Ally’s Mobile App Gets a Refresh

- 5 min read

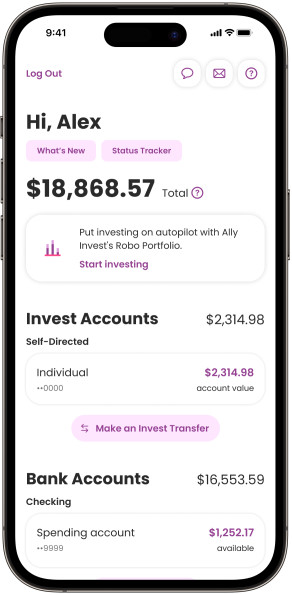

Over the past few months, we have been rolling out updates to our mobile app unveiling our “One Ally” ecosystem and our migration from product-centricity to experience-centricity. The innovative re-design brings all Ally customers into one app, streamlining a customer’s accounts into one interface allowing for increased personalization. This enables a more holistic view of their financial portfolio at Ally and offers more customization options. Our evolved app experience will help deepen customer engagement at a time when the majority of consumers prefer to manage their banking, investing and borrowing accounts through a mobile app or computer.

Home to the nation’s largest all-digital bank with a laser sharp focus on technology innovation, Ally is committed to providing a best-in-class digital experience. Through our “One Ally” approach, customers will be able to view all of their Ally auto loans, Invest, Savings, Spending, credit card and mortgage accounts in one view.

“Customers can expect a more integrated look at their finances with our reimagined mobile app,” said Sathish Muthukrishnan, Chief Information, Data and Digital Officer at Ally. “Users will now have access to their accounts at their fingertips and in one screen. They can more easily access and manage money to take care of their current and financial future and track toward their goals. Investing in our mobile app experience and constantly innovating is critical to our business outcomes as a tech-forward organization.”

The enhanced mobile app includes revised graphics and customizable data presentation allowing users to change the look of the screen based on their preferences. In addition to giving customers more control of how they view their account information through customization, Ally data and insights will soon serve users more personalized information about their financial journey. The blend of customization and personalization will offer easier navigation and a more intuitive user experience.

We’re also excited about the innovative technology that went into making these mobile app updates possible. Updates to the architecture of Ally’s mobile app include new technology with a shared codebase across platforms, called React Native. This will improve speed-to-market for updates, issue identification and resolution. The modernized app design system leverages a reusable component library, resulting in improved user experiences, developer efficiency with scalable patterns, and accessibility improvements.

The technology updates extend across the customer service colleagues too. Ally’s Customer Care Centers received technology enhancements so team members can provide a more personalized servicing experience for customers using the mobile app. The upgraded system offers a more holistic view of the customer profile, enabling access to customer products and servicing offerings to pinpoint and quickly respond to customer requests.

But that’s not all. New features and tools will continue to roll out on the mobile app throughout the year. Some of these products include badges that will “gamify” the experience and celebrate financial milestones, a debt management product, and a guest experience for non-customers to utilize Ally’s financial tools and resources.

Interested in joining Ally's team of talented technologists to make a difference for our customers and communities? Check outAlly Careersto learn more.