When it comes to finances, knowledge is power. It’s never too late to start getting familiar with money matters. We rounded up common financial questions and are here to answer them for you.

1. How do you write a check?

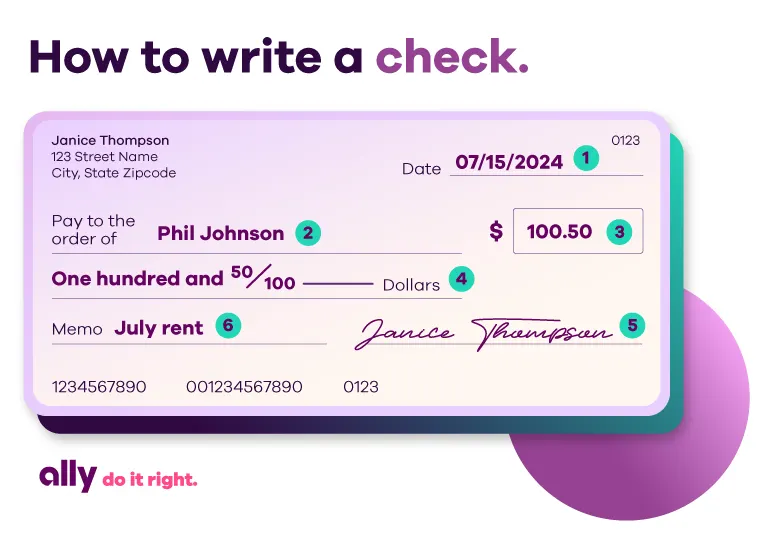

Writing a check can seem like a confusing process if you’ve never done it before. Luckily, the steps are fairly simple.

Write today’s date in the “date” field in the upper-right corner.

Write the recipient’s name on the “pay to the order of” line — this can be a person or company.

In the next box, write the amount of the check using digits. Checks usually include the dollar sign for you, so to write $100.50 you would use 100.50.

On the next line, write out the amount of the check in words, like “One hundred and 50/100” — that fraction at the end is used to designate cents as opposed to dollars. Draw a line to the right after your amount if there is additional space between the amount and the word “DOLLARS” on the check. This helps prevent someone adding to what you’ve written.

Sign the check on the line in the bottom-right corner.

Bonus: Say what the check is for on the “memo” line, like “July rent.” This isn’t required but can help you stay organized.

Double-check spelling and amounts in both number and word form, and write legibly with blue or black pen.

Tip: Your checks include sensitive banking information, so keep your checkbook in a safe place, mail them in secure envelopes and destroy checks before throwing them away.

Need to order checks? You can order standard checks at no charge as part of your Ally Bank Spending Account by visiting our website or by using the Ally Mobile app. And if you ever move, there's no need to reorder checks. You can cross out the old address and handwrite the new one if you’d like, but the address is not as important as the bank account and routing numbers.

2. Do I need to balance my checkbook?

Balancing a checkbook was more important before transactions went digital, because it allowed you to understand the amount of cash you had on-hand and what checks were yet to be processed.

It’s still important to keep an eye on your account balance so you don’t overdraw (Ally Bank eliminated overdraft fees and offers protection from overdrafting). You can receive bank statements in the mail or opt to go paperless and access your account online. Note: Some banks may charge a monthly fee for paper statements; Ally Bank does not.

Every few weeks, compare your statements with your receipts and other transaction records. This can help confirm your check was processed on time, for the correct amount and to the intended recipient.

Read more: Stay organized with Ally Bank Spending and Savings Account buckets.

3. How do I deposit a check?

Whether you’re depositing a check in person, by mail or through your bank’s mobile app, you’ll want to endorse the check by signing your name on the back. If you’re depositing the check through an app, be sure to also write “For Mobile Deposit Only” below the signature. Your experience may vary depending on your bank’s app, but typically you will take a picture of both the front and the back of your check and enter the dollar amount. After submitting your deposit, hang on to your check until you know it cleared, which usually takes a few business days.

If you are depositing your check at a bank, you’ll need to fill out a deposit slip once you’re there and hand it to the teller along with your check. Keep in mind, you’ll need your account number and a valid form of ID handy.

Another option is to deposit your check at an ATM, but not all ATMs accept deposits. You can look up ATMs in your bank’s network to see what’s available and try to avoid fees. Make sure to bring your bank debit card when you’re ready to deposit your check at the machine.

4. How do I get cash?

With most of modern banking happening online, it might not be clear how you can get your money in cash. If your bank has in-person branches, you can use an ATM or visit and speak with a bank teller to withdraw money from your accounts. If you use an online bank like Ally Bank, you can withdraw cash from any of the 75,000+ Allpoint® and MoneyPass® ATMs in the U.S. for free. Find one near you with our ATM locator. You also can use your Ally Bank debt card to get cash back from most grocery stores, gas stations and other retailers without fees.

Stay financially curious

Looking for the answers to your financial questions is a great habit. The world of money topics is vast, and there’s always more to learn. Every step you take toward expanding your financial knowledge will help empower you to make informed decisions.