What we'll cover

Tax terminology you need to know

Short vs. long-term capital gains taxes

Trading strategies that may lower your tax liability

If you’re new to investing, you might not have given much thought to how your portfolio could impact your taxes. Investing in and trading stocks can be a great tool for building wealth. But like the income from your 9 to 5 job, the money you make is taxable. Read on to understand how investment returns can impact your tax return.

Know your tax terminology

Before we dive into tax rate specifics, let’s cover some basic, need-to-know terms.

Cost basis: Amount you originally paid for a security plus commissions, which serves as a baseline for determining gains or losses.

Capital gains: Profit generated by selling a security for more money than you paid for it (or buying a security for less money than received when selling it short).

Capital losses: Loss that occurs when you sell a security for less than you paid for it (or buy a security for more money than received when selling it short).

Dividend: Portion of a company’s earnings paid to eligible stock owners on a per share basis.

Dividend taxes

When you own dividend-paying stocks, you might receive a payment a few times a year. That money is usually taxable, though the rate varies depending on whether it’s a qualified or nonqualified (a.k.a. ordinary) dividend.

The tax rate on qualified dividends is 0%, 15% or 20%, depending on your tax bracket. The higher your ordinary income tax, the more taxes you’ll pay. Ordinary dividends are taxed at your normal income tax rate.

If you reinvest dividends through a dividend reinvestment plan (DRIP), you have to pay taxes as though you received the cash. If your DRIP allows you to purchase additional shares at a discounted price, you’ll be taxed the difference between the reinvested cash and the fair market value of the stock.

If you receive dividends in the form of additional stock, they’re typically not taxable until you sell the shares.

Capital gains tax rates

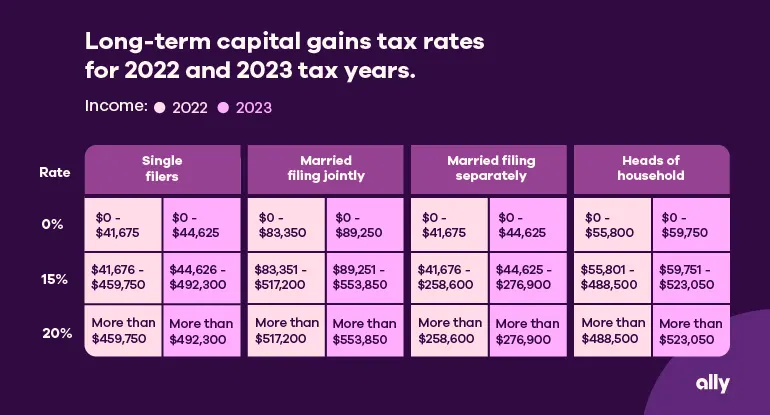

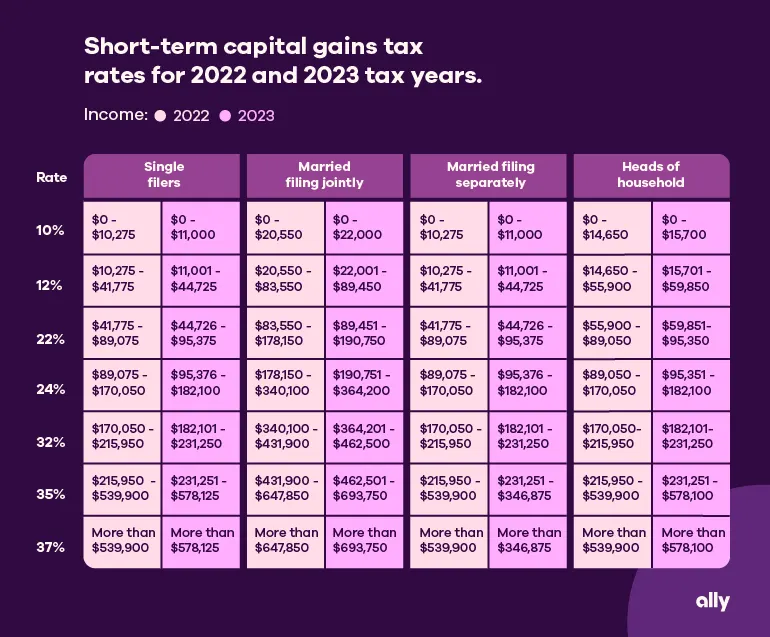

Did you know that capital gains tax rates differ depending on how long you owned the stock before selling? Understanding the difference between long-and short-term capital gains taxes may help inform your investing and trading decisions and can impact how your tax bill shakes out.

Returns made on a stock you owned for longer than a year are subject to the long-term capital gains tax rate: 0%, 15% or 20%, depending on your ordinary income.

Profit made on a stock you owned for a year or less before selling is taxed at the short-term capital gains rate, which is the same as your usual tax bracket.

Taxes on day trading

Day trading is all about buying and selling stocks quickly to make income off of the market’s short- erm fluctuations. It’s a strategy usually used by advanced or professional traders, many of whom rely on various tools and (potentially expensive) software to help monitor the market and make profitable trading decisions. Profits made from day trades are subject to short-term capital gains rates as securities aren’t held for more than one year.

Some traders may meet the government requirements to be considered “trader in securities,” which means your trading activity is substantial enough to be considered a business. The IRS sets several conditions that must be met to receive trader in securities tax treatment.

Investing in and trading stocks can be a great tool for building wealth. But like the income from your 9 to 5, the money you make is taxable

Tax ramifications of trading as a business

Compared to individuals, trading businesses can usually write off greater losses, claim broader business-related expenses related and worry less about wash sale rules (more on this below).

If you meet the following broad criteria, talk with a tax professional about whether you should consider establishing your trading as a business:

You seek to profit from daily market movements of securities, not just dividends or capital appreciation

Your trading is substantial (338+ trades annually)

Your trading activity is conducted with continuity and regularity

Declaring yourself a professional trader isn’t as clear-cut as other forms of self-employment. A tax professional can inform you of the rules that apply to your personal situation.

Stock trading tax considerations

Certain trading strategies may lower your tax liability:

Tax-loss harvesting

Tax-loss harvesting involves selling securities at a loss to lower your capital gains tax liability. The IRS allows you to deduct up to $3,000 in realized losses (or $1,500 if you’re married filing separately) to offset capital gains tax or taxes owed on ordinary income.

Tip: Beware of wash sales. Wash sales occur when you trade or sell a stock for a loss and buy the same security or a “substantially identical” security within 30 days before or after the trade. If you re-buy the security within 30 days, the IRS’s wash-sale rule prevents you from deducting it as a capital loss.

Holding stocks long-term

In general, if you hold a stock for longer than a year, you’ll pay a lower tax rate when you sell: the long-term capital gains rate.

Invest in a tax-optimized portfolio

Certain investment accounts, like our tax-optimized Robo Portfolio, can help you maximize your after-tax contributions through tax-advantaged Exchange Traded Funds, or ETFs.

How to manage your trading taxes more efficiently

The Maxit Tax Manager is an easy way to monitor the tax implications of your trading as the year progresses.

Sign into your Ally Invest account and go to Maxit Tax Manager. Your positions held at Ally Invest should load automatically. If you’ve transferred in any from another brokerage, you’ll need to add the cost basis information.

The Tax Manager offers four accounting methods: FIFO, LIFO, MinTax and Versus Purchase. It defaults to FIFO (first in, first out), but you can specify yours.

Maxit adjusts routinely for options exercise and assignment as well as diverse corporate actions. The service even fills out your Schedule D and D1 automatically at year’s end.

Handle trading taxes like a pro

Filing taxes can be confusing, especially if you have multiple income streams to account for. So, don’t be afraid to consult a tax professional who can ensure you make decisions that are best for you and your trading activity.