What we'll cover

Setting up recurring deposits between your Ally Bank accounts

Setting up recurring deposits between your Ally Bank account and another bank

How buckets and boosters can help you meet your goals

Do you find yourself not saving as much as you know you should? Just like staying hydrated or making your bed in the morning, even though we know it’s good for us, saving can feel like a chore that doesn’t always get prioritized.

Did you know you can make it just a little bit easier with the help of technology? Automating deposits into your savings account means you have one less thing to remember. When you set up automatic bank transfers, you can take saving off your to-do list and relax.

At Ally Bank, you can set up recurring transfers into your Ally Bank Online Savings Account with just a few clicks — for no fee. Here’s how.

Transfers between your Ally Bank accounts

If you’re moving money from one Ally Bank account to another, setting up recurring transfers is quick and easy.

Steps to take on a desktop

External transfers are not yet permitted on the Ally mobile app, so grab your laptop and follow these simple steps.

1. Go to Ally.com and log in to online banking with your username and password.

2. Choose “Transfers” and then click on “Bank Transfers.”

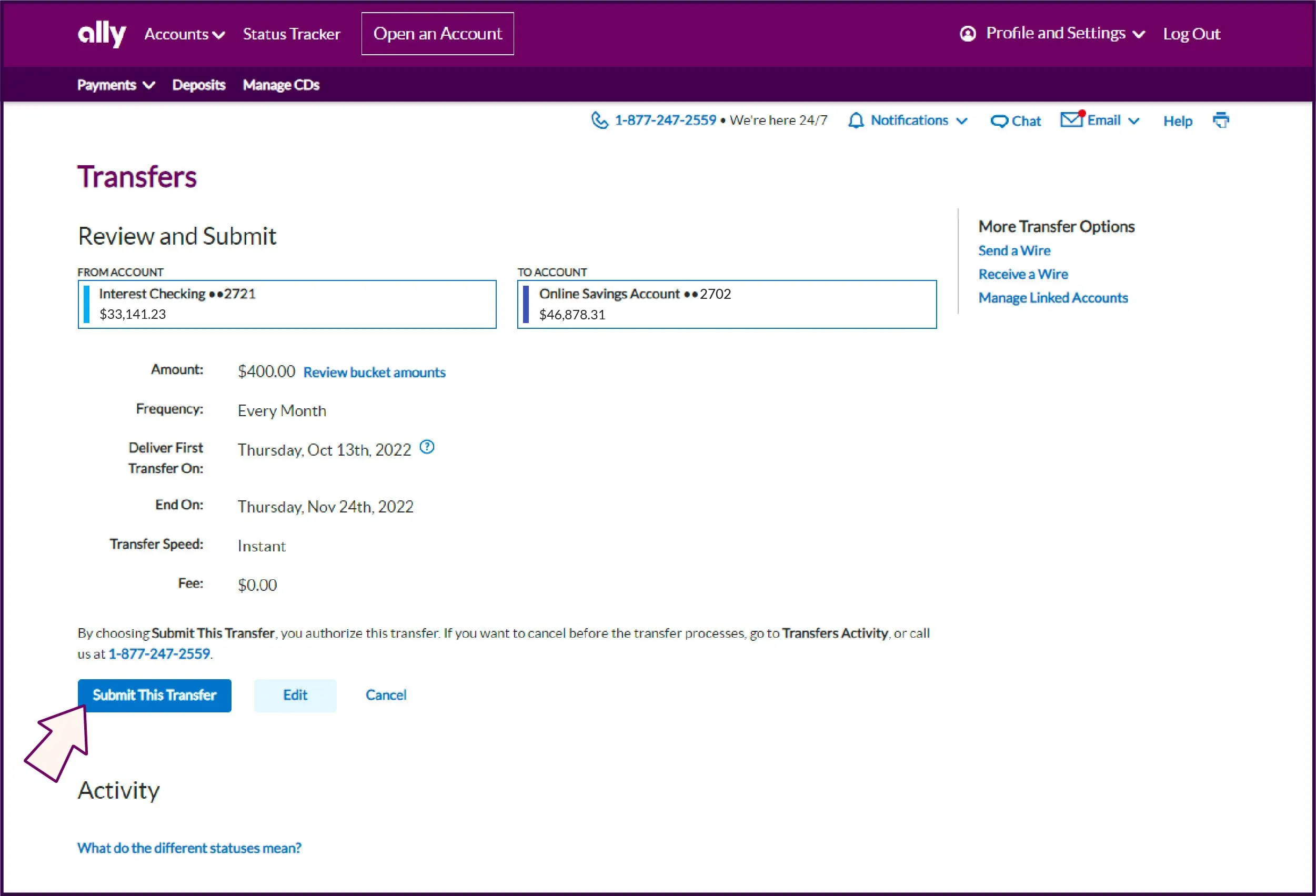

3. Select the account the money is coming from and the account the money is going to.

4. Enter the amount you want to transfer.

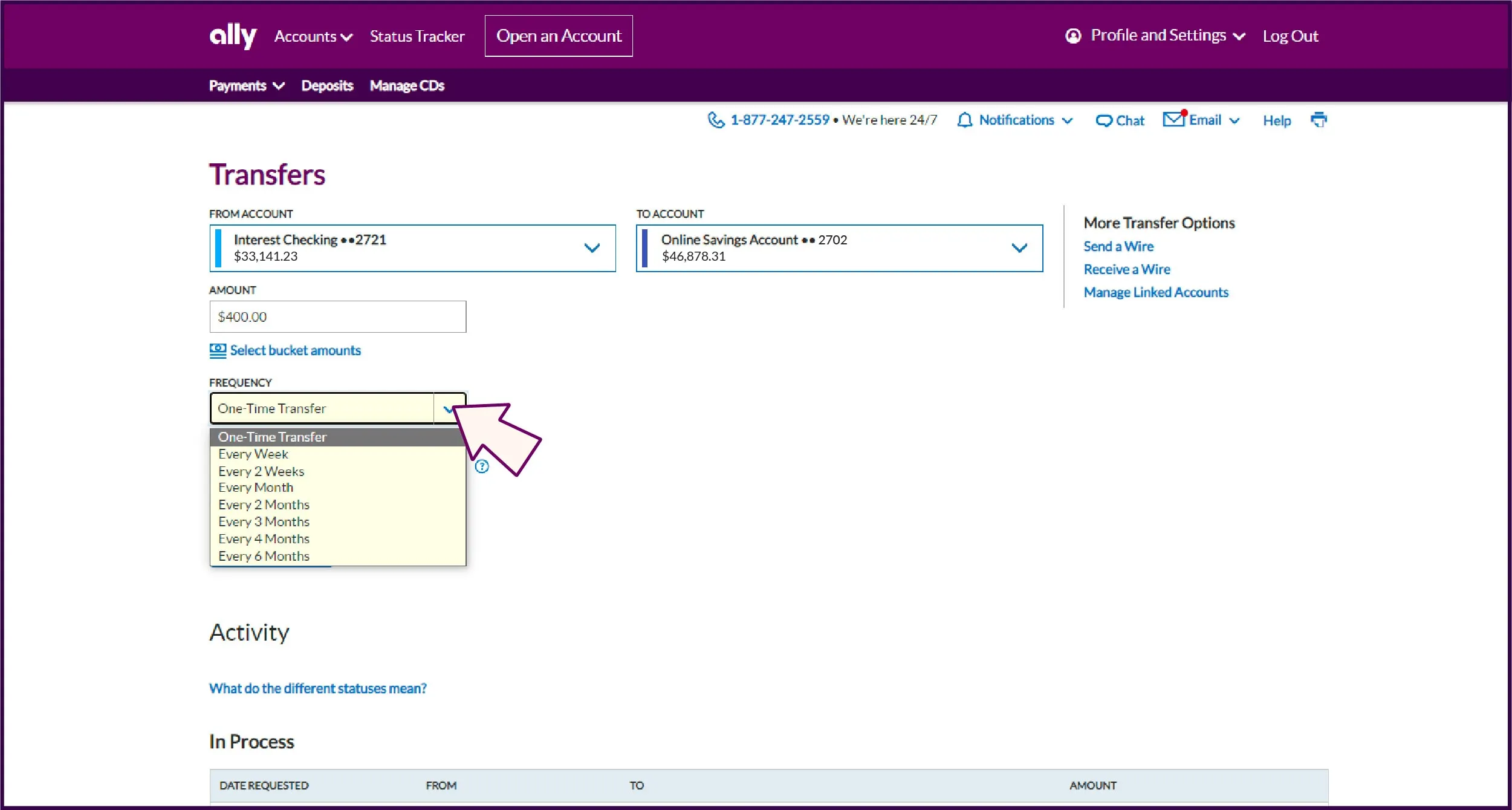

5. Set the frequency.

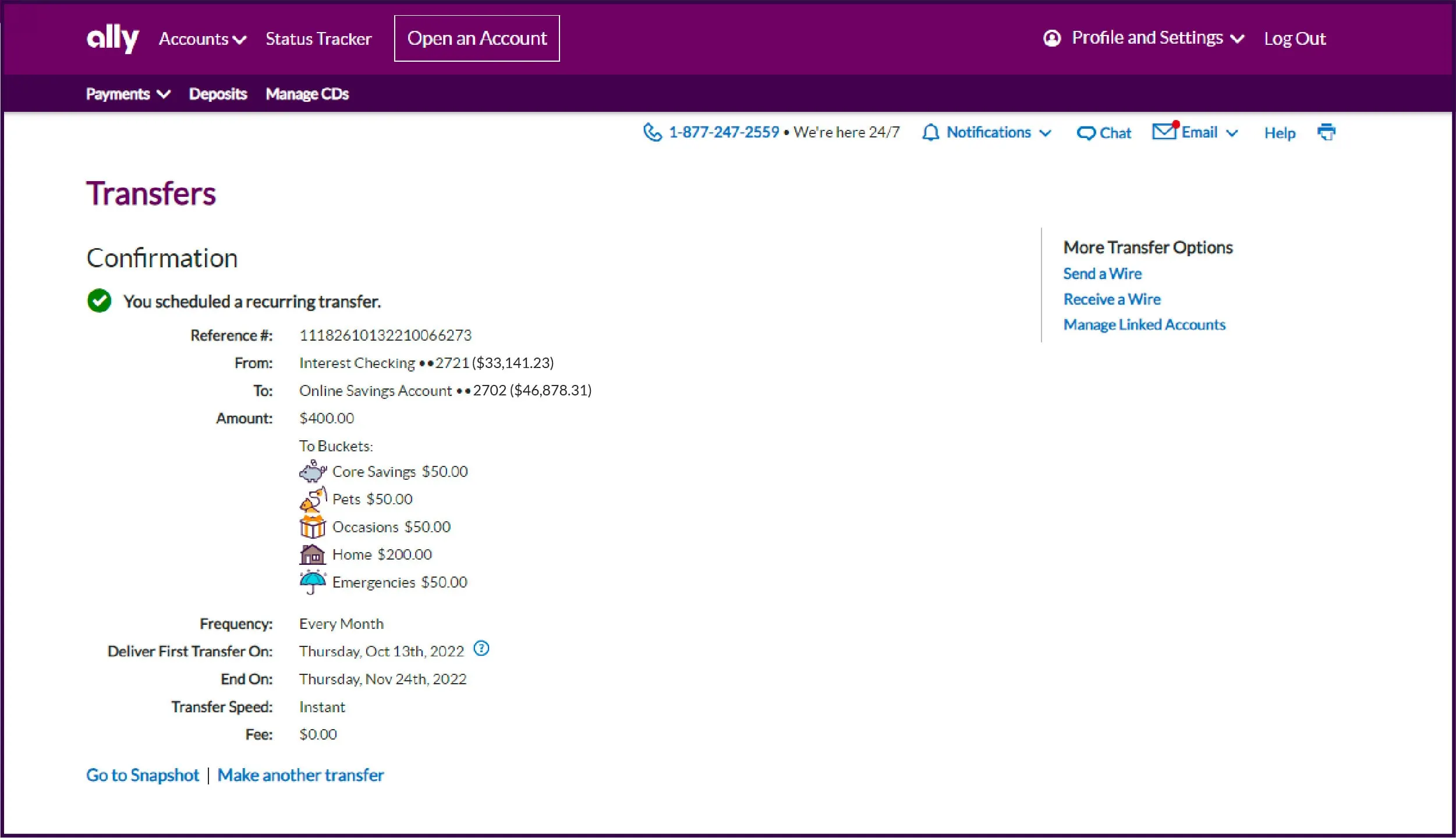

Once you’re all set up, check back periodically to confirm that you scheduled your transfers correctly. Then sit back and watch your savings balance grow. (That part never gets old.)

Tip: If you’re planning any automatic transfers out of your Ally Bank Money Market or Online Savings Accounts, remember that federal law permits limiting certain types of withdrawals and transfers out of those accounts.

Transfers between your Ally Bank account and another bank

Setting up recurring transfers from an account at another bank to your Ally Bank Online Savings Account requires a couple of additional steps for your protection, but it’s still super simple.

1. Go to Ally.com and log in to online banking with your username and password.

2. Choose “Transfers” and then “Bank Transfers.”

3. Choose “Link other accounts.”

4. Enter the information for the external account:

Account type

Account nickname

Routing number

Account number

Depending on whom the external account is with, you may be able to link the account instantaneously or by providing login information. Otherwise, we will make small trial deposits (less than $1.00 each) into the external account within three business days. Once you verify those deposit amounts, we’ll know you own the account and that we have the correct routing and account numbers and you’ll be good to go.

After your external account information is linked to your Ally Bank account, you can set up automatic transfers following the same steps as you would with your Ally accounts.

1. Go to Ally.com and log in to online banking and choose “Transfers” and then “Bank Transfers.”

2. Choose the account the money is coming from and the account the money is going to.

3. Enter the amount you want to transfer.

4. Set the frequency.

Stay on track with buckets and boosters

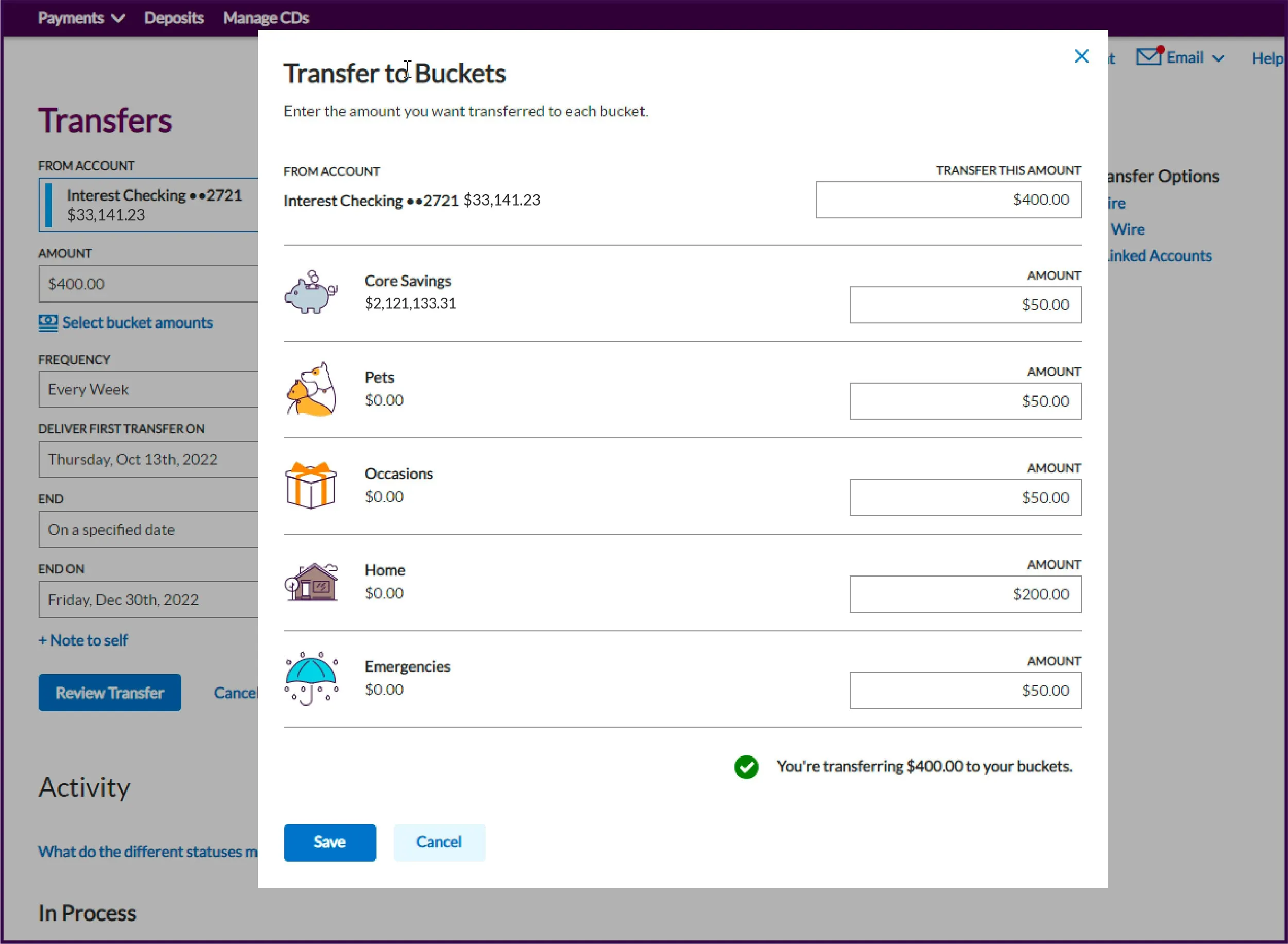

Once you’ve set up recurring transfers, take your savings to the next level with tools to help expedite your money goals. Ally buckets and boosters are smart tools that help you save toward specific goals and optimize your savings. Think of buckets like digital envelopes. You might have one for a vacation fund and another for a down payment on a home, for example. By organizing your savings for different purposes, you'll be more motivated as you move toward your total.

And don’t forget boosters(aka tools that speed up your savings by doing some of the work for you). Our boosters can provide a few different benefits like rounding up your spending to the nearest dollar and automatically transferring the difference to your savings account. (Because we could all use a little boost sometimes.)

Keep an eye on your account

Once you automate your savings deposits, you can spend less time and energy on saving consistently — but don’t forget to check on your accounts from time to time to keep up with your transfers and to spot any unauthorized activity. It’s easy to stay in the know about your accounts with Ally Bank. Download the Ally Mobile app, so your account details are right at your fingertips.

You can also get help with new accounts, check balances, transfer money, deposit checks, and more — 24/7 at Ally.com or at 877-247-ALLY (2559).