The wait for payday can be stressful. You might be eager to make sure your bills get paid or put some of your paycheck toward your weekend plans. One solution to ease the anxiety of waiting for your money is directly depositing your paycheck into your bank account.

What is direct deposit?

Direct deposit is the process of automatically transferring money into an account, whether that’s checking, savings or another account, like a money market. Typically, you’ll encounter the process when setting up a paycheck with an employer, but it’s also used for other standard transfers, such as tax refunds.

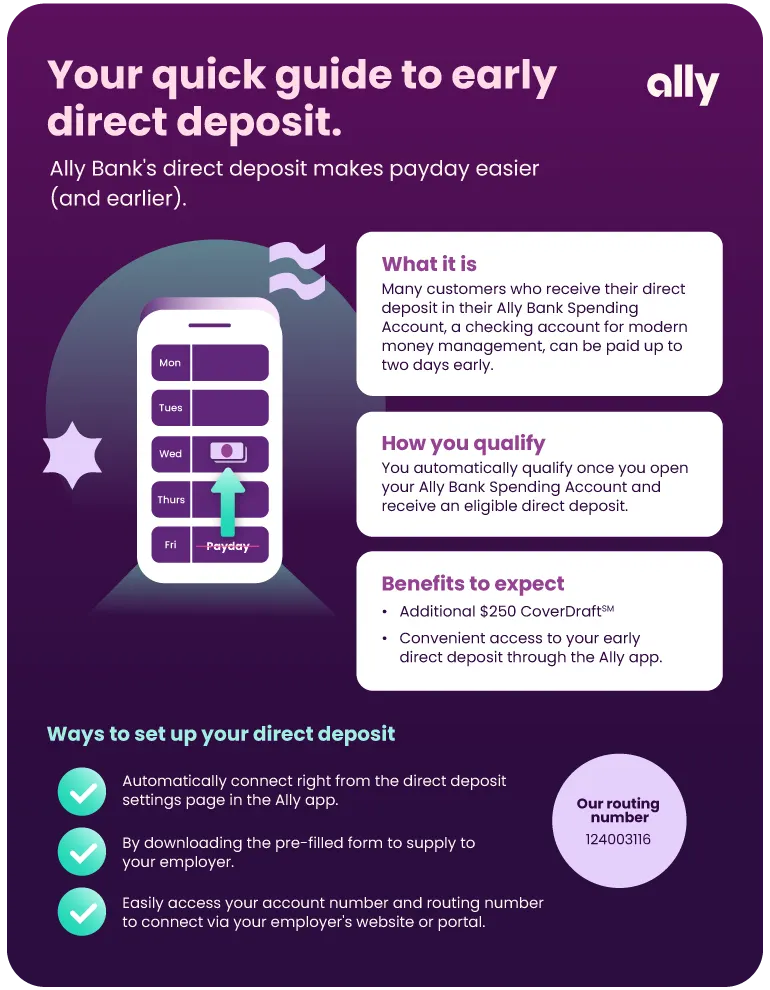

The process to set up direct deposit to your Ally Bank account is simple and straightforward, and you may be able to get your paycheck up to two days early — eliminating some of that waiting game.

Here’s how to set up direct deposit.

Read more: 8 ways an Ally Bank Spending Account can simplify your finances.

Steps to set up direct deposit to your Ally Bank Spending Account

Open an Ally Bank Spending Account (our checking account designed for modern money management). If you already have one, congrats! You're done with this step. You can also set up direct deposit to a different account instead, such as an Ally Bank Savings Account.

Gather the necessary information, such as your account number, your bank’s routing number and any forms from your employer.

Set up direct deposit using one of these three methods:

Connect automatically from the direct deposit settings page in the Ally app.

Download a form to provide your employer or government payment provider.

Access your account number and our routing number to enter into your employer or payment provider site.

Note: It might take 1-2 pay cycles for your direct deposit to take effect.

Once you've opened an Ally Bank Spending Account, you're eligible for early direct deposit and could receive your paycheck up to two days early. If you don't see your direct deposit early, it could be because we didn't receive your payment details early, or your deposit type isn't eligible (like a transfer between bank accounts). In one statement cycle, you can receive up to eight early direct deposits per account as long as each paycheck is $10,000 or less.

Verify your direct deposit is coming through as expected.

Benefits of direct deposit at Ally Bank

Automated set up: Set up direct deposit right from your account by searching for your employer and connecting directly. (As an alternate option, you can also download a pre-filled form.)

Early direct deposit: May give you access to your direct deposit up to two days before payday (for free). Having early access to paychecks can help you avoid the headache of moving money back and forth to cover upcoming expenses at the end of the month.

Split your direct deposit: If your employer or payment provider allows it, you can split your direct deposit across multiple accounts — so, if you want to set aside a portion of your paycheck in an Ally Bank Savings Account, you can automate it and not face the temptation to spend that money.

CoverDraftSM: If you do overdraw your account, CoverDraft may temporarily cover you up to $250 (standard coverage is $100). You'll have 14 days to raise your account balance above $0, with your next deposit automatically applied to the negative balance. Keep in mind, CoverDraft is a service, not a line of credit or a guarantee. If your purchase isn't covered for any reason (let's say the transaction exceeds your CoverDraft limit, for example), it will be declined – but we'll still never charge you an overdraft fee.

Convenience: You no longer have to keep track of a paper paycheck — with direct deposit, you not only may be able to access that paycheck early, but you'll also get paid directly to your bank account.

Stay ahead of the game

At Ally, we're always looking for ways to make money less stressful. And there's nothing quite like seamlessly setting up your direct deposit and getting to payday a little early.