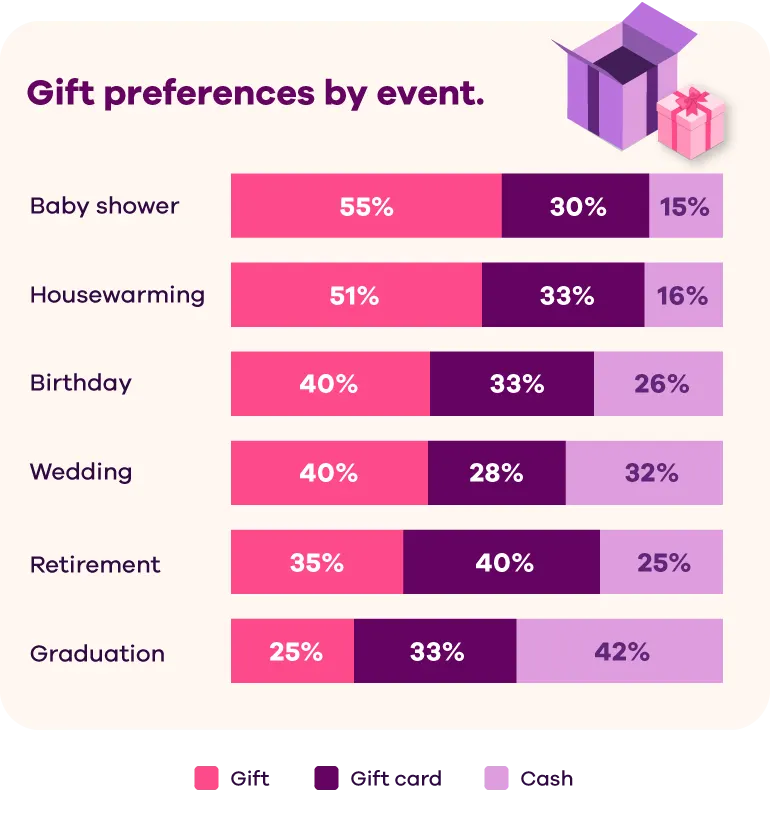

Ahead of everything, you'll want to figure out whether cash or a gift is appropriate for the person and the event you're celebrating. Our survey uncovered that people prefer to receive monetary gifts, like cash or gift cards, for weddings, birthdays and graduations — but would rather have an actual present as a baby shower or housewarming gift. Retirement is the one life event where the majority of people would like to receive a gift card.

Generosity within your budget

When celebrating major life milestones, you want your loved one to be wowed by your gift — but you also need to take your own financial situation into account.

Looking at your budget and how much you can allocate to gift giving should be the first step in striking the right balance. If the gift will significantly impact your ability to pay for your monthly necessities, stick to giving a dollar amount that makes sense for you.

How's your savings?

One smart way to plan for gifts is to save ahead of time, especially during those heavy gift-giving months like the holidays. You can save for special occasions by using Ally Bank's Savings Account and creating a specific bucketfor gifts in order to build up a stash so you have it handy when needed. You can also use Ally Bank's Savings Account Surprise Savings booster to uncover money that can be transferred automatically from checking to savings (and then later used for gifts).

Who are you shopping for?

Next, it's important to evaluate how close you are to the recipient. Are they someone you're in contact with only through group text or book club? Or is this a person who has shared in your special life moments (think: by your side at your college graduation or the godmother to your first born)?

For many, the closer you are to someone, the larger your cash gift can be (if it works for your financial situation, of course). But if your relationship is less defined, it may be more appropriate to opt for a more conservative amount when gifting.

Any upcoming expenses?

Now that you've accounted for your current budget and your lucky gift recipient(s), keep in mind any additional costs that are around the corner. Whether it's rent, a birthday-heavy month, or your annual car insurance payment, make sure to hold onto enough cash to pay for those impending expenses.

The secret's out

Remember, most people enjoy receiving gifts they can put to good use. Whether you fill an envelope with bills, offer a donation toward a financial goal or pick something off their registry, the recipient is bound to appreciate it — no matter the dollar value.