What we'll cover

What financial liquidity is

Why liquidity matters

Your most and least liquid options

Cash is often crowned king — and for good reason. It typically upholds its value and allows you to instantly make purchases. When you funnel cash into an account or an investment, it's wise to know how easily you can access it if necessary, which is known as liquidity.

Cashing in quickly

Everyone's motives for having cash readily available may be different and can vary over time. But you'll likely have moments in life where you need cash on-hand, whether it's accessible funds for an emergency, the ability to capitalize on timely investment opportunities or even to limit your exposure to market volatility.

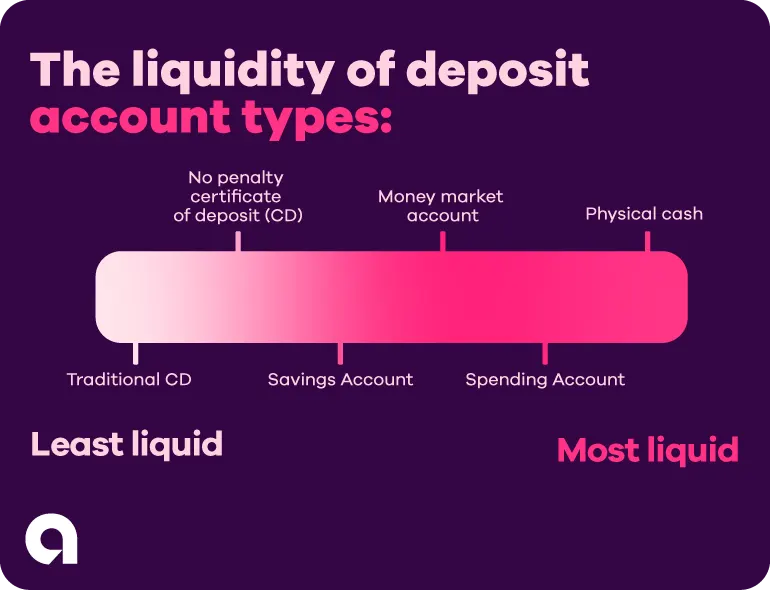

Deposit accounts are one of the best ways to keep your money both safe and liquid while also offering the potential to earn interest. Both an Ally Bank Spending Account and a Ally Bank Money Market Account typically come with checks and debit cards, providing you with nearly instant access.

In comparison, an Ally Bank Savings Account also provides a high level of liquidity, but with a few key differences. Although you can't directly withdraw from a Savings Account, you can take advantage of free transfers (up to a predetermined amount per statement cycle) to either a spending account or money market account. When your cash is stashed away in an Ally Bank Savings Account, it can work smarter for you with tools such as savings buckets and boosters.

Read more: Money market account vs. savings account: Which should you choose?

An Ally Bank Certificate of Deposit (CD) is an interest-bearing account as well. Just keep in mind that most CDs will come with an early withdrawal penalty charge if you choose to withdraw your funds before the maturity date (aka the end of the CD's term). A good alternative solution is an Ally Bank No Penalty CD, which allows you to enjoy competitive interest rates and withdraw your total balance any time after the first six days of funding your CD, penalty-free.

Gauging the liquidity of investments

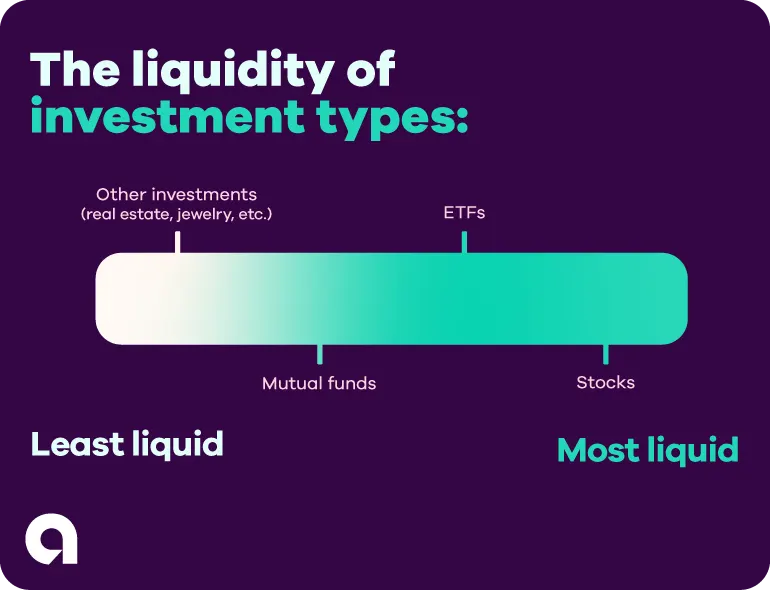

Some investments are highly liquid, while others have far less liquidity. The degree of liquidity is often determined by regulations and required processes as well as the market and demand.

If you'd like a portfolio designed by investing experts and have them position you in sound investments that maintain a level of liquidity that match your comfort level, consider an Ally Invest Robo Portfolio. But if you'd prefer to do the research and manage your trades yourself, you can open a Self-Directed Trading Account and purchase securities such as stocks, bonds, options, ETFs or mutual funds.

Before you invest, you should carefully review and consider the investment objectives, risks, charges, and expenses of any mutual fund or exchange-traded fund (ETF) you are considering. ETF trading prices may not necessarily reflect the net asset value of the underlying securities. A mutual fund/ETF prospectus contains this and other information and can be obtained by emailing support@invest.ally.com.

Factoring in other investments

Other non-security investments are not traded on a public exchange and are typically the least liquid. It can include a business, real estate and even collectible items like art or rare coins. Because it can take several steps to sell these types of investments, extra time is typically needed before you receive any cash in exchange.

Choosing your liquidity

The good news is you have plenty of deposit account types and investment choices to choose from when factoring in liquidity. A good rule of thumb is to diversify your portfolio and always allocate your funds based on your individual preference, risk tolerance and personal goals.

Ally provides plenty of resources to help you begin using your cash in ways that provide accessibility to your liking. Because we know that when you're feeling financially uneasy, you might need to rely on the king (cash) to help bring about some peace of mind.