Get ready for Tax Day 2025, which will fall on Tuesday, April 15th. That’s the due date for the federal income taxes you’ll owe on what you earned in the year 2024. Here’s what you need to know so you can knock your tax filings off your to-do list.

What are tax brackets?

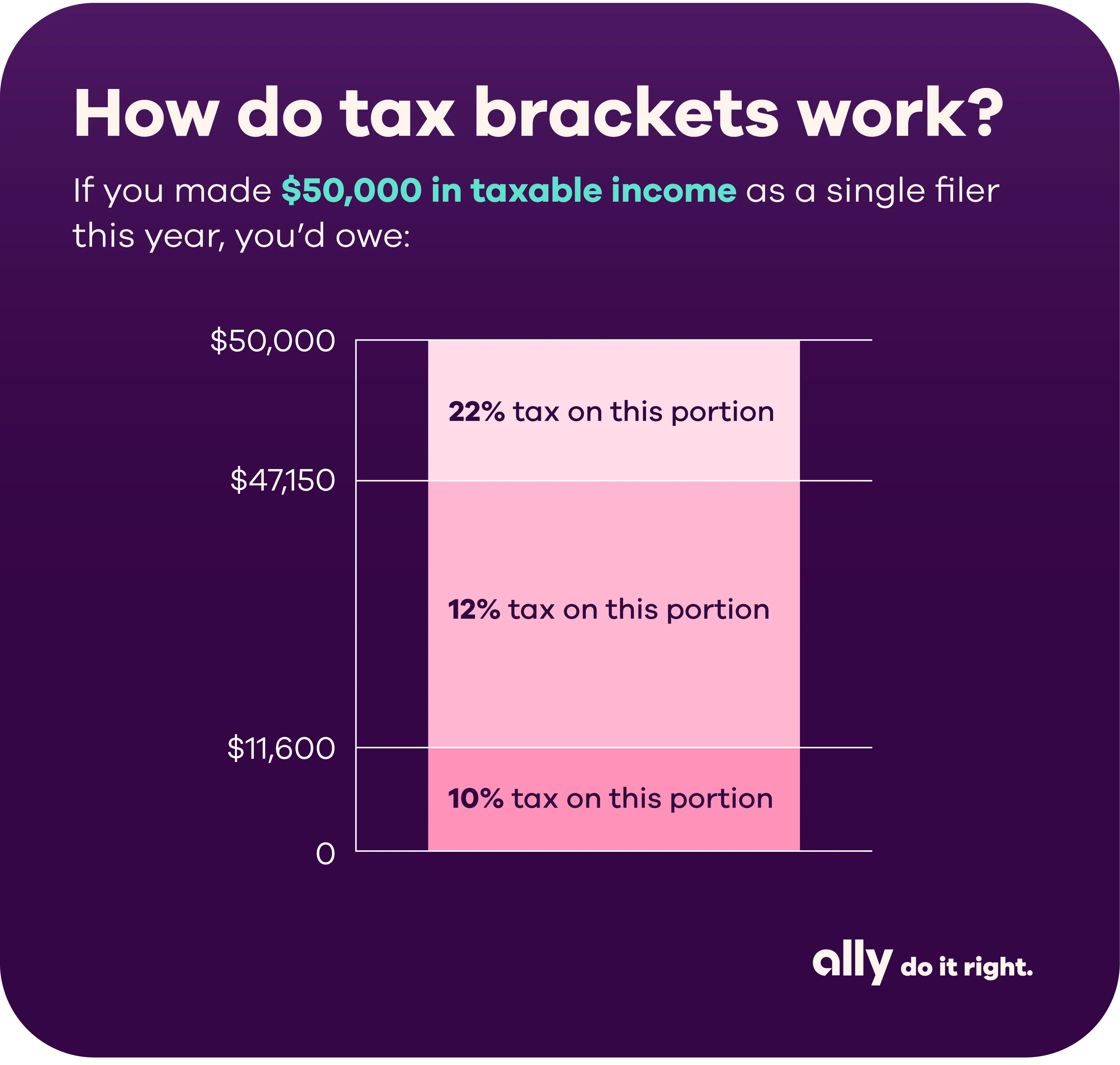

The United States uses a progressive tax system, which means each portion of your income is taxed at a different rate. As your income increases, you may enter different tiers, or brackets. The additional amount you make in this new tier will be taxed at a higher rate. Say you are a single filer and you made $75,000 of taxable income in 2024. The first $11,600 will be taxed at the 10% rate, then the amount between $11,600 and $47,150 is taxed at 12%, and the remaining $27,850 is taxed at the 22% rate, as it falls in that bracket. The total tax bill is $11,553, which is about 15.4% of your taxable income — so, even if you fall into the 22% bracket, that doesn't mean you pay 22% of your total taxable income.

How do I find my tax bracket?

Tax brackets are based on your taxable income, which is the portion of your pay you’re required to pay taxes on. This number is calculated using your adjusted gross income, which differs from your annual pay in that it takes into account things like retirement savings, Health Savings Account plans, and alimony payments. Your taxable income can be found by subtracting either the standard deduction or itemized deductions from your adjusted gross income. (You can estimate this amount based on the standardized deductions outlined below.) Your taxable income is not all taxed at the rate tier you fall into. Instead, you’ll be taxed in incremental tiers, with your tax bracket representing the maximum rate used to calculate what you owe.

2024 tax brackets and rates

Single filers

Tax rate | Federal income tax bracket | Tax owed |

|---|---|---|

10% | $0 to $11,600 | 10% of taxable income |

12% | >$11,600 to $47,150 | $1,160 plus 12% of the excess over $11,600 |

22% | >$47,150 to $100,525 | $5,426 plus 22% of the excess over $47,150 |

24% | >$100,525 to $191,950 | $17,168.50 plus 24% of the excess over $100,525 |

32% | >$191,950 to $243,725 | $39,110.50 plus 32% of the excess over $191,950 |

35% | >$243,725 to $609,350 | $55,678.50 plus 35% of the excess over $243,725 |

37% | >$609,350 | $183,647.25 plus 37% of the excess over $609,350 |

Source: IRS

Married couples filing separately

Tax rate | Federal income tax bracket | Tax owed |

|---|---|---|

10% | $0 to $11,600 | 10% of the taxable income |

12% | >$11,600 to $47,150 | $1,160 plus 12% of the excess over $11,600 |

22% | >$47,150 to $100,525 | $5,426 plus 22% of the excess over $47,150 |

24% | >$100,525 to $191,950 | $17,168.50 plus 24% of the excess over $100,525 |

32% | >$191,950 to $243,725 | $39,110.50 plus 32% of the excess over $191,950 |

35% | >$243,725 to $365,600 | $55,678.50 plus 35% of the excess over $243,725 |

37% | >$365,600 | $98,334.75 plus 37% of the excess over $365,600 |

Source: IRS

Married couples filing jointly

Tax rate | Federal income tax bracket | Tax owed |

|---|---|---|

10% | $0 to $23,200 | 10% of taxable income |

12% | >$23,200 to $94,300 | $2,320 plus 12% of the excess over $23,200 |

22% | >$94,300 to $201,050 | $10,852 plus 22% of the excess over $94,300 |

24% | >$201,050 to $383,900 | $34,337 plus 24% of the excess over $201,050 |

32% | >$383,900 to $487,450 | $78,221 plus 32% of the excess over $383,900 |

35% | >$487,450 to $731,200 | $111,357 plus 35% of the excess over $487,450 |

37% | >$731,200 | $196,669.50 plus 37% of the excess over $731,200 |

Source: IRS

Head of household

Tax rate | Federal income tax bracket | Tax owed |

|---|---|---|

10% | $0 to $16,550 | 10% of taxable income |

12% | >$16,550 to $63,100 | $1,655 plus 12% of the excess over $16,550 |

22% | >$63,100 to $100,500 | $7,241 plus 22% of the excess over $63,100 |

24% | >$100,500 to $191,950 | $15,469 plus 24% of the excess over $100,500 |

32% | >$191,950 to $243,700 | $37,417 plus 32% of the excess over $191,950 |

35% | >$243,700 to $609,3500 | $53,977 plus 35% of the excess over $243,700 |

37% | >$609,350 | $181,954.50 plus 37% of the excess over $609,350 |

Source: IRS

How to get into a lower tax bracket

Being in a lower tax bracket means you owe less money in taxes. To lower your taxable income, understand how tax deductions and credits affect how much tax you owe. Working with a tax professional can help you learn which ones you’re eligible to claim.

Tax credits

Tax credits directly lower your tax bill. For example, if you owe $1,000 in taxes and qualify for a $1,000 credit, the credit can zero out your tax liability. Some, like the Child Tax Credit, are refundable, meaning if the credit amount exceeds what you owe in taxes, you receive the difference in your refund. But if your income is higher, you may need to repay some or all of the money you received.

Tax deductions

Tax deductions reduce the amount of income that's subject to tax. They can be above-the-line (used to calculate your adjusted gross income, or AGI) or below-the-line (deducted after AGI is calculated). Above-the-line deductions include things like Individual Retirement Account contributions and student loan interest. Below-the-line deductions are itemized deductions you claim on the Schedule A tax form, which a tax professional can help prepare.

Standard deductions vs. itemized deductions

The standard deduction is a flat dollar amount you deduct based on your filing status. Your tax advisor can help you decide if a standard or itemized deduction is the right choice for your specific situation.

Filing status | 2024 Tax year standard deduction |

|---|---|

Single or married, filing separately | $14,600 |

Married, filing jointly or surviving spouses | $29,200 |

Head of household | $21,900 |

Source: IRS

Learn tax facts

Getting your tax return together shouldn't be a hassle. Whether you file on your own or work with a tax professional, staying organized throughout the year is a great way to ensure that the season doesn't sneak up on you. Happy filing!

Next in the series